Will submit list to RBI for approval

from Business Line - Money & Banking https://ift.tt/3cqKE19

Read more »

from Business Line - Money & Banking https://ift.tt/3cqKE19

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

8:02 PM

8:02 PM

Blogger

Blogger

7:31 PM

7:31 PM

Blogger

Blogger

6:31 PM

6:31 PM

Blogger

Blogger

5:57 PM

5:57 PM

Blogger

Blogger

According to an earlier ET report, the bank has three contenders to succeed Puri. These include Sashidhar (Sashi) Jagdishan and Kaizad Bharucha, both executive directors of the bank, and Sunil Garg, global CEO of Citi Commercial Bank.

According to an earlier ET report, the bank has three contenders to succeed Puri. These include Sashidhar (Sashi) Jagdishan and Kaizad Bharucha, both executive directors of the bank, and Sunil Garg, global CEO of Citi Commercial Bank. 5:27 PM

5:27 PM

Blogger

Blogger

Kathpalia has elevated Arun Khurana, head global markets and treasury of the bank, to deputy CEO.

Kathpalia has elevated Arun Khurana, head global markets and treasury of the bank, to deputy CEO. 5:03 PM

5:03 PM

Blogger

Blogger

5:03 PM

5:03 PM

Blogger

Blogger

4:35 PM

4:35 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

Private sector lender HDFC Bank on Saturday reported a 15.4% rise in consolidated net profit at Rs 7,280.22 crore for the fourth quarter of 2019-20. The bank had posted a net profit of Rs 6,300.81 crore during the corresponding January-March period of 2018-19. The bank said it will not make any further dividend payouts from profit pertaining to 2019-20.

Private sector lender HDFC Bank on Saturday reported a 15.4% rise in consolidated net profit at Rs 7,280.22 crore for the fourth quarter of 2019-20. The bank had posted a net profit of Rs 6,300.81 crore during the corresponding January-March period of 2018-19. The bank said it will not make any further dividend payouts from profit pertaining to 2019-20. 1:44 PM

1:44 PM

Blogger

Blogger

10:44 AM

10:44 AM

Blogger

Blogger

Countries have taken fiscal measures and central banks together injected a whopping USD 14 trillion as part of their efforts to mitigate the challenges posed by the novel coronavirus pandemic, the International Monetary Fund has said.

Countries have taken fiscal measures and central banks together injected a whopping USD 14 trillion as part of their efforts to mitigate the challenges posed by the novel coronavirus pandemic, the International Monetary Fund has said. 7:57 AM

7:57 AM

Blogger

Blogger

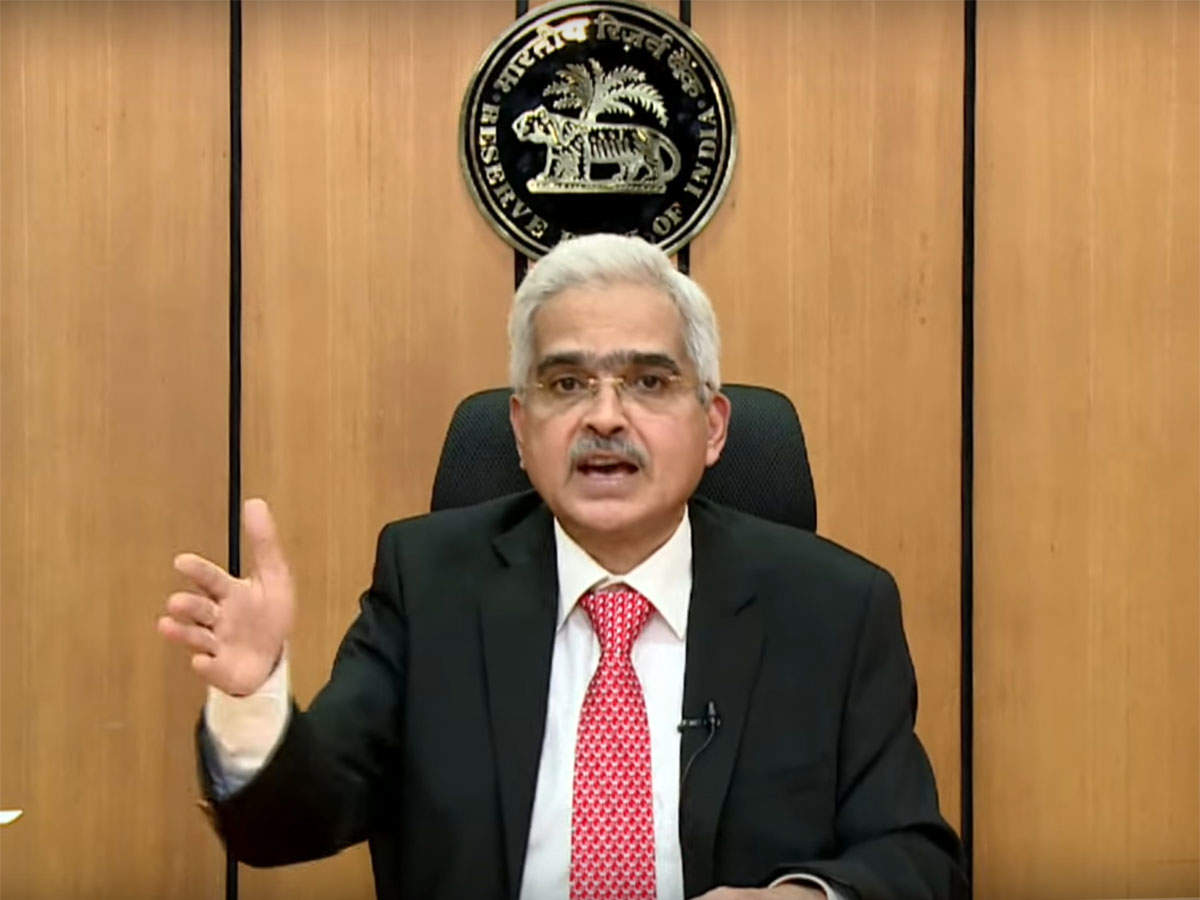

“In respect of all accounts for which lending institutions decide to grant moratorium and which were standard as on March 1, 2020, the 90-day NPA norm shall exclude the moratorium period, i.e., there would be an asset classification standstill for all such accounts from March 1, 2020 to May 31, 2020,” Shaktikanta Das said.

“In respect of all accounts for which lending institutions decide to grant moratorium and which were standard as on March 1, 2020, the 90-day NPA norm shall exclude the moratorium period, i.e., there would be an asset classification standstill for all such accounts from March 1, 2020 to May 31, 2020,” Shaktikanta Das said. 7:57 AM

7:57 AM

Blogger

Blogger

“Banks have been required to put in place business continuity plans to operate from their disaster recovery sites and to identify alternate locations for critical operations so that there is no disruption in customer services,” Das said.

“Banks have been required to put in place business continuity plans to operate from their disaster recovery sites and to identify alternate locations for critical operations so that there is no disruption in customer services,” Das said. 7:57 AM

7:57 AM

Blogger

Blogger

The Reserve Bank of India (RBI) on Friday threw a lifeline to non-bank lenders and real estate firms by allowing the former to restructure commercial realty project loans for a year.

The Reserve Bank of India (RBI) on Friday threw a lifeline to non-bank lenders and real estate firms by allowing the former to restructure commercial realty project loans for a year. 7:08 AM

7:08 AM

Blogger

Blogger

6:08 AM

6:08 AM

Blogger

Blogger

8:31 PM

8:31 PM

Blogger

Blogger

7:50 PM

7:50 PM

Blogger

Blogger

Investor wealth on Friday rose by Rs 2,83,740.31 crore as markets soared over 986 points after a second batch of stimulus measures by the Reserve Bank of India (RBI). The 30-share BSE sensex ended 986.11 points or 3.22 per cent higher at 31,588.72.

Investor wealth on Friday rose by Rs 2,83,740.31 crore as markets soared over 986 points after a second batch of stimulus measures by the Reserve Bank of India (RBI). The 30-share BSE sensex ended 986.11 points or 3.22 per cent higher at 31,588.72. 7:46 PM

7:46 PM

Blogger

Blogger

"Overall, the second set of package by RBI is an excellent reflection of combining the policy response and regulatory responses in the most optimal manner," he said in a statement. Kumar said the second set of targeted long term repo operations will help non-bank lenders and micro lenders.

"Overall, the second set of package by RBI is an excellent reflection of combining the policy response and regulatory responses in the most optimal manner," he said in a statement. Kumar said the second set of targeted long term repo operations will help non-bank lenders and micro lenders. 7:08 PM

7:08 PM

Blogger

Blogger

6:01 PM

6:01 PM

Blogger

Blogger

5:01 PM

5:01 PM

Blogger

Blogger

4:50 PM

4:50 PM

Blogger

Blogger

Finance minister Nirmala Sitharaman on Friday said the RBI has taken a slew of steps to maintain adequate liquidity in the system, incentivise bank credit flows, ease financial stress and enable normal functioning of markets, as part of the second stimulus package to deal with the impact of COVID-19 pandemic. The first stimulus package was announced on March 27.

Finance minister Nirmala Sitharaman on Friday said the RBI has taken a slew of steps to maintain adequate liquidity in the system, incentivise bank credit flows, ease financial stress and enable normal functioning of markets, as part of the second stimulus package to deal with the impact of COVID-19 pandemic. The first stimulus package was announced on March 27. 4:46 PM

4:46 PM

Blogger

Blogger

One of the glaring features of Indian banking in the past few months has been that banks are flush with funds, but they are holding back on lending to all those who are in need of credit. That came to the fore during Governor Shaktikanta Das’ address where he unveiled TLTRO 2.0, a package of measures to keep credit flowing.

One of the glaring features of Indian banking in the past few months has been that banks are flush with funds, but they are holding back on lending to all those who are in need of credit. That came to the fore during Governor Shaktikanta Das’ address where he unveiled TLTRO 2.0, a package of measures to keep credit flowing. 4:46 PM

4:46 PM

Blogger

Blogger

The branches of Muthoot Finance will function in their regular timings and will adhere to all instructions set out by the state governments for corporates resuming services from April 20, 2020.

The branches of Muthoot Finance will function in their regular timings and will adhere to all instructions set out by the state governments for corporates resuming services from April 20, 2020. 4:01 PM

4:01 PM

Blogger

Blogger

3:16 PM

3:16 PM

Blogger

Blogger

"It has been decided to provide special refinance facilities for a total amount of Rs 50,000 crore to NABARD, SIDBI and NHB to enable them to meet sectoral credit needs" RBI governor Shaktikanta Das said in his media statement.

"It has been decided to provide special refinance facilities for a total amount of Rs 50,000 crore to NABARD, SIDBI and NHB to enable them to meet sectoral credit needs" RBI governor Shaktikanta Das said in his media statement. 3:16 PM

3:16 PM

Blogger

Blogger

"It has been decided that in view of the COVID-19 related economic shock, scheduled commercial banks and cooperative banks shall not make any further dividend payouts from profits pertaining to the financial year ended March 31, 2020 until further instructions," RBI governor Shaktikanta Das said.

"It has been decided that in view of the COVID-19 related economic shock, scheduled commercial banks and cooperative banks shall not make any further dividend payouts from profits pertaining to the financial year ended March 31, 2020 until further instructions," RBI governor Shaktikanta Das said. 1:16 PM

1:16 PM

Blogger

Blogger

Daily operations of banks are running despite the business continuity challenges faced by financial institutions since the nationwide lockdown to curb the spread covid-19 was imposed by the Government of India from March 25, RBI governor Shaktikanta Das said on Friday.

Daily operations of banks are running despite the business continuity challenges faced by financial institutions since the nationwide lockdown to curb the spread covid-19 was imposed by the Government of India from March 25, RBI governor Shaktikanta Das said on Friday. 1:01 PM

1:01 PM

Blogger

Blogger

12:20 PM

12:20 PM

Blogger

Blogger

Reserve Bank of India (RBI) governor Shaktikanta Das on Friday addressed the media via video conferencing to announce measures to support economy during the ongoing coronavirus crisis. The RBI chief unveiled a slew of measures which included reduction in reverse repo rate and liquidity support for financial institutions, among others.

Reserve Bank of India (RBI) governor Shaktikanta Das on Friday addressed the media via video conferencing to announce measures to support economy during the ongoing coronavirus crisis. The RBI chief unveiled a slew of measures which included reduction in reverse repo rate and liquidity support for financial institutions, among others. 11:20 AM

11:20 AM

Blogger

Blogger

RBI governor Shaktikanta Das addressed the media amid the ongoing coronavirus crisis. Under liquidity adjustment facility (LAF), reverse repo rate (rate at which RBI borrows funds from banks) reduced by 25 basis points to 3.75%; repo rate unchanged (4.40%) as the decision is taken by the Monetary Policy Committee, Das announced.

RBI governor Shaktikanta Das addressed the media amid the ongoing coronavirus crisis. Under liquidity adjustment facility (LAF), reverse repo rate (rate at which RBI borrows funds from banks) reduced by 25 basis points to 3.75%; repo rate unchanged (4.40%) as the decision is taken by the Monetary Policy Committee, Das announced. 11:16 AM

11:16 AM

Blogger

Blogger

After doling out nearly two-thirds of new lending in 2019, the private banks have been unable to escape the effects of India’s lockdown of its economy, which is expected to devastate many of their retail and corporate customers. If they curtail new loans even to healthy borrowers, that will have serious consequences for the Indian economy and the pace at which it can emerge from the crisis.

After doling out nearly two-thirds of new lending in 2019, the private banks have been unable to escape the effects of India’s lockdown of its economy, which is expected to devastate many of their retail and corporate customers. If they curtail new loans even to healthy borrowers, that will have serious consequences for the Indian economy and the pace at which it can emerge from the crisis. 11:01 AM

11:01 AM

Blogger

Blogger

11:01 AM

11:01 AM

Blogger

Blogger

10:01 AM

10:01 AM

Blogger

Blogger

9:50 AM

9:50 AM

Blogger

Blogger

Equity indices surged on Friday with the benchmark BSE sensex rising more than 1,050 points on stimulus hopes ahead of the Reserve Bank of India (RBI) briefing. Sensex jumped 1,073 points to 31,676 in opening trade; while the broader NSE Nifty traded above the 9,300-mark.

Equity indices surged on Friday with the benchmark BSE sensex rising more than 1,050 points on stimulus hopes ahead of the Reserve Bank of India (RBI) briefing. Sensex jumped 1,073 points to 31,676 in opening trade; while the broader NSE Nifty traded above the 9,300-mark. 9:16 AM

9:16 AM

Blogger

Blogger

Non-bank lenders with large exposure to construction finance and housing finance companies have written to the Reserve Bank of India (RBI) Governor Shaktikanta Das, saying they will run out of cash by May-June if they don’t get the benefit of the moratorium on repayments applicable to other borrowers.

Non-bank lenders with large exposure to construction finance and housing finance companies have written to the Reserve Bank of India (RBI) Governor Shaktikanta Das, saying they will run out of cash by May-June if they don’t get the benefit of the moratorium on repayments applicable to other borrowers. 9:16 AM

9:16 AM

Blogger

Blogger

Staring at a double blow of rising delinquences and falling loan demand, banks are all set to request the Reserve Bank of India (RBI) for extraordinary relaxations in accounting of non-performing assets (NPAs) and could also seek government guarantees for loans to small and medium enterprises (SMEs).

Staring at a double blow of rising delinquences and falling loan demand, banks are all set to request the Reserve Bank of India (RBI) for extraordinary relaxations in accounting of non-performing assets (NPAs) and could also seek government guarantees for loans to small and medium enterprises (SMEs). 3:38 AM

3:38 AM

Blogger

Blogger

1:38 AM

1:38 AM

Blogger

Blogger

10:46 PM

10:46 PM

Blogger

Blogger

Private sector lenders have mostly decided not to buy papers rated lower than AAA or AA, while public sector banks find traditional loans priced on Marginal Cost Based Lending Rate (MCLR) more viable, three top NBFC executives told ET.

Private sector lenders have mostly decided not to buy papers rated lower than AAA or AA, while public sector banks find traditional loans priced on Marginal Cost Based Lending Rate (MCLR) more viable, three top NBFC executives told ET. 9:01 PM

9:01 PM

Blogger

Blogger

8:31 PM

8:31 PM

Blogger

Blogger

7:16 PM

7:16 PM

Blogger

Blogger

On the table is a relaxation of the NPA recognition timeline to 180 days from 90 days, which would give banks more time to assess damage and cushion impact on their financial metrics, especially capital and provision coverage, three persons familiar with the deliberations said. The suggestions also include a possible government guarantee of first loss for funding SMEs.

On the table is a relaxation of the NPA recognition timeline to 180 days from 90 days, which would give banks more time to assess damage and cushion impact on their financial metrics, especially capital and provision coverage, three persons familiar with the deliberations said. The suggestions also include a possible government guarantee of first loss for funding SMEs. 7:01 PM

7:01 PM

Blogger

Blogger

6:01 PM

6:01 PM

Blogger

Blogger

4:31 PM

4:31 PM

Blogger

Blogger

4:08 PM

4:08 PM

Blogger

Blogger

3:16 PM

3:16 PM

Blogger

Blogger

IndusInd Bank said it has supplied relief materials such as face masks, hand sanitisers and gloves to the affected areas to and is also working on facilitating personal protective equipment (PPE) for medical officials on duty.

IndusInd Bank said it has supplied relief materials such as face masks, hand sanitisers and gloves to the affected areas to and is also working on facilitating personal protective equipment (PPE) for medical officials on duty. 2:16 PM

2:16 PM

Blogger

Blogger

"Since March 15, our volumes on outward remittance services have increased many fold. There is a significant difference in before-and-after demand since mid of March," said Praveen Kutty, Head of Retail and SME Banking, DCB Bank without quantifying the increase in demand.

"Since March 15, our volumes on outward remittance services have increased many fold. There is a significant difference in before-and-after demand since mid of March," said Praveen Kutty, Head of Retail and SME Banking, DCB Bank without quantifying the increase in demand. 1:31 PM

1:31 PM

Blogger

Blogger

11:31 AM

11:31 AM

Blogger

Blogger

11:01 AM

11:01 AM

Blogger

Blogger

8:16 AM

8:16 AM

Blogger

Blogger

The country’s largest lender, SBI, has reduced the interest rate on all staff loans (housing, education, vehicle, computer and personal) by 1%. The extra day’s salary will be paid to frontline staff until the nationwide lockdown ends.

The country’s largest lender, SBI, has reduced the interest rate on all staff loans (housing, education, vehicle, computer and personal) by 1%. The extra day’s salary will be paid to frontline staff until the nationwide lockdown ends. 8:16 AM

8:16 AM

Blogger

Blogger

Sashi Jagdishan & Kaizad Bharucha are from the bank while Sunil Garg is a Citibank honcho.

Sashi Jagdishan & Kaizad Bharucha are from the bank while Sunil Garg is a Citibank honcho. 6:08 AM

6:08 AM

Blogger

Blogger

11:20 PM

11:20 PM

Blogger

Blogger

Former chief economic adviser (CEA) Arvind Subramanian on Wednesday said the GDP (gross domestic product) numbers being projected by the World Bank and IMF (International Monetary Fund) for India are far "too optimistic" and the country would require additional expenditure of Rs 10 lakh crore to bring the coronavirus-hit economy back on track.

Former chief economic adviser (CEA) Arvind Subramanian on Wednesday said the GDP (gross domestic product) numbers being projected by the World Bank and IMF (International Monetary Fund) for India are far "too optimistic" and the country would require additional expenditure of Rs 10 lakh crore to bring the coronavirus-hit economy back on track. 10:46 PM

10:46 PM

Blogger

Blogger

EarlySalary, KreditBee and LoanTap are focusing only on servicing their existing clients and collect the loans back, in a bid to survive the economic downturn. Fintech lenders charge 1.4-2.5% per month.

EarlySalary, KreditBee and LoanTap are focusing only on servicing their existing clients and collect the loans back, in a bid to survive the economic downturn. Fintech lenders charge 1.4-2.5% per month. 9:01 PM

9:01 PM

Blogger

Blogger

8:16 PM

8:16 PM

Blogger

Blogger

PACL, which had raised money from the public in the name of agriculture and real estate businesses, was found by Sebi to have collected more than Rs 60,000 crore through illegal collective investment schemes (CISs) over a period of 18 years.

PACL, which had raised money from the public in the name of agriculture and real estate businesses, was found by Sebi to have collected more than Rs 60,000 crore through illegal collective investment schemes (CISs) over a period of 18 years. 8:16 PM

8:16 PM

Blogger

Blogger

The insurance is offered under Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), the bank said in a release.

The insurance is offered under Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), the bank said in a release. 7:31 PM

7:31 PM

Blogger

Blogger

7:01 PM

7:01 PM

Blogger

Blogger

6:46 PM

6:46 PM

Blogger

Blogger

"The most important thing is that the hardship of the lockdown is being borne very severely by the vulnerable sections." Because of the closure of the factories, the daily wage earner including the migrant labourer has been severely affected, he said.

"The most important thing is that the hardship of the lockdown is being borne very severely by the vulnerable sections." Because of the closure of the factories, the daily wage earner including the migrant labourer has been severely affected, he said. 6:31 PM

6:31 PM

Blogger

Blogger

6:01 PM

6:01 PM

Blogger

Blogger

5:46 PM

5:46 PM

Blogger

Blogger

The central government through its notification dated April 13 has appointed Mrutyunjay Mahapatra, former managing director and chief executive officer of Syndicate Bank, as an Officer on Special Duty on a supernumerary basis in Canara Bank, it said in a regulatory filing.

The central government through its notification dated April 13 has appointed Mrutyunjay Mahapatra, former managing director and chief executive officer of Syndicate Bank, as an Officer on Special Duty on a supernumerary basis in Canara Bank, it said in a regulatory filing. 5:46 PM

5:46 PM

Blogger

Blogger

A senior bank official said the service was being offered as the nationwide lockdown has been extended till May 3 and would help customers avoid visiting branches. He said customers can open Selfe Fixed Deposit online for value upto Rs 90,000 by providing Aadhar and PAN details.

A senior bank official said the service was being offered as the nationwide lockdown has been extended till May 3 and would help customers avoid visiting branches. He said customers can open Selfe Fixed Deposit online for value upto Rs 90,000 by providing Aadhar and PAN details. 5:46 PM

5:46 PM

Blogger

Blogger

Private lender Bandhan Bank's MD said that repayments should not be a cause for concern as borrowers' businesses are continuing. The official said most of the bank's customers are apprised of the costs of opting for the moratorium and are agreeable to repay as per schedule.

Private lender Bandhan Bank's MD said that repayments should not be a cause for concern as borrowers' businesses are continuing. The official said most of the bank's customers are apprised of the costs of opting for the moratorium and are agreeable to repay as per schedule. 4:20 PM

4:20 PM

Blogger

Blogger

Equity indices on Wednesday finished in red with the benchmark BSE sensex falling over 300 points dragged by bank and auto stocks. The 30-share BSE index plunged 310 points or 1.01% to 30,380; while the broader NSE Nifty settled 69 points or 0.76% lower at 8,925. Top losers in the BSE pack included Kotak Bank, Hero MotoCorp, Bajaj Finance, Maruti, HDFC twin and M&M.

Equity indices on Wednesday finished in red with the benchmark BSE sensex falling over 300 points dragged by bank and auto stocks. The 30-share BSE index plunged 310 points or 1.01% to 30,380; while the broader NSE Nifty settled 69 points or 0.76% lower at 8,925. Top losers in the BSE pack included Kotak Bank, Hero MotoCorp, Bajaj Finance, Maruti, HDFC twin and M&M. 4:08 PM

4:08 PM

Blogger

Blogger

4:01 PM

4:01 PM

Blogger

Blogger

3:16 PM

3:16 PM

Blogger

Blogger

Right now, as we think about changes galore in our life from how we can better reorganize our lives after this ‘do it yourself’ experience and beginning to question why do we need so many things, it’s interesting to take a close look at what direction the financial system and markets could take as we navigate the current Covid and post Covid phase.

Right now, as we think about changes galore in our life from how we can better reorganize our lives after this ‘do it yourself’ experience and beginning to question why do we need so many things, it’s interesting to take a close look at what direction the financial system and markets could take as we navigate the current Covid and post Covid phase. 2:31 PM

2:31 PM

Blogger

Blogger

2:01 PM

2:01 PM

Blogger

Blogger

2:01 PM

2:01 PM

Blogger

Blogger

12:31 PM

12:31 PM

Blogger

Blogger

8:16 AM

8:16 AM

Blogger

Blogger

Fincare Small Finance Bank has seen deposits grow nearly 50% as compared to March 2019 and 13% over December 2019. In actual terms, Fincare clocked deposits worth ₹4,606 crore at the end of March 2020. The figure was at ₹4,076 crore at the end of December and ₹2,043 crore at the end of March 2019. And 77% of its deposits are retail.

Fincare Small Finance Bank has seen deposits grow nearly 50% as compared to March 2019 and 13% over December 2019. In actual terms, Fincare clocked deposits worth ₹4,606 crore at the end of March 2020. The figure was at ₹4,076 crore at the end of December and ₹2,043 crore at the end of March 2019. And 77% of its deposits are retail. 8:16 AM

8:16 AM

Blogger

Blogger

Most corporates are using available working capital facilities and drawing down on term loans presumably to conserve adequate liquidity, according to State Bank of India’s deputy managing director for corporate accounts, Sujit Varma.

Most corporates are using available working capital facilities and drawing down on term loans presumably to conserve adequate liquidity, according to State Bank of India’s deputy managing director for corporate accounts, Sujit Varma. 3:35 AM

3:35 AM

Blogger

Blogger

11:51 PM

11:51 PM

Blogger

Blogger

State-owned banks have barred employees from posting pictures, video clips or messages on social media on issues such as overcrowding at bank branches during the coronavirus crisis, according to multiple sources and documents seen by Reuters.

State-owned banks have barred employees from posting pictures, video clips or messages on social media on issues such as overcrowding at bank branches during the coronavirus crisis, according to multiple sources and documents seen by Reuters. 11:29 PM

11:29 PM

Blogger

Blogger

Both Sa-dhan, India's largest microfinance industry body with 212 members, and Microfinance Institutions Network (MFIN), the industry grouping for NBFC-MFIs, have separately urged the prime minister to take action.

Both Sa-dhan, India's largest microfinance industry body with 212 members, and Microfinance Institutions Network (MFIN), the industry grouping for NBFC-MFIs, have separately urged the prime minister to take action. 10:29 PM

10:29 PM

Blogger

Blogger

The review meeting - held via video conference - reviewed banks functioning during the lockdown and also took stock of liquidity situation, sources said.

The review meeting - held via video conference - reviewed banks functioning during the lockdown and also took stock of liquidity situation, sources said. 9:05 PM

9:05 PM

Blogger

Blogger

8:52 PM

8:52 PM

Blogger

Blogger

6:35 PM

6:35 PM

Blogger

Blogger

4:52 PM

4:52 PM

Blogger

Blogger

4:22 PM

4:22 PM

Blogger

Blogger

2:35 PM

2:35 PM

Blogger

Blogger

1:22 PM

1:22 PM

Blogger

Blogger

12:59 PM

12:59 PM

Blogger

Blogger

Moody's said the Yes Bank episode places the country's financial system on "alert" and the rescue in itself "exposes weaknesses in the process to support a failing private sector bank". The RBI - which had to steer the over Rs 10,000 crore Yes Bank bailout - has however repeatedly assuaged such concerns, saying money in all the banks is safe.

Moody's said the Yes Bank episode places the country's financial system on "alert" and the rescue in itself "exposes weaknesses in the process to support a failing private sector bank". The RBI - which had to steer the over Rs 10,000 crore Yes Bank bailout - has however repeatedly assuaged such concerns, saying money in all the banks is safe. 11:29 AM

11:29 AM

Blogger

Blogger

State Bank of India's Chairman Rajnish Kumar has sought government guarantees to enable banks to lend to companies to expedite a post-lockdown economic recovery in the aftermath of the Covid-19 pandemic.

State Bank of India's Chairman Rajnish Kumar has sought government guarantees to enable banks to lend to companies to expedite a post-lockdown economic recovery in the aftermath of the Covid-19 pandemic. 11:22 AM

11:22 AM

Blogger

Blogger

11:22 AM

11:22 AM

Blogger

Blogger

10:22 AM

10:22 AM

Blogger

Blogger

10:22 AM

10:22 AM

Blogger

Blogger

8:35 AM

8:35 AM

Blogger

Blogger

8:29 AM

8:29 AM

Blogger

Blogger

Sidbi’s query follows a Delhi High Court decision on a plea by Indiabulls Commercial Credit (ICC) seeking benefit of the moratorium that had been announced by the RBI on March 27 as part of reliefs for borrowers on account of the Covid-19 pandemic.

Sidbi’s query follows a Delhi High Court decision on a plea by Indiabulls Commercial Credit (ICC) seeking benefit of the moratorium that had been announced by the RBI on March 27 as part of reliefs for borrowers on account of the Covid-19 pandemic. 6:05 AM

6:05 AM

Blogger

Blogger

3:22 PM

3:22 PM

Blogger

Blogger

2:35 PM

2:35 PM

Blogger

Blogger

2:29 PM

2:29 PM

Blogger

Blogger

Building on the 15-year partnership, the two firms remain committed to offering their customers a broad range of need-based products and services, deploying technology across the customer value chain to further enhance efficiencies and leveraging existing ecosystems to facilitate superior experiences for their customers, the insurer said.

Building on the 15-year partnership, the two firms remain committed to offering their customers a broad range of need-based products and services, deploying technology across the customer value chain to further enhance efficiencies and leveraging existing ecosystems to facilitate superior experiences for their customers, the insurer said. 2:22 PM

2:22 PM

Blogger

Blogger

1:51 PM

1:51 PM

Blogger

Blogger

All-out efforts are needed to mitigate the adverse impact of the Covid-19 pandemic, and the RBI will use any instrument necessary to revive growth and preserve financial stability, according to the minutes of the central bank's policy meeting.

All-out efforts are needed to mitigate the adverse impact of the Covid-19 pandemic, and the RBI will use any instrument necessary to revive growth and preserve financial stability, according to the minutes of the central bank's policy meeting. 1:22 PM

1:22 PM

Blogger

Blogger

1:22 PM

1:22 PM

Blogger

Blogger

1:22 PM

1:22 PM

Blogger

Blogger

11:52 AM

11:52 AM

Blogger

Blogger

11:29 AM

11:29 AM

Blogger

Blogger

The retail deposits formed bulk of the total deposits at 78.4 per cent, which showed an increase of 34 per cent to Rs 44,760 crore as on March 31, 2020, Bandhan Bank said in a regulatory filing.

The retail deposits formed bulk of the total deposits at 78.4 per cent, which showed an increase of 34 per cent to Rs 44,760 crore as on March 31, 2020, Bandhan Bank said in a regulatory filing. 11:29 AM

11:29 AM

Blogger

Blogger

More currency with banks is part of a strategy worked out by the finance ministry and RBI when the lockdown began almost three weeks ago and was meant to avoid any panic in the system as ATMs running out of cash post-demonetisation in 2016 was fresh in the minds of people.

More currency with banks is part of a strategy worked out by the finance ministry and RBI when the lockdown began almost three weeks ago and was meant to avoid any panic in the system as ATMs running out of cash post-demonetisation in 2016 was fresh in the minds of people. 11:29 AM

11:29 AM

Blogger

Blogger

The country’s top NBFCs that are actively monitored by the RBI have around Rs 65,000 crore of bank debt maturing in three months and may not get any reprieve via a moratorium on loans.

The country’s top NBFCs that are actively monitored by the RBI have around Rs 65,000 crore of bank debt maturing in three months and may not get any reprieve via a moratorium on loans. RSS Feed

RSS Feed Twitter

Twitter