from The HinduBusinessLine - Money & Banking https://ift.tt/iI7aThE

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

9:02 AM

9:02 AM

Blogger

Blogger

Unity Small Finance Bank has taken over Punjab and Maharashtra Co-Operative Bank (PMC) in a revival programme for the scandal-hit lender.

Unity Small Finance Bank has taken over Punjab and Maharashtra Co-Operative Bank (PMC) in a revival programme for the scandal-hit lender. 7:11 AM

7:11 AM

Blogger

Blogger

By Sanjiv Chadha

The Budget has made announcements that have a bearing on the banking sector. While there were no major structural changes on the anvil, the assurance given that the IBC resolution process will be sped up is encouraging.

The banking sector has faced a challenge in FY22 in the market with respect to bond yields. It looks like that this will persist for one more year. The gross borrowing programme at Rs 14.95 lakh crore is once again relatively large.

There are two issues for banks here. The first is that interest rates will continue to move up even if we ignore the inflation aspect. Bond yields are already up and have crossed the 6.85% mark. This will have repercussions on investment portfolio of banks which have excess SLR securities.

The other issue is around liquidity. Higher gross borrowings are going to take place under changed conditions unlike last year, where demand for credit was low. We had seen sluggish growth in private demand for credit, which did ensure that the government’s borrowing programme went through quite well with strong support from the RBI, which maintained a permanent surplus liquidity situation. These conditions will change this year. Bank credit can be expected to grow by a double-digit rate and 10-12% looks possible. This means that there would be some competition for funds.

Here we can see two scenarios emerging. In the first, the surplus liquidity is allowed to persist and is progressively used for lending rather than putting in the reverse repo auctions. In the alternative scenario, where the RBI decides to eject this surplus liquidity out as part of its normalisation plan, there could be tightness in liquidity in some phases. Here, we may expect RBI to ensure that any normalisation would be gradual to ensure that there are no tight situations in the market.

But any which way, we can expect interest rates to increase under these conditions, which will be hastened by the rising inflation scene. Bankers have to buffer in these developments for sure.

The Budget has put a lot of emphasis on MSMEs, with the ECLGS scheme being extended to Rs 5 lakh crore with the hospitality sector benefiting by the additional Rs 50,000 crore. This is almost equivalent to the outstanding credit to this segment and hence is a big boost. Other sectors such as housing, data centres, solar energy and telecom have been provided a push in the Budget, which in turn will lead to higher demand for credit from these segments, opening the doors for enhancing business for banks.

While rising interest rates will constrain bond portfolios, higher credit growth and return of pricing power will herald a return to normal.

The author is MD & CEO, Bank of Baroda

5:11 AM

5:11 AM

Blogger

Blogger

Punjab National Bank (PNB) is looking for consultants to aid in the process of sale of its land and building assets across the country. The Delhi-based lender has floated a tender seeking applications from agencies to assist in the sale of its immovable non-core assets.

“The firms would be empanelled for a period of three years subject to annual review based on the performance,” the tender said. The process is being run as part of PNB’s plan to offload stakes in non-core investments and immovable properties. Last month, the lender had sought bids from process advisors to sell its stakes in Pridhvi Asset Reconstruction and Securitisation Company and National Commodity & Derivatives Exchange (NCDEX).

In a post-results call in January, SS Mallikarjuna Rao, MD & CEO of PNB, said the bank has continued to follow the same approach to sale of assets over the last two years. “We have been pursuing liquidation of or gaining the amount from non-core assets,” he said.

In October 2020, PNB sold a 3% stake in UTI Asset Management Company (AMC) for Rs 180 crore. As for real estate assets, the bank has already sold one of the floors in its erstwhile headquarters at 7, Bhikaji Cama Place and a couple of other floors are also in line for sale.

“In some of them (assets) we have already realised smaller amounts of up to Rs 10 crore. The fundamental principle of the bank where we have identified the non-core assets in two categories – real estate as well as investment assets – we will move forward to sell them. So during the current year as well, there are a good amount of stakes which we kept for liquidating and we are definitely going to gain out of those non-core assets,” Rao said.

He indicated that the bank could sell some more of its shares in UTI AMC. PNB is also in the process of offloading its stake in Canara HSBC Oriental Bank of Commerce Insurance Company. The bank expects many of these transactions to be concluded in FY23.

The government has not made any provision for capital infusion into public sector banks (PSBs) in FY23 while reducing the outlay for capitalisation in FY22 to Rs 15,000 crore from Rs 20,000 crore. PNB’s capital adequacy ratio (CRAR) improved to 14.91% in December 2021 from 13.88% as at December 2020. The common equity tier-I (CET-1) ratio stood at 10.99%.

3:11 AM

3:11 AM

Blogger

Blogger

Bank of India (BoI) on Friday reported a 90% year-on-year rise in its net profit to Rs 1,027 crore for the October-December quarter, on the back of lower provisions. On a sequential basis, the bank’s net profit was lower 2.3%. The net interest margin (NIM) stood at 2.27% for the quarter, lower than 2.42% as on September 30 and 2.58% during the corresponding period a year ago.

The state-owned bank’s total loan book stood at Rs 4.37 lakh crore as on December 31, of which domestic advances stood at Rs 3.82 lakh crore, up 5.3% on year. Retail loans grew at the fastest pace of 16% on year to Rs 75,542 crore as on December 31, while loans to micro, small and medium enterprises (MSMEs) grew 8.9% on year to Rs 67,400 crore, and agriculture loans grew 12.4% on year to Rs 64,439 crore. Advances to corporates and others, however, declined 4% on year to Rs 1.25 lakh crore. The bank is targeting 7-8% of on-year advances growth for the current fiscal year, managing director and chief executive officer Atanu kumar Das said in a post-earnings call on Friday.

“We find at the end of December quarter and subsequently in the month of January there is much better traction in the RAM (retail, agriculture and MSME) segments. The corporate segment has grown, but again the required traction is still awaited…we are hoping by Q1 (April-June) of next financial year, things (credit growth) should be more or less normal,” Das said.

On the liabilities side, the bank’s domestic deposits increased 1.7% on year to Rs 5.45 lakh crore as on December 31. Low-cost current account and savings account accounted for 44.1% of the lender’s domestic deposit book. Owing to lower growth in advances, the bank’s net interest income — difference between interest earned and expended — stood at Rs 3,408 crore in the reporting quarter, lower than Rs 3,739 crore a year ago and down 3.3% on a sequential basis.

Global net interest margin (NIM) stood at 2.27%, lower than 2.42% a quarter ago. Global NIM will likely improve back to 2.4% by March- end, Das said. He said while there were factors — like asset classification standstill last year, recent volatility in bond yields and other one-off events that have caused a fall in the bank’s income — the lender was progressing towards higher NII growth by increasing the advances growth rate compared to previous quarters and by shoring up the credit-deposit ratio.

Further, Bank of India’s asset quality improved in the reporting quarter with gross and net non-performing asset (NPA) ratio falling to 10.46% and 2.66%, respectively, as on December 31, from 13.25% and 2.46% a year ago, respectively. The lender’s slippage ratio, however, increased to 0.47% in the reporting quarter from 0.36% a quarter ago. By March-end, Bank of India is aiming to lower its gross NPA ratio to 9.5% and net NPA to around 2.25%, Das said. Total provisions stood at 335 crore in the reporting quarter, sharply lower than894 crore a quarter ago and Rs 1,810 crore a year ago.

The bank has identified six NPAs with Rs 3,000 crore outstanding that will be transferred to the National Asset Reconstruction Company (NARCL), the management said. The lender has also made 47% provision on Future Retail’s account with an exposure of Rs 1,078 crore. As on December-end, Bank of India’s capital adequacy ratio stood at 16.66%, of which tier-I capital stood at 13.60% and tier-II capital was 3.06%.

1:11 AM

1:11 AM

Blogger

Blogger

Private sector lender City Union Bank (CUB) on Friday reported a 15% increase in its net profit to Rs 196 crore for the third quarter of FY’22 as against Rs 170 crore in the corresponding quarter of previous fiscal year. Total income of the bank fell to Rs 1, 195 crore from Rs1, 268 crore.

Interest income contracted to Rs 1,035 crore from Rs 1,048 crore, net interest income remained flat at Rs 490 crore and other income decreased 27% to Rs 160 crore. Net interest margin was down to 4% from 4.16%.

The bank’s capital adequacy as per Reserve Bank of India (RBI) guidelines on Basel III norms was at 19.39% and tier-1 capital adequacy was at 18.34%, well above regulatory requirements. Gross non-performing asset rose to 5.21% from 2.94% and net NPA more than doubled to 3.44% from 1.47%. Provision coverage ratio was down to 62% from 73%.

8:11 AM

8:11 AM

Blogger

Blogger

Mahindra Finance’s gross stage 3 loans, those which have been delinquent for over 90 days, should fall to 8-9% by March from 11.3% in December, vice-chairman and managing director Ramesh Iyer tells Shritama Bose. If borrowing costs rise by 50 bps, NBFC customers could see lending rates rise, he added. Excerpts:

Your gross NPA figure is Rs 10,987 crore, but the gross stage 3 is Rs 7,223 crore. Why the difference?

The new RBI (Reserve Bank of India) guidelines of November 12 demand the categorisation of NPAs under the IRAC (income recognition and asset classification) norms, which would mean that you have to mark the NPA on a daily basis as well as if they move a stage – from 3 to 2 – you still have to keep them in NPA until the full amount is cleared. That’s the new requirement, but that’s not for the accounting purpose but for return of collectibles. So if our Ind-As provision is Rs 100 and under IRAC it is Rs 110, then we have to make an additional Rs 10 provision or we have to create a reserve. In our case, it’s the reverse. Our Ind-AS provision is much higher than the IRAC provision even though IRAC NPA is higher, which is why we don’t have to make any additional provision requirement in our book.

You need to provide Rs 500-1,500 crore more to meet the 6% threshold under the new IRACP norms? Over what time period?

The rationalisation norms also say companies need to bring their net NPAs below 6% under the IRAC norms, as computed. If you take our Rs 10,987 crore NPAs, we have said if that same number remains as of March 31, then in the worst-case scenario, we have to make a provision of Rs 1,500 crore. Now, we have also estimated that Rs11,000 crore can come down to Rs 10,000 crore or Rs 9,000 crore, then we have to do only500 crore. But if it goes below that, then we may not have to make any provisions. So that’s only an indicative number.

The Stage 3 ratio has fallen sequentially, but it remains in double digits. What is the reason for that and when do you expect it to move into single digits?

If you go back to our Q1 results, then because of the pandemic, the NPA had gone up to 15-16% and we had said we would reverse 80% of this additional provision we are carrying in the first quarter before March 31. As of December, we have already reversed 60%. Just about another 20% is left and that will also be done in this quarter. We’ll get the benefit, given the way collections are going. Clearly, we think 11% can come down to anywhere between 8% and 9% by March and the net NPA is already at 5.6%. We are one of the NBFCs who are carrying the highest coverage ratio of 52-53%. If we come down to 8-9% and we maintain the coverage of over 50%, we will also go below 4% net NPA, which is our other commitment to the market.

There were some movement restrictions in January. Did that affect collections?

No, because fortunately, there was no total lockdown. Even the employees who might have got impacted during this wave were only temporarily out of action for about four-five days. So I wouldn’t say there was any impact, but the media coverage of such waves results in people’s sentiments getting affected. They start to wait and watch. So initially for a week or 10 days, there was a little slowdown, but then that got corrected by the next two weeks. We closed December with a 100% collection efficiency. We would definitely be around 95% even in January.

How do you see higher borrowing costs impacting profitability?

We are fortunate to have a long-term fund which includes borrowings from two years back. They are maturing and they are at a high rate because those days the rates were high. So even if the rates were to go up by 25 basis points (bps) or so, our current borrowing will be cheaper than the amount we are sitting on. I actually see a benefit whenever we correct our past borrowing. Secondly, we have multiple sources of borrowing and our securitisation portfolio gets us a very attractive rate. So we don’t see a major impact of the cost of borrowing hitting us, but if there is a 50-bps increase, I’m reasonably sure that all of us will increase rates to the customer as well. So the yields and margins will definitely get protected.

8:10 AM

8:10 AM

Blogger

Blogger

7:02 AM

7:02 AM

Blogger

Blogger

Advent is currently conducting due diligence and may form a consortium. Sources said the private lender is keen to rope in at least one more bulge-bracket player for co-investing.

Advent is currently conducting due diligence and may form a consortium. Sources said the private lender is keen to rope in at least one more bulge-bracket player for co-investing. 2:11 AM

2:11 AM

Blogger

Blogger

Sundaram Finance Holdings (SF Holdings) has reported a consolidated net profit of Rs 33.63 crore for the quarter ended December 31, 2021, an increase of 22% over Rs 27.65 crore in the corresponding period of the previous year.

SF Holdings primarily operates as a holding company owning a portfolio of automotive businesses, including foundries, wheels, brakes, turbo chargers, axles and distribution of spare parts. As a result, dividend from portfolio companies forms a substantial part of financial results. Dividend received from portfolio companies was at Rs 29.38 crore for the period ended December 31, 2021, against the total dividend of Rs 14.13 crore received during 2020-21.

During the quarter, SF Holdings sold a 1.50% stake held in Sundaram Clayton for a total gain of Rs 124.66 crore, bringing its stake down to 9.74%. Using the proceeds of the divestment, the board of SF Holdings has declared a special dividend of 20%.

SF Holdings made further investments in its composites business during the quarter. It made a follow-on investment of euro 2 million in Mind S.r.l., Italy, which focuses on carbon fibre components for the automotive industry. Prior to this, over the previous 18 months, SF Holdings invested euro 2.60 million in Mind S.r.l. The company now has a 48.86% stake in the Italian firm.

It has also promoted a greenfield operation to manufacture carbon fibre components in Tamil Nadu at an initial investment of Rs 19.50 crore in Sundaram Composite Structures.

2:02 AM

2:02 AM

Blogger

Blogger

Apollo will end up owning a 9%-11% stake in the NBFC on a fully diluted basis and have a board seat. Other than flagship Hero MotoCorp that owns 40% of the company, the Munjal family, the promoters of Hero MotoCorp also have substantial shareholding in Hero Fincorp of 30-35%.

Apollo will end up owning a 9%-11% stake in the NBFC on a fully diluted basis and have a board seat. Other than flagship Hero MotoCorp that owns 40% of the company, the Munjal family, the promoters of Hero MotoCorp also have substantial shareholding in Hero Fincorp of 30-35%. 12:02 AM

12:02 AM

Blogger

Blogger

"The proposed amendments by curtailing the unwarranted time spent on various activities aim to ensure early completion of voluntary liquidation process, thereby, provide quicker exit for the corporate person, release the idle resources faster, and put them into productive uses," IBBI said.

"The proposed amendments by curtailing the unwarranted time spent on various activities aim to ensure early completion of voluntary liquidation process, thereby, provide quicker exit for the corporate person, release the idle resources faster, and put them into productive uses," IBBI said. 12:11 AM

12:11 AM

Blogger

Blogger

State-run Union Bank of India on Tuesday said Nidhu Saxena has assumed the charge as its Executive Director.

Prior to this, Saxena was with UCO Bank as General Manager & Vertical Head (retail credit, MSME & bancassurance), a release said.

He started his banking career at Bank of Baroda where he worked for 10 years before joining UCO Bank.

2:02 PM

2:02 PM

Blogger

Blogger

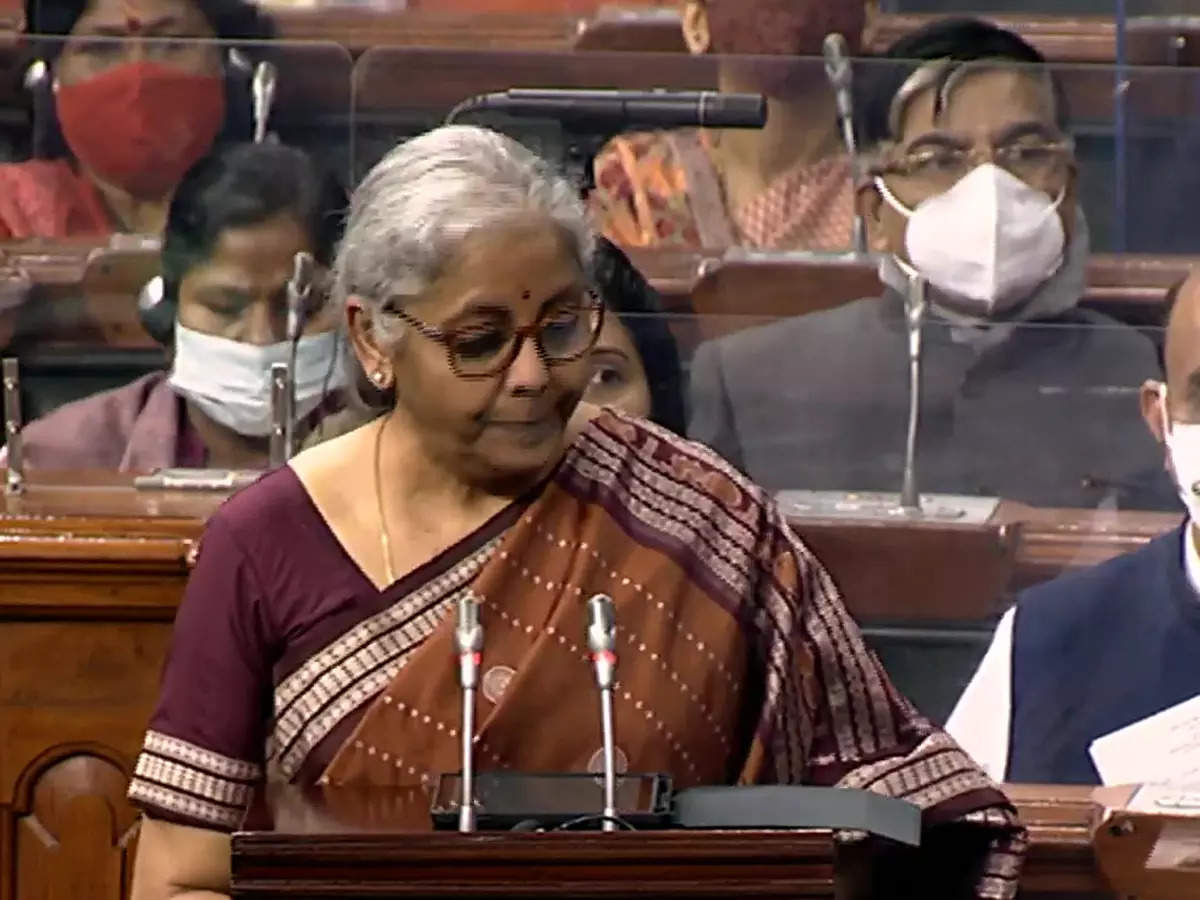

Talking about urban planning, the government will be promoting the shift to use to public transport in urban areas. This will be complemented by cleantech and governance solutions and zero mobility zones with a fossil fuel policy and EVs,” she said.

Talking about urban planning, the government will be promoting the shift to use to public transport in urban areas. This will be complemented by cleantech and governance solutions and zero mobility zones with a fossil fuel policy and EVs,” she said. 1:02 PM

1:02 PM

Blogger

Blogger

Finance minister Nirmala Sitharaman also announced to set up 75 digital banking centres in 75 districts by scheduled commercial banks.

Finance minister Nirmala Sitharaman also announced to set up 75 digital banking centres in 75 districts by scheduled commercial banks. 11:12 AM

11:12 AM

Blogger

Blogger

By Siji Philip

Like every budget, the Government of India faces the challenge of managing the priorities and wishlist of its citizens. The prevailing Covid-19 pandemic has changed the business landscape for almost all industries across the country and the BFSI sector is right in the middle of the ensued uncertain dynamics.

The country’s economy is witnessing encouraging signs of recovery, and to provide further impetus, the Union Budget 2022-23 is expected to continue Capex-related spending to support growth. This will directly impact the Banking & Financial sector through credit growth expansion which is yet to kick in meaningfully. The government may consider credit-support measures for businesses and sectors (such as transport and hospitality, among others) facing recovery challenges due to the adverse impact of the Covid-19. This will help banks and NBFCs address NPA issues that may surface from these segments.

MSME sector has been amongst the most impacted sectors due to the recurring resurgence of Covid-19 variants. Keeping cognizance of the crucial role played by the MSME in the Indian economy (contributing ~30% in nominal GDP), the government focused its efforts on revitalizing MSMEs by undertaking several formalization initiatives. Against this backdrop, making it mandatory to share credit data of small borrowers to rating agencies will significantly aid in the formalization of credit to marginal borrowers. Continuing last year’s measures, such as the extension of the ECLGS scheme by one more year and easing conditions of the scheme to make it available to a wider set of MSMEs will help alleviate the stress in the sector.

Over the past two to three years, the banking sector is undergoing a structural makeover that requires institutions to have robust tech and analytics capabilities.

This transformation is quite challenging in the current operating framework with constraints of the public sector. A bolder move to transform the public sector banking industry is on the wish list. Partial privatization wherein the government reduces its stake below 51% is one way forward. Though the government has announced the privatization of two PSBs in the previous Budget, the progress has been slow. A step-up on the roadmap for privatization of PSBs will be keenly eyed and would be positive, especially for the lower-tier banks. The demonstration of a few PSBs raising equity without government support over the last few quarters coupled with better earnings prospects for most PSBs indicates that the capital infusion to PSBs is unlikely in this year’s Union Budget.

The Union Budget 2021-22 had announced the setting up of a Bad Bank or NARCL. However, with almost a year passed by, the Bad Bank is yet to take off with impediments such as issues arising from the ownership structure and operational mechanism. We expect further measures around the operations of NARCL. Similarly, NAFID is yet to commence business and is pivotal to catalyze investments in the fund-starved infrastructure sector.

Housing push is essential to mobilize the financial resources needed to develop the domestic economy. Housing will be a key focus area of the Budget, supported through tax incentives and extension of schemes, thereby benefitting housing finance companies and large banks. Among the direct benefits, Budget 2022-23 might bring a potential relief to direct home buyers with an increased limit of home loan interest deduction for a tax rebate from Rs 2 Lacs to Rs 5 Lacs. Moreover, redefining affordable housing criteria to outspread the benefits of additional deduction to a larger market will be a key positive for the sector.

Insurance has gained prominence in the prevailing pandemic times, and the government may look at providing further tax incentives to support higher off-take and penetration of insurance. Increasing Section 80C allowance from Rs 1.50 Lacs to Rs 2.5 Lacs along with reducing GST rate for insurance to make them more affordable are some of the expectations in the insurance space.

The Indian economy is rapidly transforming with deeper penetration and rapid adoption of technology. Keeping this in view, setting up a formal body to oversee the operations of Fintech players and providing financial incentives to promote digital payments may also be on the anvil.

Keeping India’s macro-stability indicators such as inflation and the trade deficit in mind, the onus of Budget 2022-23 would be towards improving real income for the masses. We believe this will provide just the right push needed for sustainable growth going forward!

(Siji Philip is Senior Research Analyst at Axis Securities. The views expressed are author’s own.)

10:02 AM

10:02 AM

Blogger

Blogger

The city police had earlier arrested the promoter, Ajay Ajit Peter Kerkar, and former chief financial officer Anil Khandelwal, who are now in jail in the case.

The city police had earlier arrested the promoter, Ajay Ajit Peter Kerkar, and former chief financial officer Anil Khandelwal, who are now in jail in the case. 9:02 AM

9:02 AM

Blogger

Blogger

These suggestions have been made in the investor feedback sought by KPMG, the transaction advisor for the IDBI Bank strategic sale, according to officials with knowledge of the matter.

These suggestions have been made in the investor feedback sought by KPMG, the transaction advisor for the IDBI Bank strategic sale, according to officials with knowledge of the matter. 8:02 AM

8:02 AM

Blogger

Blogger

Several individuals - including those who were investigated, re-assessed and taxed - have been asked by the Foreign Assets Investigation Unit (FAIU) to share details of offshore bank accounts since 2001, residency status for the past two decades, passport copies and names of overseas service providers. Overseas service providers are professional outfits setting up tax haven vehicles and trusts to hold the funds.

Several individuals - including those who were investigated, re-assessed and taxed - have been asked by the Foreign Assets Investigation Unit (FAIU) to share details of offshore bank accounts since 2001, residency status for the past two decades, passport copies and names of overseas service providers. Overseas service providers are professional outfits setting up tax haven vehicles and trusts to hold the funds. 4:02 PM

4:02 PM

Blogger

Blogger

The appellate tribunal observed that NCLT has passed directions to consider the second proposal from Wadhwan, despite the fact that the Committee of Creditors (CoC) of DHFL had already by an overwhelming majority approved the Piramal Capital & Housing Finance's resolution plan and the administrator had applied before it for its approval.

The appellate tribunal observed that NCLT has passed directions to consider the second proposal from Wadhwan, despite the fact that the Committee of Creditors (CoC) of DHFL had already by an overwhelming majority approved the Piramal Capital & Housing Finance's resolution plan and the administrator had applied before it for its approval. 3:02 PM

3:02 PM

Blogger

Blogger

PNB Housing Finance is focussing on its high-yielding affordable housing business 'Unnati' in tier-II and -III cities, and targets to operationalise 25 new branches by March this year. Besides, the housing financier targets to increase the Unnati business from nine per cent currently to about 12-14 per cent going forward. PNB Housing opened 13 Unnati locations during the quarter ended December 2021.

PNB Housing Finance is focussing on its high-yielding affordable housing business 'Unnati' in tier-II and -III cities, and targets to operationalise 25 new branches by March this year. Besides, the housing financier targets to increase the Unnati business from nine per cent currently to about 12-14 per cent going forward. PNB Housing opened 13 Unnati locations during the quarter ended December 2021. 1:12 PM

1:12 PM

Blogger

Blogger

By Brajesh Kumar Tiwari

Banking sector constitutes a major part of the economy hence the banking system is the bloodline of any economy. According to a PricewaterhouseCoopers (PwC) report, India could be the world’s third largest banking hub by 2040 and India’s fintech market is expected to reach Rs 6.2 trillion by 2025.

The banking sector of India is going through a very difficult situation due to the pandemic. It may take 24 to 36 months for banks to recover from the current situation. Global rating agency Moody’s has said that public sector banks will need an additional capital of Rs 2.1 lakh crore to overcome this pandemic. State Bank of India (SBI) is the only bank in India, which comes in the top 50 banks of the world. Proper budget, right tax and regulatory policies can put the banking industry back on the fast growth path. The banking sector is expecting positive amendments and policies in the coming Union Budget 2022.

At present, banks are withdrawing from lending as the biggest problem before the banks is Non-Performing Assets (NPA), which is affecting both private and public sector banks alike. Credit growth is also a big problem for banks. Banks will have to start giving loans, which is their main source of income and companies can get it in the form of working capital. Financial services company “Bank Bazaar” says that there has been a decline in the demand for loans like personal loans, car loans and home loans.

Banks can be in a good position through provisioning of bad loans, provisioning means that banks may reserve enough money for their bad loans in advance. Basel-IV, which is to be formalized in January 2023, will further increase the capital cap. Unless the government pumps in money externally, banks will be in severe loss creating massive capital adequacy problems. The banking sector must help in MSME advances. MSMEs are the backbone of Indian economy and creates employment for 65 million people. This sector has a 16% contribution to the Indian GDP, which as per reports is to become 25% by 2022. Provision should be made for all these in the coming budget.

The upcoming budget could lead to bold policy support to strengthen the digital infrastructure for Banking sector which will ultimately help in digitizing the overall economy. From adding best-in-class technology to upgrading services to upgrading an existing set-up, technology holds a plethora of opportunities. Technological inclusion and technical literacy campaigns should be undertaken to ensure that paperless banking takes place. If rural people can order products on Amazon and use Facebook then why not e-banking services. There is a need for digital literacy programs which can be done through budgetary allocation. The government may consider creating a dedicated fund to strengthen the digital infrastructure of cooperative banks too.

Innovation is the key to maintain long-term relationship with customers. Keeping pace with the changing environment and other industries, the banking sector has to invest in innovation, the government should make a provision on banking innovation in the budget. The more agile and accessible the services and banking practices are, the stronger the relationship with the customers. The banking sector can also be given impetus by reducing the rates of income tax on fixed deposits.

The introduction of a special regulatory and taxation regime to cover various aspects of the cryptocurrency digital currency can be expected from this budget. Increasing the home loan interest rate tax deduction from the existing limit of Rs 2 lakh to Rs 5 lakh will give a boost to home loans.

The financial sector is the pillar of the economy. Such policy measures in the budget will go a long way in boosting and strengthening the banking sector, else the impact of any loss of banking sector will be deep and long lasting on the economy.

(Brajesh Kumar Tiwari is the author of “Changing Scenario of Indian Banking Industry”, Associate Professor Atal Bihari Vajpayee School of Management & Entrepreneurship and Member of Innovation Council at Jawaharlal Nehru University. The views expressed are the author’s own.)

8:11 AM

8:11 AM

Blogger

Blogger

State Bank of India on Saturday said it has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter after the lender faced criticism online and was served a notice by the Delhi Commission for Women (DCW) seeking withdrawal of the “anti-women rule”.

As per its circular dated December 31, SBI said in case of pregnancy that is less than 3 months, a woman candidate will be considered fit to join the organisation. However, if pregnancy is more than 3 months, then the candidate will be considered temporarily unfit and she may be allowed to join within four months after delivery. As per its earlier rules, women candidates could be appointed in the bank up to six months of pregnancy, provided the candidate furnished a certificate from a gynaecologist.

“State Bank of India seems to have issued guidelines preventing women who are over 3 months pregnant from joining service and have termed them as ‘temporarily unfit’. This is both discriminatory and illegal. We have issued a notice to them seeking withdrawal of this anti-women rule,” tweeted Swati Maliwal, chairperson of DCW.

In its notice addressed to SBI chairman Dinesh Khara, the DCW has sought information on steps taken by the bank to ensure future recruitment guidelines do not discriminate on basis of gender. Further, the DCW has sought information about the detailed process through which the revised recruitment guidelines were formed along with names and designation of the approval authority. SBI has been asked to provide the said information to the commission by February 1.

8:02 AM

8:02 AM

Blogger

Blogger

The bank said, "In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter."

The bank said, "In view of the public sentiments, SBI has decided to keep the revised instructions regarding recruitment of pregnant women candidates in abeyance and continue with the existing instructions in the matter." 4:11 AM

4:11 AM

Blogger

Blogger

RSS Feed

RSS Feed Twitter

Twitter