Collections seen inching up by 3% y-o-y in FY21 on falling rates, rising equities

from Business Line - Money & Banking https://ift.tt/3kBYjI8

Read more »

from Business Line - Money & Banking https://ift.tt/3kBYjI8

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

11:12 PM

11:12 PM

Blogger

Blogger

10:12 PM

10:12 PM

Blogger

Blogger

10:12 PM

10:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

The private sector lender said it will seek approval from the shareholders through an ordinary resolution for the required reclassification.

The private sector lender said it will seek approval from the shareholders through an ordinary resolution for the required reclassification. 8:12 PM

8:12 PM

Blogger

Blogger

2:12 PM

2:12 PM

Blogger

Blogger

9:14 AM

9:14 AM

Blogger

Blogger

10:12 PM

10:12 PM

Blogger

Blogger

8:05 PM

8:05 PM

Blogger

Blogger

The submission was made before Justice Prathiba M Singh by Additional Solicitor General (ASG) Chetan Sharma who said the committee held a meeting on February 23 and another is scheduled on March 4 after which it would submit its final report.

The submission was made before Justice Prathiba M Singh by Additional Solicitor General (ASG) Chetan Sharma who said the committee held a meeting on February 23 and another is scheduled on March 4 after which it would submit its final report. 7:12 PM

7:12 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

"We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said.

"We are delighted to partner with one of the leading players in general insurance businesses-SBI General Insurance. We will efficiently nurture it to be a long running mutually beneficial relationship", the bank's Managing Director Partha Pratim Sengupta said. 6:05 PM

6:05 PM

Blogger

Blogger

Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless.

Deliberating on what the future holds for digital payments in India, Sajith Sivanandan, MD & Business Head - Google Pay & Next Billion User Initiative, Google India, and T.R. Ramachandran, Group Country Manager - India & South Asia, VISA, said the primary requirement was to make payments seamless. 5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:05 PM

5:05 PM

Blogger

Blogger

Panellists at the ET India Inc Boardroom emphasised the need for banks to invest in digital technology to bring down costs, and drive better delivery.

Panellists at the ET India Inc Boardroom emphasised the need for banks to invest in digital technology to bring down costs, and drive better delivery. 5:05 PM

5:05 PM

Blogger

Blogger

While stating that it has enabled loans to over 1.1 lakh merchants across over 75 cities in India, BharatPe said it is likely to end up facilitating disbursals of Rs 1,250 crores in FY 21.

While stating that it has enabled loans to over 1.1 lakh merchants across over 75 cities in India, BharatPe said it is likely to end up facilitating disbursals of Rs 1,250 crores in FY 21. 5:05 PM

5:05 PM

Blogger

Blogger

"With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said.

"With the objective of having a standard product with common coverage and policy wordings across the industry, the authority has decided to mandate all general and health insurers to offer the standard personal accident insurance product," Irdai said. 4:12 PM

4:12 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

“Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services.

“Private enterprises are being promoted wherever possible, still, along with this, an effective participation of the public sector in banking and insurance is still needed by the country,” he said in a webinar on effective implementation of Budget provisions regarding financial services. 4:05 PM

4:05 PM

Blogger

Blogger

The offering is the new version of its flagship product Activ Health, which provides a comprehensive health protection with extensive wellness benefits, the company said on Friday.

The offering is the new version of its flagship product Activ Health, which provides a comprehensive health protection with extensive wellness benefits, the company said on Friday. 2:12 PM

2:12 PM

Blogger

Blogger

2:05 PM

2:05 PM

Blogger

Blogger

"As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said.

"As our economy is growing, and growing fast, credit flow has also become equally important. You have to see how credit reaches new sectors, new entrepreneurs. Now you will have to focus on creation of new and better financial products for Startups and Fintech," Modi said. 1:05 PM

1:05 PM

Blogger

Blogger

According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid.

According to banking sources, lenders have already identified corporate loans of over Rs 1.5 lakh crore to be transferred to the NARC, which will be promoted in the public sector. The NARC will offer to purchase bad loans at a negotiated rate. However, once a negotiated rate is struck, private ARCs will be allowed to better the bid. 12:12 PM

12:12 PM

Blogger

Blogger

11:05 AM

11:05 AM

Blogger

Blogger

The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too.

The case involves one where Citibank acted as an administrative agent for a term loan taken by Revlon, and where it was to wire approximately $7.8 million in interest payments to Revlon’s lenders. Instead, Citibank wired almost $900 million. It mistakenly sent the principal amount too. 10:12 AM

10:12 AM

Blogger

Blogger

10:12 AM

10:12 AM

Blogger

Blogger

10:12 AM

10:12 AM

Blogger

Blogger

8:05 AM

8:05 AM

Blogger

Blogger

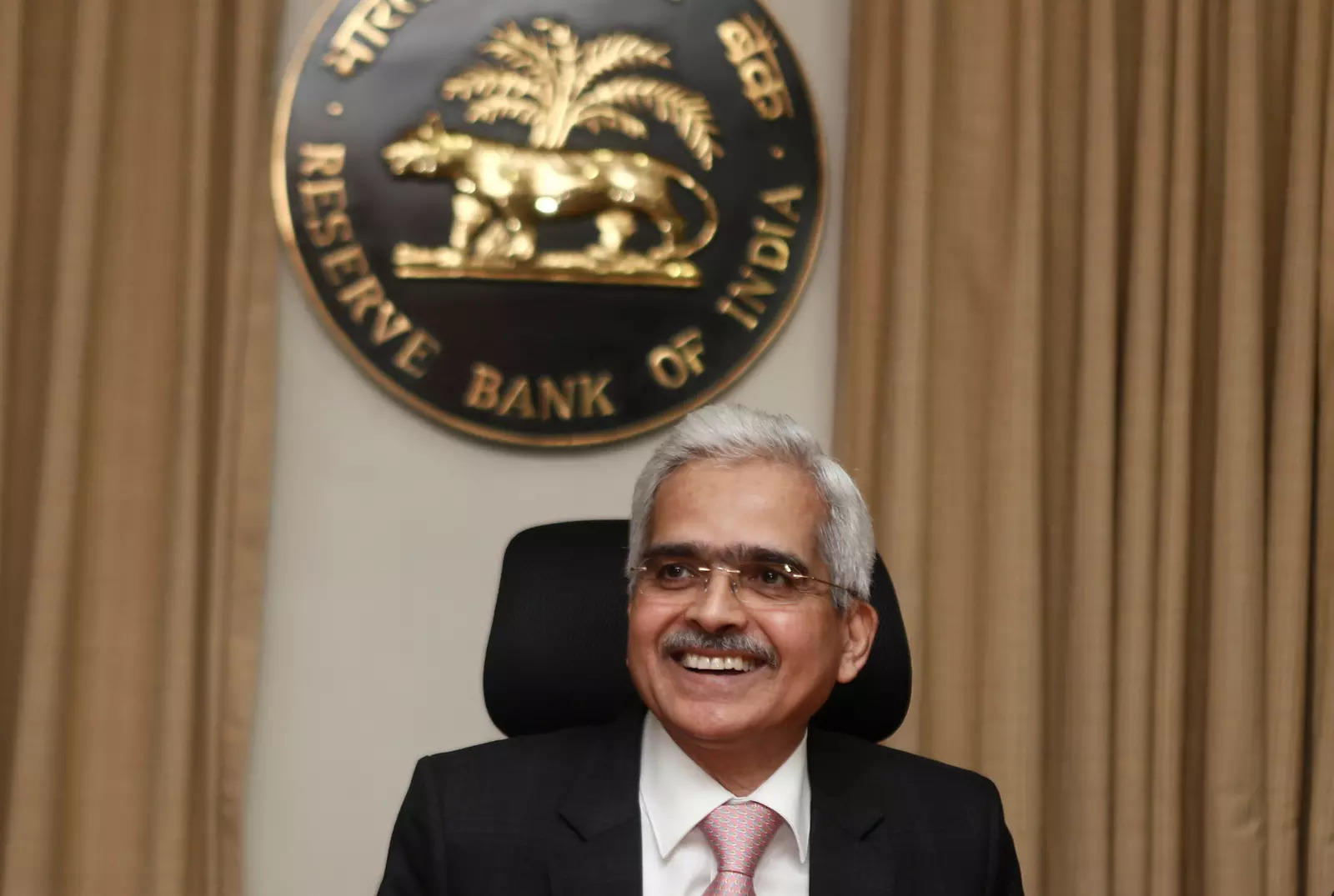

Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets.

Central bank governor Shaktikanta Das said the proposed bad bank, considered crucial in helping extract capital stuck in soured loans, will be a new asset reconstruction company (ARC) set up by public sector lenders to take over bad assets. 2:14 AM

2:14 AM

Blogger

Blogger

1:14 AM

1:14 AM

Blogger

Blogger

12:05 AM

12:05 AM

Blogger

Blogger

In November 2019, the Reserve Bank had referred DHFL, the third-largest pure-play mortgage lender, to the National Company Law Tribunal (NCLT) for insolvency proceedings.

In November 2019, the Reserve Bank had referred DHFL, the third-largest pure-play mortgage lender, to the National Company Law Tribunal (NCLT) for insolvency proceedings. 10:12 PM

10:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

The standardized product set to go live from April 1 has been named “Saral Suraksha Bima.” The minimum sum assured has been set as Rs 2.5 lakh.

The standardized product set to go live from April 1 has been named “Saral Suraksha Bima.” The minimum sum assured has been set as Rs 2.5 lakh. 8:12 PM

8:12 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

The bank is offering customised loans in Chhattisgarh, Karnataka, Andhra Pradesh, Telangana, Madhya Pradesh, Maharashtra, Odisha and Rajasthan, which saw a growth in demand last year.

The bank is offering customised loans in Chhattisgarh, Karnataka, Andhra Pradesh, Telangana, Madhya Pradesh, Maharashtra, Odisha and Rajasthan, which saw a growth in demand last year. 6:12 PM

6:12 PM

Blogger

Blogger

6:05 PM

6:05 PM

Blogger

Blogger

Under the amended Companies Act, 2013 and the Nidhi Rules, 2014, companies need to get themselves updated or declared as Nidhi company by applying to the Ministry of Corporate Affairs (MCA) in form NDH-4.

Under the amended Companies Act, 2013 and the Nidhi Rules, 2014, companies need to get themselves updated or declared as Nidhi company by applying to the Ministry of Corporate Affairs (MCA) in form NDH-4. 4:12 PM

4:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

2:05 PM

2:05 PM

Blogger

Blogger

Das also added that just like non-bank lenders the RBI was internally working on refining and strengthening guidelines governing asset reconstruction companies.

Das also added that just like non-bank lenders the RBI was internally working on refining and strengthening guidelines governing asset reconstruction companies. 2:05 PM

2:05 PM

Blogger

Blogger

The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI).

The merger that will create one of India's largest listed property development platforms has received nod from anti-monopoly watchdog the Competition Commission of India (CCI). It has also received regulatory approvals from the NSE, BSE, capital market regulator Securities & Exchange Board of India (SEBI). 12:12 PM

12:12 PM

Blogger

Blogger

9:14 AM

9:14 AM

Blogger

Blogger

3:14 AM

3:14 AM

Blogger

Blogger

11:14 PM

11:14 PM

Blogger

Blogger

10:12 PM

10:12 PM

Blogger

Blogger

10:05 PM

10:05 PM

Blogger

Blogger

As per the proposed transaction, Axis Entities have the right to acquire up to 19% stake in Max Life, of which, Axis Bank proposes to acquire up to 9%, and Axis Capital Limited and Axis Securities Limited together propose to acquire up to 3% of the share capital of Max Life in the first leg of the transaction.

As per the proposed transaction, Axis Entities have the right to acquire up to 19% stake in Max Life, of which, Axis Bank proposes to acquire up to 9%, and Axis Capital Limited and Axis Securities Limited together propose to acquire up to 3% of the share capital of Max Life in the first leg of the transaction. 10:05 PM

10:05 PM

Blogger

Blogger

The scheduled commercial bank, also called scheduled bank, status allows Fino to enhance its banking position in the treasury and participation in liquidity adjustment facility (LAF) window as per the RBI. It also helps the bank strengthen its business proposition on liabilities generation, Fino said in a release.

The scheduled commercial bank, also called scheduled bank, status allows Fino to enhance its banking position in the treasury and participation in liquidity adjustment facility (LAF) window as per the RBI. It also helps the bank strengthen its business proposition on liabilities generation, Fino said in a release. 9:12 PM

9:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

8:05 PM

8:05 PM

Blogger

Blogger

Bankers say that the Supreme Court moratorium over classifying loans as non performing assets (NPAs) has so far kept defaults under wraps, even as recovery efforts are ongoing. But they fear that as much as 25% loans under the scheme could turn bad.

Bankers say that the Supreme Court moratorium over classifying loans as non performing assets (NPAs) has so far kept defaults under wraps, even as recovery efforts are ongoing. But they fear that as much as 25% loans under the scheme could turn bad. 8:05 PM

8:05 PM

Blogger

Blogger

"While the Indian economy is on a mend, the permanent GDP loss stemming from the brunt of the coronavirus is huge at 10 per cent. We estimate the banking system's weak loans are at 12 per cent of gross loans," S&P said. An improvement in India's macroeconomic conditions is likely to alleviate stress for the country's banking sector, said S&P.

"While the Indian economy is on a mend, the permanent GDP loss stemming from the brunt of the coronavirus is huge at 10 per cent. We estimate the banking system's weak loans are at 12 per cent of gross loans," S&P said. An improvement in India's macroeconomic conditions is likely to alleviate stress for the country's banking sector, said S&P. 7:12 PM

7:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

2:12 PM

2:12 PM

Blogger

Blogger

1:05 PM

1:05 PM

Blogger

Blogger

A total of around 46 per cent of the consumer preference is now in the range of Rs 30 lakh-Rs 1 crore and above category, with most of the demand being generated from the key residential markets of Bengaluru, Hyderabad and Delhi.

A total of around 46 per cent of the consumer preference is now in the range of Rs 30 lakh-Rs 1 crore and above category, with most of the demand being generated from the key residential markets of Bengaluru, Hyderabad and Delhi. 10:12 AM

10:12 AM

Blogger

Blogger

2:14 AM

2:14 AM

Blogger

Blogger

11:12 PM

11:12 PM

Blogger

Blogger

11:05 PM

11:05 PM

Blogger

Blogger

While continuing to bank on gold loans as primary growth driver, the bank is set to target opportunities in the SME, two wheeler and secured loan segments.

While continuing to bank on gold loans as primary growth driver, the bank is set to target opportunities in the SME, two wheeler and secured loan segments. 10:05 PM

10:05 PM

Blogger

Blogger

Paytm Payments Bank MD and CEO Satish Gupta said in a statement, "It has been our endeavour to empower our users with seamless and hassle-free travel on road. In this quest, we support our users in every possible way, including fast redressal of any grievance they face with toll plazas."

Paytm Payments Bank MD and CEO Satish Gupta said in a statement, "It has been our endeavour to empower our users with seamless and hassle-free travel on road. In this quest, we support our users in every possible way, including fast redressal of any grievance they face with toll plazas." 7:05 PM

7:05 PM

Blogger

Blogger

The profit growth came despite an increase in provision for credit losses in the year dominated by the pandemic, the bank said in a statement, pointing out that money set aside for losses for wholesale advances almost doubled to USD 94 million, while the same for retail more than doubled to USD 54 million.

The profit growth came despite an increase in provision for credit losses in the year dominated by the pandemic, the bank said in a statement, pointing out that money set aside for losses for wholesale advances almost doubled to USD 94 million, while the same for retail more than doubled to USD 54 million. 6:05 PM

6:05 PM

Blogger

Blogger

Its Managing Director and Chief Executive Officer Shyam Srinivasan said the increase in virus infections in states like Maharashtra needs to be watched, but exuded confidence that it will not affect the overall economic activity, terming it a "minor blip".

Its Managing Director and Chief Executive Officer Shyam Srinivasan said the increase in virus infections in states like Maharashtra needs to be watched, but exuded confidence that it will not affect the overall economic activity, terming it a "minor blip". 5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

3:05 PM

3:05 PM

Blogger

Blogger

"KFC has achieved the highest growth among the Government owned State Financial Corporations (SFCs) in India. This important achievement was facilitated by fresh loan sanctions of Rs 3385 crore so far in the current financial year," said Tomin J Thachankary, CMD of KFC.

"KFC has achieved the highest growth among the Government owned State Financial Corporations (SFCs) in India. This important achievement was facilitated by fresh loan sanctions of Rs 3385 crore so far in the current financial year," said Tomin J Thachankary, CMD of KFC. 2:12 PM

2:12 PM

Blogger

Blogger

8:14 AM

8:14 AM

Blogger

Blogger

6:14 AM

6:14 AM

Blogger

Blogger

1:14 AM

1:14 AM

Blogger

Blogger

11:05 PM

11:05 PM

Blogger

Blogger

The tie up is expected to reduce SBI customers’ transaction costs and time taken for payments, sources said. Time taken to resolve cross-border payments-related inquiries can be reduced to a few hours from up to a fortnight, they said. This will help cross-border payments reach beneficiaries faster and using limited steps.

The tie up is expected to reduce SBI customers’ transaction costs and time taken for payments, sources said. Time taken to resolve cross-border payments-related inquiries can be reduced to a few hours from up to a fortnight, they said. This will help cross-border payments reach beneficiaries faster and using limited steps. 9:12 PM

9:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

The lender, which expects to close the year at Rs 3,700 crore, aims to close FY23 with a book size of Rs 10,000 crore. Bulk of the growth is expected to come from the affordable housing loan segment.

The lender, which expects to close the year at Rs 3,700 crore, aims to close FY23 with a book size of Rs 10,000 crore. Bulk of the growth is expected to come from the affordable housing loan segment. 9:05 PM

9:05 PM

Blogger

Blogger

“It’s quite unfortunate that the regulator has been dragging its heels on Iqbal’s appointment since the last 10 months, in fact several shareholders have even shot off letters of complaint to the RBI and the bank board about the CEO’s appointment, but there hasn’t been any response,” an official in the know said.

“It’s quite unfortunate that the regulator has been dragging its heels on Iqbal’s appointment since the last 10 months, in fact several shareholders have even shot off letters of complaint to the RBI and the bank board about the CEO’s appointment, but there hasn’t been any response,” an official in the know said. 8:12 PM

8:12 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

Developing a retirement strategy for your parent

Developing a retirement strategy for your parent 6:12 PM

6:12 PM

Blogger

Blogger

6:05 PM

6:05 PM

Blogger

Blogger

With collections bouncing back to the pre-moratorium levels in most of the secured asset classes and businesses of non-bank lenders nearing their pre-moratorium levels, ICRA expects a rise in securitisation transactions.

With collections bouncing back to the pre-moratorium levels in most of the secured asset classes and businesses of non-bank lenders nearing their pre-moratorium levels, ICRA expects a rise in securitisation transactions. 6:05 PM

6:05 PM

Blogger

Blogger

The court said Mahajan did not express any concern or opposed the alleged loan proposal which clearly established conspiracy with the promoters/other accused persons for alleged diversion of funds.

The court said Mahajan did not express any concern or opposed the alleged loan proposal which clearly established conspiracy with the promoters/other accused persons for alleged diversion of funds. 5:12 PM

5:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

3:05 PM

3:05 PM

Blogger

Blogger

The ratings agency forecasts total stressed loans from retail to rise to 4.7% in March 2022 from 1.60% in March 2021 led by slippages in unsecured loans especially from private sector banks.

The ratings agency forecasts total stressed loans from retail to rise to 4.7% in March 2022 from 1.60% in March 2021 led by slippages in unsecured loans especially from private sector banks. 2:12 PM

2:12 PM

Blogger

Blogger

2:12 PM

2:12 PM

Blogger

Blogger

2:12 PM

2:12 PM

Blogger

Blogger

2:05 PM

2:05 PM

Blogger

Blogger

The administrator of the company received an initial report from the professional agency appointed as the transaction auditor indicating that there are certain transactions which are "undervalued, fraudulent and preferential in nature", DHFL said in a regulatory filing.

The administrator of the company received an initial report from the professional agency appointed as the transaction auditor indicating that there are certain transactions which are "undervalued, fraudulent and preferential in nature", DHFL said in a regulatory filing. 1:12 PM

1:12 PM

Blogger

Blogger

12:12 PM

12:12 PM

Blogger

Blogger

11:12 AM

11:12 AM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

8:05 PM

8:05 PM

Blogger

Blogger

Non-life insurance premium reached Rs 18488.1 crore for the month against Rs 17333.7 crore January of 2020. At 2.8% the Gross Direct Premium (GDPI) growth has been much slower for the year-to-date (YTD) period for FY21, as per data released by the General Insurance Council.

Non-life insurance premium reached Rs 18488.1 crore for the month against Rs 17333.7 crore January of 2020. At 2.8% the Gross Direct Premium (GDPI) growth has been much slower for the year-to-date (YTD) period for FY21, as per data released by the General Insurance Council. 5:12 PM

5:12 PM

Blogger

Blogger

5:05 PM

5:05 PM

Blogger

Blogger

The company has transferred over Rs 300 crore of loan subsidy under Pradhan Mantri Awas Yojana's Credit Linked Subsidy Scheme from National Housing Bank (NHB), the release said.

The company has transferred over Rs 300 crore of loan subsidy under Pradhan Mantri Awas Yojana's Credit Linked Subsidy Scheme from National Housing Bank (NHB), the release said. 4:14 PM

4:14 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

Max Life, ranked No. 4 among private players, registered a 35 per cent rise in net profit to Rs 417 crore in the nine months of 2020-21. Gross written premium were up by 16 per cent at Rs 11,912 crore, assets under management (AUM) grew by 23 per cent to Rs 84,724 crore.

Max Life, ranked No. 4 among private players, registered a 35 per cent rise in net profit to Rs 417 crore in the nine months of 2020-21. Gross written premium were up by 16 per cent at Rs 11,912 crore, assets under management (AUM) grew by 23 per cent to Rs 84,724 crore. RSS Feed

RSS Feed Twitter

Twitter