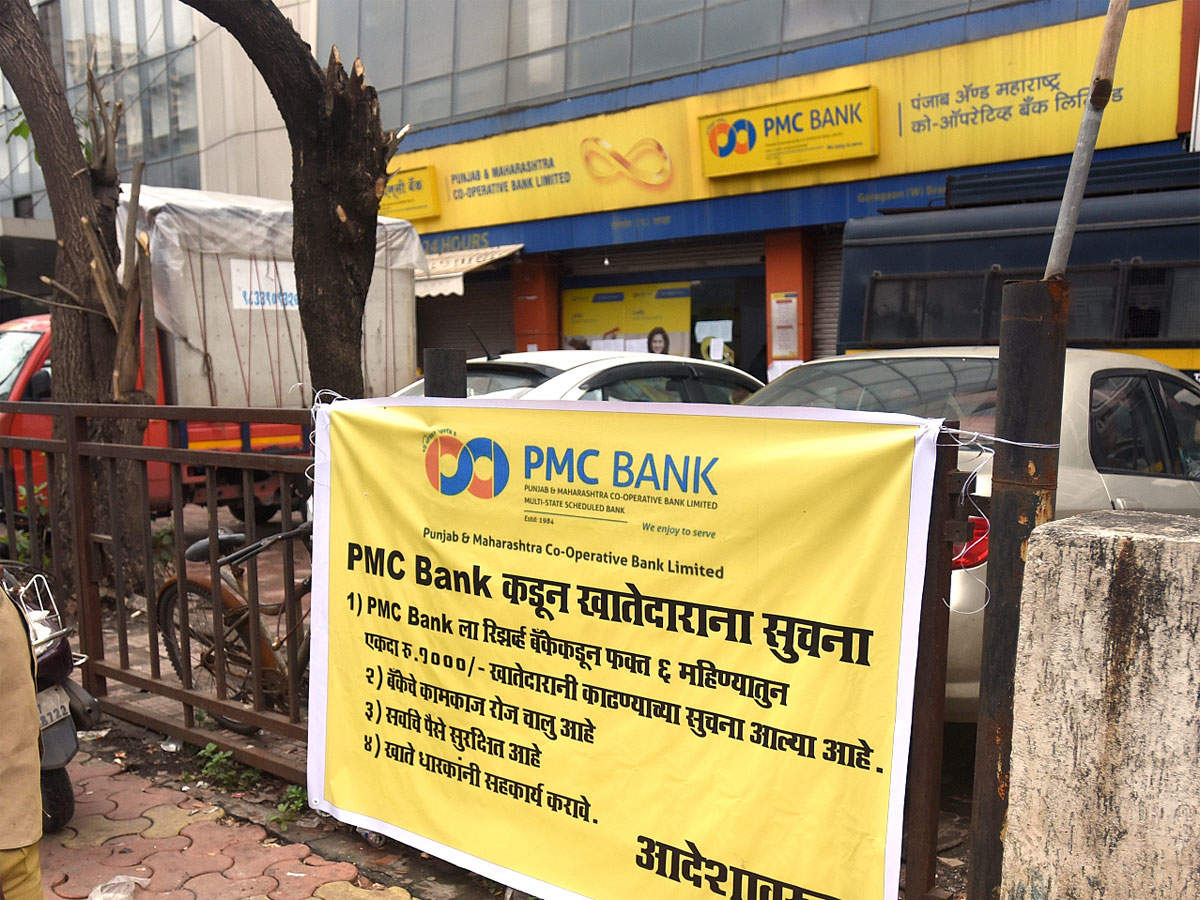

Former managing director of Punjab and Maharashtra Cooperative (PMC) Bank, Joy Thomas, arrested in connection with the alleged Rs 4,355 crore scam at the bank, was on Saturday remanded in police custody till October 17. The economic offences wing (EOW) of Mumbai Police, which had arrested Thomas on Friday, produced him before Additional Chief Metropolitan Magistrate S G Shaikh.

Former managing director of Punjab and Maharashtra Cooperative (PMC) Bank, Joy Thomas, arrested in connection with the alleged Rs 4,355 crore scam at the bank, was on Saturday remanded in police custody till October 17. The economic offences wing (EOW) of Mumbai Police, which had arrested Thomas on Friday, produced him before Additional Chief Metropolitan Magistrate S G Shaikh.from Business News: Latest News on Business, Stock Markets, Financial News, India Business & World Business News https://ift.tt/31QXQHU

RSS Feed

RSS Feed Twitter

Twitter

4:28 PM

4:28 PM

Blogger

Blogger