Srei Infrastructure Finance is on a no-infra diet to recover from the stock market battering it received after the IL&FS defaults.

Srei Infrastructure Finance is on a no-infra diet to recover from the stock market battering it received after the IL&FS defaults.from Banking/Finance-Industry-Economic Times http://bit.ly/2WnCIGd

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

11:32 PM

11:32 PM

Blogger

Blogger

Srei Infrastructure Finance is on a no-infra diet to recover from the stock market battering it received after the IL&FS defaults.

Srei Infrastructure Finance is on a no-infra diet to recover from the stock market battering it received after the IL&FS defaults. 6:43 PM

6:43 PM

Blogger

Blogger

6:23 PM

6:23 PM

Blogger

Blogger

4:23 PM

4:23 PM

Blogger

Blogger

4:08 PM

4:08 PM

Blogger

Blogger

4:03 PM

4:03 PM

Blogger

Blogger

3:53 PM

3:53 PM

Blogger

Blogger

3:43 PM

3:43 PM

Blogger

Blogger

3:05 PM

3:05 PM

Blogger

Blogger

12:56 PM

12:56 PM

Blogger

Blogger

The number of debit cards in India has doubled to 94 crore in February this year from 42 crore in August 2014 when Jan-Dhan Yojana was launched. However, the number of ATMs has increased only 20% from 1.70 to 2.02 lakh, and a stand-off between banks, ATM companies and cash logistics firms on sharing costs are holding back investments.

The number of debit cards in India has doubled to 94 crore in February this year from 42 crore in August 2014 when Jan-Dhan Yojana was launched. However, the number of ATMs has increased only 20% from 1.70 to 2.02 lakh, and a stand-off between banks, ATM companies and cash logistics firms on sharing costs are holding back investments. 12:56 PM

12:56 PM

Blogger

Blogger

The role of three public sector lenders — State Bank of India, Punjab National Bank and Uco Bank — is under the scanner for allegedly issuing letters of credit based on the false documents. SFIO suspects that letters of credit (LC), a widely used instrument guaranteeing that a buyer’s payment will be received on time, of close to Rs 20,000 crore were opened using false documents on behalf of Bhushan Steel.

The role of three public sector lenders — State Bank of India, Punjab National Bank and Uco Bank — is under the scanner for allegedly issuing letters of credit based on the false documents. SFIO suspects that letters of credit (LC), a widely used instrument guaranteeing that a buyer’s payment will be received on time, of close to Rs 20,000 crore were opened using false documents on behalf of Bhushan Steel. 12:47 PM

12:47 PM

Blogger

Blogger

While cash in circulation has jumped to Rs 21.36 lakh crore, the ATM network of banks has shrunk from 2.06 lakh a year ago to 2.02 lakh this year.

While cash in circulation has jumped to Rs 21.36 lakh crore, the ATM network of banks has shrunk from 2.06 lakh a year ago to 2.02 lakh this year. 10:00 AM

10:00 AM

Blogger

Blogger

10:00 AM

10:00 AM

Blogger

Blogger

8:42 AM

8:42 AM

Blogger

Blogger

Under the earlier scheme of amalgamation announced on April 5, LVB was supposed to be merged with Indiabulls Housing Finance subject to regulatory approval.

Under the earlier scheme of amalgamation announced on April 5, LVB was supposed to be merged with Indiabulls Housing Finance subject to regulatory approval. 8:35 AM

8:35 AM

Blogger

Blogger

8:05 AM

8:05 AM

Blogger

Blogger

7:45 AM

7:45 AM

Blogger

Blogger

7:10 AM

7:10 AM

Blogger

Blogger

12:50 AM

12:50 AM

Blogger

Blogger

11:42 PM

11:42 PM

Blogger

Blogger

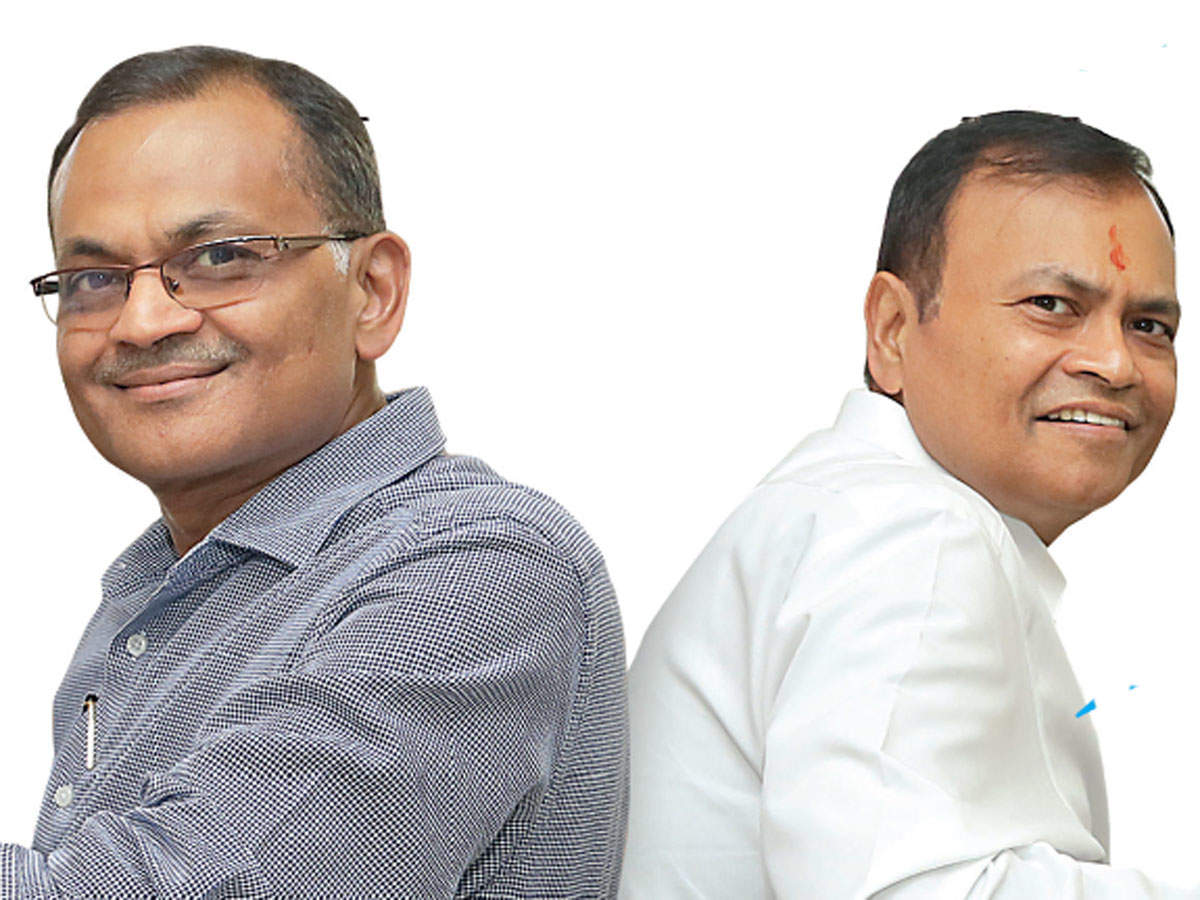

The new corporate insolvency regime has saved nearly four lakh jobs in India.

The new corporate insolvency regime has saved nearly four lakh jobs in India. 9:50 PM

9:50 PM

Blogger

Blogger

9:28 PM

9:28 PM

Blogger

Blogger

9:28 PM

9:28 PM

Blogger

Blogger

9:18 PM

9:18 PM

Blogger

Blogger

9:18 PM

9:18 PM

Blogger

Blogger

9:18 PM

9:18 PM

Blogger

Blogger

8:05 PM

8:05 PM

Blogger

Blogger

7:43 PM

7:43 PM

Blogger

Blogger

7:43 PM

7:43 PM

Blogger

Blogger

7:36 PM

7:36 PM

Blogger

Blogger

7:18 PM

7:18 PM

Blogger

Blogger

6:53 PM

6:53 PM

Blogger

Blogger

6:36 PM

6:36 PM

Blogger

Blogger

5:03 PM

5:03 PM

Blogger

Blogger

5:03 PM

5:03 PM

Blogger

Blogger

4:50 PM

4:50 PM

Blogger

Blogger

4:47 PM

4:47 PM

Blogger

Blogger

The numbers assume importance as the bankruptcy law enters the third year this month.

The numbers assume importance as the bankruptcy law enters the third year this month. 4:20 PM

4:20 PM

Blogger

Blogger

4:00 PM

4:00 PM

Blogger

Blogger

1:32 PM

1:32 PM

Blogger

Blogger

RBI had misgivings about Kochhar's doings as early as 2014, but ICICI fended off the regulator's red flags.

RBI had misgivings about Kochhar's doings as early as 2014, but ICICI fended off the regulator's red flags. 1:03 PM

1:03 PM

Blogger

Blogger

1:03 PM

1:03 PM

Blogger

Blogger

12:34 PM

12:34 PM

Blogger

Blogger

12:34 PM

12:34 PM

Blogger

Blogger

11:37 AM

11:37 AM

Blogger

Blogger

Banks have decided to shortlist a resolution professional from a field of 15 players after NCLAT allowed resumption of insolvency resolution action against RCom.

Banks have decided to shortlist a resolution professional from a field of 15 players after NCLAT allowed resumption of insolvency resolution action against RCom. 10:52 AM

10:52 AM

Blogger

Blogger

Tighter regulatory oversight and asset sales have staved off the worst of the problems afflicting India’s non-bank financial firms following last year’s defaults by IL&FS.

Tighter regulatory oversight and asset sales have staved off the worst of the problems afflicting India’s non-bank financial firms following last year’s defaults by IL&FS. 9:46 AM

9:46 AM

Blogger

Blogger

Auditors Pawan Kumar Aggarwal and Ravi Bhatia filed their report after a forensic audit of 46 registered companies and numerous shell companies of Amrapali group and bank accounts of the directors. They provided a graphic account of how Rs 3,500 crore of homebuyers’ money was diverted for purposes other than construction.

Auditors Pawan Kumar Aggarwal and Ravi Bhatia filed their report after a forensic audit of 46 registered companies and numerous shell companies of Amrapali group and bank accounts of the directors. They provided a graphic account of how Rs 3,500 crore of homebuyers’ money was diverted for purposes other than construction. 7:10 AM

7:10 AM

Blogger

Blogger

7:10 AM

7:10 AM

Blogger

Blogger

6:55 AM

6:55 AM

Blogger

Blogger

6:55 AM

6:55 AM

Blogger

Blogger

6:45 AM

6:45 AM

Blogger

Blogger

6:45 AM

6:45 AM

Blogger

Blogger

6:15 AM

6:15 AM

Blogger

Blogger

6:15 AM

6:15 AM

Blogger

Blogger

4:10 AM

4:10 AM

Blogger

Blogger

4:10 AM

4:10 AM

Blogger

Blogger

9:50 PM

9:50 PM

Blogger

Blogger

9:40 PM

9:40 PM

Blogger

Blogger

9:40 PM

9:40 PM

Blogger

Blogger

9:35 PM

9:35 PM

Blogger

Blogger

9:20 PM

9:20 PM

Blogger

Blogger

8:32 PM

8:32 PM

Blogger

Blogger

{image_1} Concept Medical Inc CMI has been granted ‘Breakthrough Device Designation’ from the US Food and Drug Administration FDA for MagicTouch, its si...

{image_1} Concept Medical Inc CMI has been granted ‘Breakthrough Device Designation’ from the US Food and Drug Administration FDA for MagicTouch, its si... 8:14 PM

8:14 PM

Blogger

Blogger

7:54 PM

7:54 PM

Blogger

Blogger

7:35 PM

7:35 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

6:50 PM

6:50 PM

Blogger

Blogger

6:50 PM

6:50 PM

Blogger

Blogger

4:57 PM

4:57 PM

Blogger

Blogger

However, the tribunal clarified that banks can not initiate recovery process and debit money.

However, the tribunal clarified that banks can not initiate recovery process and debit money. 4:25 PM

4:25 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

3:52 PM

3:52 PM

Blogger

Blogger

The multilateral funding institution committed $3 billion in sovereign loans to India in 2018, the highest level of assistance since sovereign operations began in the country in 1986.

The multilateral funding institution committed $3 billion in sovereign loans to India in 2018, the highest level of assistance since sovereign operations began in the country in 1986. 3:25 PM

3:25 PM

Blogger

Blogger

2:55 PM

2:55 PM

Blogger

Blogger

1:47 PM

1:47 PM

Blogger

Blogger

1:10 PM

1:10 PM

Blogger

Blogger

9:27 AM

9:27 AM

Blogger

Blogger

As an ex-career bureaucrat, Das has worked under governments led by both the ruling BJP and the opposition Congress.

As an ex-career bureaucrat, Das has worked under governments led by both the ruling BJP and the opposition Congress. 9:09 AM

9:09 AM

Blogger

Blogger

9:09 AM

9:09 AM

Blogger

Blogger

8:39 AM

8:39 AM

Blogger

Blogger

8:39 AM

8:39 AM

Blogger

Blogger

8:12 AM

8:12 AM

Blogger

Blogger

About 16,000 complaints, or 10% of all customer grievances at the banking ombudsman offices in FY18, were registered under the head ‘account debited but cash not dispensed at ATM’.

About 16,000 complaints, or 10% of all customer grievances at the banking ombudsman offices in FY18, were registered under the head ‘account debited but cash not dispensed at ATM’. 7:49 AM

7:49 AM

Blogger

Blogger

7:49 AM

7:49 AM

Blogger

Blogger

7:37 AM

7:37 AM

Blogger

Blogger

The CEA said there was a need to incentivise young businesses as opposed to small businesses, as these were the ones that create more jobs and deliver growth.

The CEA said there was a need to incentivise young businesses as opposed to small businesses, as these were the ones that create more jobs and deliver growth. 7:19 AM

7:19 AM

Blogger

Blogger

7:19 AM

7:19 AM

Blogger

Blogger

7:07 AM

7:07 AM

Blogger

Blogger

Indian economy is witnessing high growth, low inflation and is doing pretty okay on the external sector and fiscal prudence part, said Subramanian.

Indian economy is witnessing high growth, low inflation and is doing pretty okay on the external sector and fiscal prudence part, said Subramanian. 5:44 AM

5:44 AM

Blogger

Blogger

5:44 AM

5:44 AM

Blogger

Blogger

4:54 AM

4:54 AM

Blogger

Blogger

4:54 AM

4:54 AM

Blogger

Blogger

3:59 AM

3:59 AM

Blogger

Blogger

3:59 AM

3:59 AM

Blogger

Blogger

3:34 AM

3:34 AM

Blogger

Blogger

3:34 AM

3:34 AM

Blogger

Blogger

12:12 AM

12:12 AM

Blogger

Blogger

BSR jointly audited the books of IL&FS Fin Services with Deloitte Haskins.

BSR jointly audited the books of IL&FS Fin Services with Deloitte Haskins. 10:15 PM

10:15 PM

Blogger

Blogger

9:59 PM

9:59 PM

Blogger

Blogger

9:50 PM

9:50 PM

Blogger

Blogger

9:50 PM

9:50 PM

Blogger

Blogger

9:45 PM

9:45 PM

Blogger

Blogger

9:10 PM

9:10 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

8:55 PM

8:55 PM

Blogger

Blogger

6:54 PM

6:54 PM

Blogger

Blogger

6:44 PM

6:44 PM

Blogger

Blogger

6:44 PM

6:44 PM

Blogger

Blogger

6:29 PM

6:29 PM

Blogger

Blogger

6:29 PM

6:29 PM

Blogger

Blogger

6:04 PM

6:04 PM

Blogger

Blogger

5:39 PM

5:39 PM

Blogger

Blogger

11:43 AM

11:43 AM

Blogger

Blogger

Earlier in March, the SBI had announced that it will be linking its savings deposits rates and short-term loans to the RBI's repo rate from May 1 with an aim to ensure faster monetary transmission. The bank further said all cash credit accounts and overdrafts with limits above Rs 1 lakh will also be linked to the benchmark policy rate, plus a spread of 2.25 per cent.

Earlier in March, the SBI had announced that it will be linking its savings deposits rates and short-term loans to the RBI's repo rate from May 1 with an aim to ensure faster monetary transmission. The bank further said all cash credit accounts and overdrafts with limits above Rs 1 lakh will also be linked to the benchmark policy rate, plus a spread of 2.25 per cent. 11:35 AM

11:35 AM

Blogger

Blogger

9:54 AM

9:54 AM

Blogger

Blogger

9:54 AM

9:54 AM

Blogger

Blogger

9:39 AM

9:39 AM

Blogger

Blogger

9:39 AM

9:39 AM

Blogger

Blogger

9:29 AM

9:29 AM

Blogger

Blogger

9:29 AM

9:29 AM

Blogger

Blogger

9:19 AM

9:19 AM

Blogger

Blogger

9:19 AM

9:19 AM

Blogger

Blogger

8:59 AM

8:59 AM

Blogger

Blogger

8:59 AM

8:59 AM

Blogger

Blogger

8:14 AM

8:14 AM

Blogger

Blogger

8:14 AM

8:14 AM

Blogger

Blogger

8:07 AM

8:07 AM

Blogger

Blogger

ICICI loans case: Probe follows anonymous letter alleging kickbacks received by Rajiv’s 2 Singapore-based firms.

ICICI loans case: Probe follows anonymous letter alleging kickbacks received by Rajiv’s 2 Singapore-based firms. 8:01 AM

8:01 AM

Blogger

Blogger

8:01 AM

8:01 AM

Blogger

Blogger

7:44 AM

7:44 AM

Blogger

Blogger

7:44 AM

7:44 AM

Blogger

Blogger

7:37 AM

7:37 AM

Blogger

Blogger

The board said it had found the two firms failed to issue warnings about shortcomings while auditing the books of IL&FS Financial Services, a subsidiary of IL&FS.

The board said it had found the two firms failed to issue warnings about shortcomings while auditing the books of IL&FS Financial Services, a subsidiary of IL&FS. 7:14 AM

7:14 AM

Blogger

Blogger

7:14 AM

7:14 AM

Blogger

Blogger

6:14 AM

6:14 AM

Blogger

Blogger

6:14 AM

6:14 AM

Blogger

Blogger

5:29 AM

5:29 AM

Blogger

Blogger

5:29 AM

5:29 AM

Blogger

Blogger

12:12 AM

12:12 AM

Blogger

Blogger

L&T Finance, Piramal Capital Housing, Bajaj Finance declined to comment on the matter. An email sent to Hero FinCorp remained unanswered.

L&T Finance, Piramal Capital Housing, Bajaj Finance declined to comment on the matter. An email sent to Hero FinCorp remained unanswered. 10:45 PM

10:45 PM

Blogger

Blogger

10:45 PM

10:45 PM

Blogger

Blogger

9:55 PM

9:55 PM

Blogger

Blogger

9:53 PM

9:53 PM

Blogger

Blogger

Next six months are going to be very crucial in how India handles the challenges in financial sector.

Next six months are going to be very crucial in how India handles the challenges in financial sector. 9:15 PM

9:15 PM

Blogger

Blogger

9:10 PM

9:10 PM

Blogger

Blogger

9:10 PM

9:10 PM

Blogger

Blogger

7:55 PM

7:55 PM

Blogger

Blogger

7:49 PM

7:49 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

5:30 PM

5:30 PM

Blogger

Blogger

5:15 PM

5:15 PM

Blogger

Blogger

5:05 PM

5:05 PM

Blogger

Blogger

5:05 PM

5:05 PM

Blogger

Blogger

4:15 PM

4:15 PM

Blogger

Blogger

4:00 PM

4:00 PM

Blogger

Blogger

3:49 PM

3:49 PM

Blogger

Blogger

3:02 PM

3:02 PM

Blogger

Blogger

Bharti AXA General Insurance, a joint venture between Bharti Enterprises and global insurance firm AXA, will sell the policies on the website of Wishfin's insurance arm Wishpolicy.

Bharti AXA General Insurance, a joint venture between Bharti Enterprises and global insurance firm AXA, will sell the policies on the website of Wishfin's insurance arm Wishpolicy. 1:30 PM

1:30 PM

Blogger

Blogger

1:23 PM

1:23 PM

Blogger

Blogger

Shares of Yes Bank plummeted nearly 30 per cent on Tuesday after the company reported a loss of Rs 1,506.64 crore for the fourth quarter ended March 31, owing to rise in provisioning for bad loans. The scrip was the worst hit among the front-line companies on both the indices during the morning trade.

Shares of Yes Bank plummeted nearly 30 per cent on Tuesday after the company reported a loss of Rs 1,506.64 crore for the fourth quarter ended March 31, owing to rise in provisioning for bad loans. The scrip was the worst hit among the front-line companies on both the indices during the morning trade. 8:47 AM

8:47 AM

Blogger

Blogger

In the March quarter, the realisation by banks was 24% of their claims, in comparison to 43% overall.

In the March quarter, the realisation by banks was 24% of their claims, in comparison to 43% overall. 8:12 AM

8:12 AM

Blogger

Blogger

Maintainability petition decides whether a case can be tried in a court of law.

Maintainability petition decides whether a case can be tried in a court of law. 8:12 AM

8:12 AM

Blogger

Blogger

Files insolvency petitions against Kondapalli Power and Lanco Solar.

Files insolvency petitions against Kondapalli Power and Lanco Solar. 6:29 AM

6:29 AM

Blogger

Blogger

12:47 AM

12:47 AM

Blogger

Blogger

New age technology-led NBFC InCred has raised Rs 600 crore from a group of global investors in a move that will raise its equity capital.

New age technology-led NBFC InCred has raised Rs 600 crore from a group of global investors in a move that will raise its equity capital. 12:47 AM

12:47 AM

Blogger

Blogger

Finmin likely to hold discussions soon; consolidation expected in second or third quarter of this fiscal year.

Finmin likely to hold discussions soon; consolidation expected in second or third quarter of this fiscal year. 10:19 PM

10:19 PM

Blogger

Blogger

10:19 PM

10:19 PM

Blogger

Blogger

9:39 PM

9:39 PM

Blogger

Blogger

9:39 PM

9:39 PM

Blogger

Blogger

9:39 PM

9:39 PM

Blogger

Blogger

9:34 PM

9:34 PM

Blogger

Blogger

9:04 PM

9:04 PM

Blogger

Blogger

8:48 PM

8:48 PM

Blogger

Blogger

The lenders will receive merely 17% of the Rs 29500 crore dues from Alok Industries, raising doubts over the future realization.

The lenders will receive merely 17% of the Rs 29500 crore dues from Alok Industries, raising doubts over the future realization. 8:35 PM

8:35 PM

Blogger

Blogger

7:58 PM

7:58 PM

Blogger

Blogger

Data from the DSCI report showed that 350 cyber insurance policies were bought by Indian corporates in 2018 as against 250 in 2017 marking a 40 per cent increase in the sale of these products.

Data from the DSCI report showed that 350 cyber insurance policies were bought by Indian corporates in 2018 as against 250 in 2017 marking a 40 per cent increase in the sale of these products. 7:31 PM

7:31 PM

Blogger

Blogger

6:35 PM

6:35 PM

Blogger

Blogger

5:34 PM

5:34 PM

Blogger

Blogger

5:18 PM

5:18 PM

Blogger

Blogger

Embattled liquor tycoon Vijay Mallya took to social media on Monday to lament the collapse of Jet Airways and repeated his offer of a "100 per cent payback" for state-owned Indian banks to cover his now-defunct Kingfisher Airlines' debt. The 63-year-old former Kingfisher Airlines boss is currently appealing against his extradition order from the UK to India.

Embattled liquor tycoon Vijay Mallya took to social media on Monday to lament the collapse of Jet Airways and repeated his offer of a "100 per cent payback" for state-owned Indian banks to cover his now-defunct Kingfisher Airlines' debt. The 63-year-old former Kingfisher Airlines boss is currently appealing against his extradition order from the UK to India. 4:30 PM

4:30 PM

Blogger

Blogger

4:01 PM

4:01 PM

Blogger

Blogger

3:39 PM

3:39 PM

Blogger

Blogger

12:30 PM

12:30 PM

Blogger

Blogger

10:28 AM

10:28 AM

Blogger

Blogger

The move for smooth implementation of the Insolvency & Bankruptcy Code and loan restructuring by banks, is crucial after the Supreme Court set aside the controversial February 12 circular issued by then governor Urjit Patel. The RBI was initially planning to issue the revised circular that is expected to give more flexibility in restructuring stressed loans.

The move for smooth implementation of the Insolvency & Bankruptcy Code and loan restructuring by banks, is crucial after the Supreme Court set aside the controversial February 12 circular issued by then governor Urjit Patel. The RBI was initially planning to issue the revised circular that is expected to give more flexibility in restructuring stressed loans. 9:23 AM

9:23 AM

Blogger

Blogger

Visa, which is one of the largest card schemes globally, has been bringing in innovation to help India in its cashless journey.

Visa, which is one of the largest card schemes globally, has been bringing in innovation to help India in its cashless journey. 9:13 AM

9:13 AM

Blogger

Blogger

Financiers undertake more due diligence; seek RoI, capital safety assurance.

Financiers undertake more due diligence; seek RoI, capital safety assurance. 8:13 AM

8:13 AM

Blogger

Blogger

Draft circular suggests current accounts to be opened and operated only with lead bank in consortium.

Draft circular suggests current accounts to be opened and operated only with lead bank in consortium. 3:30 AM

3:30 AM

Blogger

Blogger

12:03 AM

12:03 AM

Blogger

Blogger

Insolvency and Bankruptcy Board of India (IBBI) chairman MS Sahoo earlier this week led a 10-member team to Hong Kong to individually meet over a dozen investors.

Insolvency and Bankruptcy Board of India (IBBI) chairman MS Sahoo earlier this week led a 10-member team to Hong Kong to individually meet over a dozen investors. 9:09 PM

9:09 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

7:10 PM

7:10 PM

Blogger

Blogger

7:10 PM

7:10 PM

Blogger

Blogger

6:45 PM

6:45 PM

Blogger

Blogger

6:45 PM

6:45 PM

Blogger

Blogger

6:39 PM

6:39 PM

Blogger

Blogger

6:25 PM

6:25 PM

Blogger

Blogger

6:25 PM

6:25 PM

Blogger

Blogger

6:14 PM

6:14 PM

Blogger

Blogger

6:14 PM

6:14 PM

Blogger

Blogger

4:53 PM

4:53 PM

Blogger

Blogger

IDBI received the nod to handle import-export transactions with Iran in early March.

IDBI received the nod to handle import-export transactions with Iran in early March. 4:24 PM

4:24 PM

Blogger

Blogger

2:33 PM

2:33 PM

Blogger

Blogger

RBI had reportedly found serious lapses in governance and poor compliance culture at Yes Bank under Kapoor.

RBI had reportedly found serious lapses in governance and poor compliance culture at Yes Bank under Kapoor. 12:15 AM

12:15 AM

Blogger

Blogger

RSS Feed

RSS Feed Twitter

Twitter