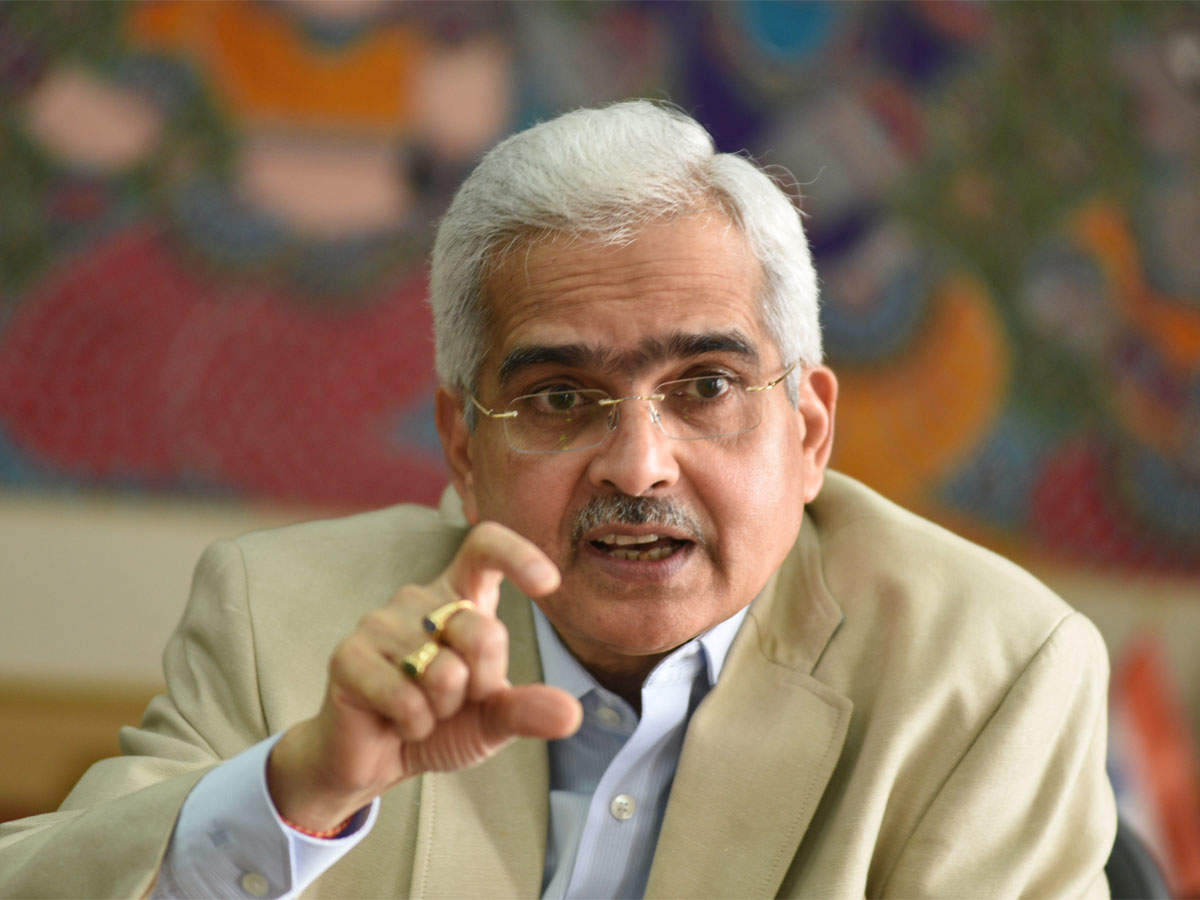

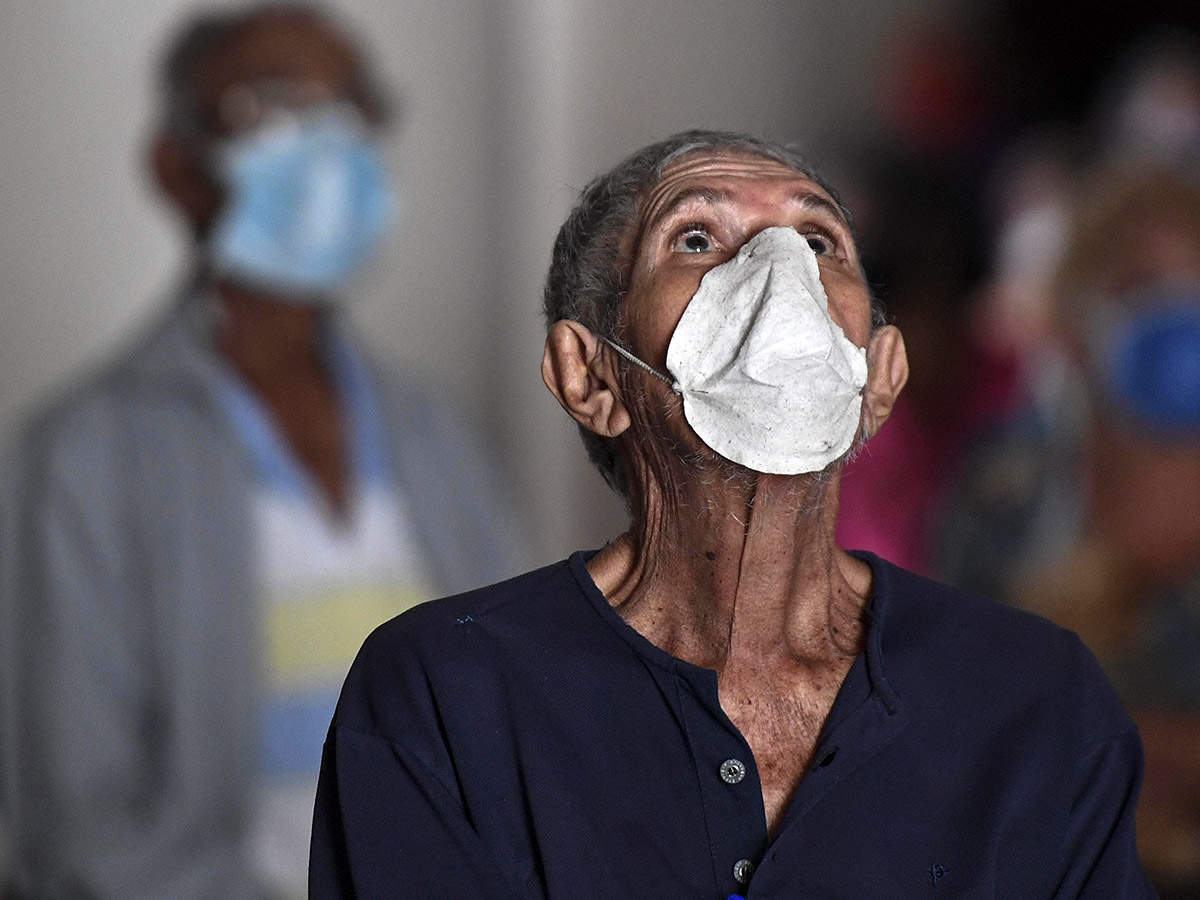

Former Governor of the Reserve Bank of India (RBI) Raghuram Rajan said on Saturday that the Centre should extend fiscal relief that can help rebuild a

from Business Line - Money & Banking https://ift.tt/3jFjTuo

Read more »

from Business Line - Money & Banking https://ift.tt/3jFjTuo

RSS Feed

RSS Feed Twitter

Twitter

11:12 PM

11:12 PM

Blogger

Blogger