Equitas Bank received the final licence from the RBI in July 2016.

Equitas Bank received the final licence from the RBI in July 2016.from Banking/Finance-Industry-Economic Times https://ift.tt/313jqIG

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

1:04 PM

1:04 PM

Blogger

Blogger

Equitas Bank received the final licence from the RBI in July 2016.

Equitas Bank received the final licence from the RBI in July 2016. 12:49 PM

12:49 PM

Blogger

Blogger

12:49 PM

12:49 PM

Blogger

Blogger

12:33 PM

12:33 PM

Blogger

Blogger

12:08 PM

12:08 PM

Blogger

Blogger

12:04 PM

12:04 PM

Blogger

Blogger

12:04 PM

12:04 PM

Blogger

Blogger

11:13 AM

11:13 AM

Blogger

Blogger

11:04 AM

11:04 AM

Blogger

Blogger

11:04 AM

11:04 AM

Blogger

Blogger

9:54 AM

9:54 AM

Blogger

Blogger

9:54 AM

9:54 AM

Blogger

Blogger

9:54 AM

9:54 AM

Blogger

Blogger

9:54 AM

9:54 AM

Blogger

Blogger

7:40 AM

7:40 AM

Blogger

Blogger

7:40 AM

7:40 AM

Blogger

Blogger

7:25 AM

7:25 AM

Blogger

Blogger

"The SBI is hereby prohibited to go ahead with the advertisement and directed to maintain the status quo till the decision is pronounced on merits", said NCLT.

"The SBI is hereby prohibited to go ahead with the advertisement and directed to maintain the status quo till the decision is pronounced on merits", said NCLT. 3:33 PM

3:33 PM

Blogger

Blogger

2:40 PM

2:40 PM

Blogger

Blogger

Resolution professionals are practitioners who are registered with the IBBI and are certified to administer companies undergoing bankruptcy proceedings.

Resolution professionals are practitioners who are registered with the IBBI and are certified to administer companies undergoing bankruptcy proceedings. 2:28 PM

2:28 PM

Blogger

Blogger

2:03 PM

2:03 PM

Blogger

Blogger

The OBC has now issued notices declaring the duo and their companies as 'Willful Defaulters' for varying loan amounts.

The OBC has now issued notices declaring the duo and their companies as 'Willful Defaulters' for varying loan amounts. 1:43 PM

1:43 PM

Blogger

Blogger

The board of Punjab National Bank (PNB), which cleared a plan for the merger of Oriental Bank of Commerce (OBC) and United Bank of India on Thursday, is looking at an April deadline for completing the process to create the country's second largest bank, while trying to minimise hardships to customers.

The board of Punjab National Bank (PNB), which cleared a plan for the merger of Oriental Bank of Commerce (OBC) and United Bank of India on Thursday, is looking at an April deadline for completing the process to create the country's second largest bank, while trying to minimise hardships to customers. 1:38 PM

1:38 PM

Blogger

Blogger

12:25 PM

12:25 PM

Blogger

Blogger

“The concerns on NBFCs have arisen but have now bottomed or seem to be bottomed out, have also led to the current problem,” the CEA said.

“The concerns on NBFCs have arisen but have now bottomed or seem to be bottomed out, have also led to the current problem,” the CEA said. 11:53 AM

11:53 AM

Blogger

Blogger

State Bank of India (SBI) will review its existing repo rate-linked home loan following the RBI directive that all retail loans should be linked to an external benchmark. The bank will also try to link interest rates on deposits to floating rate benchmarks.

State Bank of India (SBI) will review its existing repo rate-linked home loan following the RBI directive that all retail loans should be linked to an external benchmark. The bank will also try to link interest rates on deposits to floating rate benchmarks. 11:38 AM

11:38 AM

Blogger

Blogger

10:58 AM

10:58 AM

Blogger

Blogger

8:44 AM

8:44 AM

Blogger

Blogger

8:44 AM

8:44 AM

Blogger

Blogger

8:29 AM

8:29 AM

Blogger

Blogger

8:29 AM

8:29 AM

Blogger

Blogger

8:18 AM

8:18 AM

Blogger

Blogger

NPA-laden banks may increase spreads over benchmark rates to protect profitability.

NPA-laden banks may increase spreads over benchmark rates to protect profitability. 8:09 AM

8:09 AM

Blogger

Blogger

8:09 AM

8:09 AM

Blogger

Blogger

7:19 AM

7:19 AM

Blogger

Blogger

7:19 AM

7:19 AM

Blogger

Blogger

7:10 AM

7:10 AM

Blogger

Blogger

PremjiInvest to put in Rs 100 cr; fundraise to help refinance debt, provide growth equity.

PremjiInvest to put in Rs 100 cr; fundraise to help refinance debt, provide growth equity. 6:44 AM

6:44 AM

Blogger

Blogger

6:44 AM

6:44 AM

Blogger

Blogger

2:53 PM

2:53 PM

Blogger

Blogger

2:21 PM

2:21 PM

Blogger

Blogger

2:21 PM

2:21 PM

Blogger

Blogger

1:56 PM

1:56 PM

Blogger

Blogger

1:56 PM

1:56 PM

Blogger

Blogger

1:56 PM

1:56 PM

Blogger

Blogger

1:16 PM

1:16 PM

Blogger

Blogger

12:56 PM

12:56 PM

Blogger

Blogger

12:56 PM

12:56 PM

Blogger

Blogger

12:26 PM

12:26 PM

Blogger

Blogger

12:06 PM

12:06 PM

Blogger

Blogger

12:06 PM

12:06 PM

Blogger

Blogger

11:16 AM

11:16 AM

Blogger

Blogger

10:34 AM

10:34 AM

Blogger

Blogger

10:01 AM

10:01 AM

Blogger

Blogger

All banks are now mandatorily required to link floating rate loans extended to retail and small business to the repo rate - the rate at which lenders borrow from the RBI - or to treasury bill rates from October 2019. The move comes days after public sector banks announced a slew of repo-linked loans after a nudge from finance minister Nirmala Sitharaman.

All banks are now mandatorily required to link floating rate loans extended to retail and small business to the repo rate - the rate at which lenders borrow from the RBI - or to treasury bill rates from October 2019. The move comes days after public sector banks announced a slew of repo-linked loans after a nudge from finance minister Nirmala Sitharaman. 9:12 AM

9:12 AM

Blogger

Blogger

8:20 AM

8:20 AM

Blogger

Blogger

July saw 822 million transactions; use may touch 1 billion in the upcoming festival months.

July saw 822 million transactions; use may touch 1 billion in the upcoming festival months. 8:20 AM

8:20 AM

Blogger

Blogger

The data showed that housing, property and auto loan segments were the worst hit. Housing loan sanctions declined by 30% to Rs 45,000 crore against Rs 64,000 crore in March.

The data showed that housing, property and auto loan segments were the worst hit. Housing loan sanctions declined by 30% to Rs 45,000 crore against Rs 64,000 crore in March. 8:01 AM

8:01 AM

Blogger

Blogger

7:41 AM

7:41 AM

Blogger

Blogger

7:35 AM

7:35 AM

Blogger

Blogger

Regime kicks in from October 1, covers all new loans to retail customers and MSMEs.

Regime kicks in from October 1, covers all new loans to retail customers and MSMEs. 7:35 AM

7:35 AM

Blogger

Blogger

The RBI had spoken about a similar risk on payments ecosystem while circulating a discussion paper on setting up other retail payment systems like UPI.

The RBI had spoken about a similar risk on payments ecosystem while circulating a discussion paper on setting up other retail payment systems like UPI. 6:51 AM

6:51 AM

Blogger

Blogger

6:16 PM

6:16 PM

Blogger

Blogger

6:16 PM

6:16 PM

Blogger

Blogger

6:16 PM

6:16 PM

Blogger

Blogger

3:18 PM

3:18 PM

Blogger

Blogger

2:38 PM

2:38 PM

Blogger

Blogger

2:06 PM

2:06 PM

Blogger

Blogger

12:36 PM

12:36 PM

Blogger

Blogger

12:05 PM

12:05 PM

Blogger

Blogger

Syndicate Bank has three-percentage-point higher capital compared to the minimum requirement.

Syndicate Bank has three-percentage-point higher capital compared to the minimum requirement. 10:59 AM

10:59 AM

Blogger

Blogger

10:48 AM

10:48 AM

Blogger

Blogger

10:48 AM

10:48 AM

Blogger

Blogger

8:56 AM

8:56 AM

Blogger

Blogger

8:56 AM

8:56 AM

Blogger

Blogger

8:56 AM

8:56 AM

Blogger

Blogger

8:43 AM

8:43 AM

Blogger

Blogger

8:23 AM

8:23 AM

Blogger

Blogger

8:16 AM

8:16 AM

Blogger

Blogger

8:16 AM

8:16 AM

Blogger

Blogger

8:16 AM

8:16 AM

Blogger

Blogger

8:05 AM

8:05 AM

Blogger

Blogger

Mega public sector bank mergers tick many boxes, but the success or failure of the move will depend on the execution rather than the action itself.

Mega public sector bank mergers tick many boxes, but the success or failure of the move will depend on the execution rather than the action itself. 8:03 AM

8:03 AM

Blogger

Blogger

PE group may pick up 6-7% of Aditya Birla Capital; ABCL board to meet on Thursday to approve fundraising deal.

PE group may pick up 6-7% of Aditya Birla Capital; ABCL board to meet on Thursday to approve fundraising deal. 7:11 AM

7:11 AM

Blogger

Blogger

7:11 AM

7:11 AM

Blogger

Blogger

9:18 PM

9:18 PM

Blogger

Blogger

9:13 PM

9:13 PM

Blogger

Blogger

9:03 PM

9:03 PM

Blogger

Blogger

8:58 PM

8:58 PM

Blogger

Blogger

7:36 PM

7:36 PM

Blogger

Blogger

Uco Bank is, however, a bigger bank with 3088 branches and Rs 3.11 lakh crore business mix compared with UBI’s 2055 branches and Rs 2.06 lakh crore business.

Uco Bank is, however, a bigger bank with 3088 branches and Rs 3.11 lakh crore business mix compared with UBI’s 2055 branches and Rs 2.06 lakh crore business. 6:16 PM

6:16 PM

Blogger

Blogger

Power, infrastructure and steel sectors together constitute about half of Rs 4.1 lakh crore worth stressed assets.

Power, infrastructure and steel sectors together constitute about half of Rs 4.1 lakh crore worth stressed assets. 6:16 PM

6:16 PM

Blogger

Blogger

IRDAI said it decided to revisit the guidelines after it received representations from various stakeholders.

IRDAI said it decided to revisit the guidelines after it received representations from various stakeholders. 5:21 PM

5:21 PM

Blogger

Blogger

ICICI Bank executive director Anup Bagchi said that two major segments of retail loans - consumer loan and mortgages are set to grow at a rapid pace in the state this financial year.

ICICI Bank executive director Anup Bagchi said that two major segments of retail loans - consumer loan and mortgages are set to grow at a rapid pace in the state this financial year. 4:05 PM

4:05 PM

Blogger

Blogger

Last week, the government announced consolidation of 10 public sector banks into four mega state-owned lenders.

Last week, the government announced consolidation of 10 public sector banks into four mega state-owned lenders. 4:05 PM

4:05 PM

Blogger

Blogger

Finance Minister Nirmala Sitharaman last week announced the merger of 10 Public Sector Banks into 4.

Finance Minister Nirmala Sitharaman last week announced the merger of 10 Public Sector Banks into 4. 3:53 PM

3:53 PM

Blogger

Blogger

3:38 PM

3:38 PM

Blogger

Blogger

3:36 PM

3:36 PM

Blogger

Blogger

The government on Tuesday approved a recapitalisation plan of Rs 9,000 crore for the beleagured IDBI Bank. The one-time fund infusion will be done by both government and Life Insurance Corporation of India (LIC). While government will infuse Rs 4,557 crore by as one-time re-capitalisation, LIC -- which is the major owner of IDBI Bank, will also infuse Rs 4,700 crore in IDBI.

The government on Tuesday approved a recapitalisation plan of Rs 9,000 crore for the beleagured IDBI Bank. The one-time fund infusion will be done by both government and Life Insurance Corporation of India (LIC). While government will infuse Rs 4,557 crore by as one-time re-capitalisation, LIC -- which is the major owner of IDBI Bank, will also infuse Rs 4,700 crore in IDBI. 2:43 PM

2:43 PM

Blogger

Blogger

1:56 PM

1:56 PM

Blogger

Blogger

1:56 PM

1:56 PM

Blogger

Blogger

1:25 PM

1:25 PM

Blogger

Blogger

Any court ruling favoring the banks would deal another blow to the tycoon’s stressed empire

Any court ruling favoring the banks would deal another blow to the tycoon’s stressed empire 12:03 PM

12:03 PM

Blogger

Blogger

11:25 AM

11:25 AM

Blogger

Blogger

While LIC, which is the majority owner of IDBI Bank, will have to cough up close to Rs 4,500 crore as its share, the government is expected to chip in with a matching contribution, sources told TOI.

While LIC, which is the majority owner of IDBI Bank, will have to cough up close to Rs 4,500 crore as its share, the government is expected to chip in with a matching contribution, sources told TOI. 10:16 AM

10:16 AM

Blogger

Blogger

Beleaguered IDBI Bank is set to get a fresh lifeline of Rs 9,000 crore, with the government planning to pay its share of the bailout money that Life Insurance Corporation has been seeking for the past several months.

Beleaguered IDBI Bank is set to get a fresh lifeline of Rs 9,000 crore, with the government planning to pay its share of the bailout money that Life Insurance Corporation has been seeking for the past several months. 8:40 AM

8:40 AM

Blogger

Blogger

CICI Bank Ltd. and Axis Bank Ltd. remain UBS’s most-preferred picks.

CICI Bank Ltd. and Axis Bank Ltd. remain UBS’s most-preferred picks. 7:05 AM

7:05 AM

Blogger

Blogger

“The board shall consider capital infusion up to Rs 18,000 crore in its meeting scheduled on September 5, 2019,” PNB said in a regulatory filing.

“The board shall consider capital infusion up to Rs 18,000 crore in its meeting scheduled on September 5, 2019,” PNB said in a regulatory filing. 5:51 AM

5:51 AM

Blogger

Blogger

5:21 AM

5:21 AM

Blogger

Blogger

5:06 AM

5:06 AM

Blogger

Blogger

4:51 AM

4:51 AM

Blogger

Blogger

12:25 AM

12:25 AM

Blogger

Blogger

Banks have been asked to form a risk management committee, and to combine the nomination and remuneration committees.

Banks have been asked to form a risk management committee, and to combine the nomination and remuneration committees. 9:41 PM

9:41 PM

Blogger

Blogger

8:47 PM

8:47 PM

Blogger

Blogger

Punjab National Bank (PNB) on Monday said the board will consider capital infusion of up to Rs 18,000 crore in its meeting later this week. It comes against the backdrop of the government's announcement on August 30 about merging 10 public sector banks into four entities, as part of which PNB will merge Oriental Bank of Commerce (OBC) and United Bank of India (UBI) with itself.

Punjab National Bank (PNB) on Monday said the board will consider capital infusion of up to Rs 18,000 crore in its meeting later this week. It comes against the backdrop of the government's announcement on August 30 about merging 10 public sector banks into four entities, as part of which PNB will merge Oriental Bank of Commerce (OBC) and United Bank of India (UBI) with itself. 8:22 PM

8:22 PM

Blogger

Blogger

8:10 PM

8:10 PM

Blogger

Blogger

The mega merger plan of public sector banks (PSBs) is being seen as the biggest consolidated exercise in the banking space, aimed at making them lenders of global size and scale.

The mega merger plan of public sector banks (PSBs) is being seen as the biggest consolidated exercise in the banking space, aimed at making them lenders of global size and scale. 6:38 PM

6:38 PM

Blogger

Blogger

Widespread adoption of Facebook's proposed "Libra" cryptocurrency could harm the European Central Bank's ability to manage the eurozone economy and threaten the euro itself, a top official said on Monday.

Widespread adoption of Facebook's proposed "Libra" cryptocurrency could harm the European Central Bank's ability to manage the eurozone economy and threaten the euro itself, a top official said on Monday. 5:51 PM

5:51 PM

Blogger

Blogger

5:50 PM

5:50 PM

Blogger

Blogger

Last week, the government announced consolidation of 10 public sector banks (PSBs) into four mega state-owned lenders.

Last week, the government announced consolidation of 10 public sector banks (PSBs) into four mega state-owned lenders. 4:27 PM

4:27 PM

Blogger

Blogger

India Inc's foreign borrowings grew over two-fold to $4.98 billion in July over the same month a year ago, according to Reserve Bank of India (RBI) data.

India Inc's foreign borrowings grew over two-fold to $4.98 billion in July over the same month a year ago, according to Reserve Bank of India (RBI) data. 3:33 PM

3:33 PM

Blogger

Blogger

IL&FS was deemed ‘too big to fail’ by many experts but eventually succumbed to greed and ambition.

IL&FS was deemed ‘too big to fail’ by many experts but eventually succumbed to greed and ambition. 12:05 PM

12:05 PM

Blogger

Blogger

11:36 AM

11:36 AM

Blogger

Blogger

Even if the core banking platforms are the same, each would require customisation.

Even if the core banking platforms are the same, each would require customisation. 5:25 PM

5:25 PM

Blogger

Blogger

4:27 PM

4:27 PM

Blogger

Blogger

She was replying to a question on the bank employees unions opposing the merger plan on the ground it would lead to loss of jobs. Sitharaman on Friday unveiled a mega plan to merge 10 public sector banks into four as part of plans to create fewer and stronger global-sized lenders as the government looked to boost economic growth from a five-year low.

She was replying to a question on the bank employees unions opposing the merger plan on the ground it would lead to loss of jobs. Sitharaman on Friday unveiled a mega plan to merge 10 public sector banks into four as part of plans to create fewer and stronger global-sized lenders as the government looked to boost economic growth from a five-year low. 4:20 PM

4:20 PM

Blogger

Blogger

She was replying to a question on the bank employees unions opposing the merger plan on the ground it would lead to loss of jobs.

She was replying to a question on the bank employees unions opposing the merger plan on the ground it would lead to loss of jobs. 4:16 PM

4:16 PM

Blogger

Blogger

3:56 PM

3:56 PM

Blogger

Blogger

3:41 PM

3:41 PM

Blogger

Blogger

3:24 PM

3:24 PM

Blogger

Blogger

3:10 PM

3:10 PM

Blogger

Blogger

The Centre's decision to merge Andhra Bank with Union Bank of India and Corporation Bank will snap the emotional link the people of Andhra Pradesh and Telangana had with this 96-year-old bank.

The Centre's decision to merge Andhra Bank with Union Bank of India and Corporation Bank will snap the emotional link the people of Andhra Pradesh and Telangana had with this 96-year-old bank. 2:10 PM

2:10 PM

Blogger

Blogger

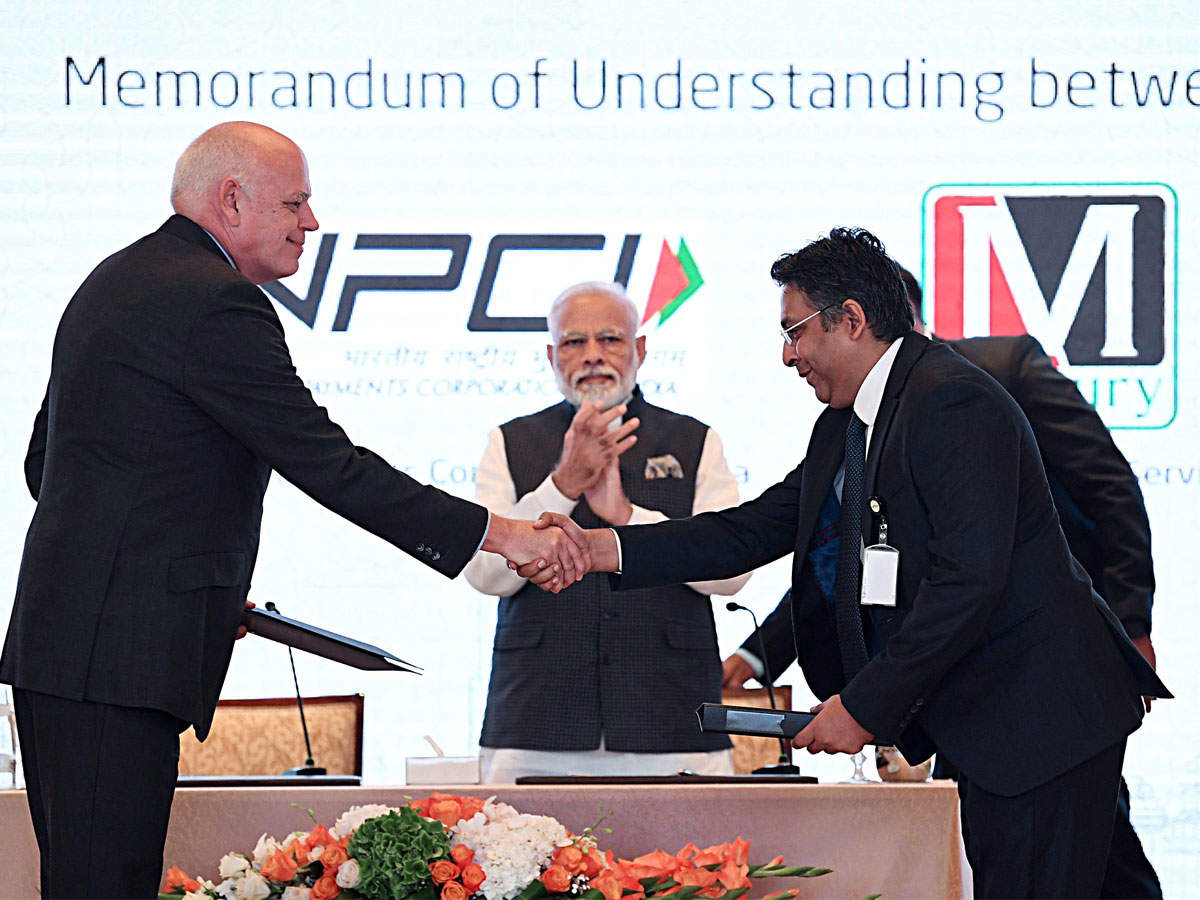

RuPay is the first-of-its-kind domestic debit and credit card payment network of India developed by National Payments Corporation of India (NPCI).

RuPay is the first-of-its-kind domestic debit and credit card payment network of India developed by National Payments Corporation of India (NPCI). 2:05 PM

2:05 PM

Blogger

Blogger

1:41 PM

1:41 PM

Blogger

Blogger

1:35 PM

1:35 PM

Blogger

Blogger

11:05 AM

11:05 AM

Blogger

Blogger

10:05 AM

10:05 AM

Blogger

Blogger

9:35 AM

9:35 AM

Blogger

Blogger

9:25 AM

9:25 AM

Blogger

Blogger

Simply freezing lending by the worst banks was never a long-term solution.

Simply freezing lending by the worst banks was never a long-term solution. 9:03 AM

9:03 AM

Blogger

Blogger

7:35 AM

7:35 AM

Blogger

Blogger

7:10 AM

7:10 AM

Blogger

Blogger

6:55 AM

6:55 AM

Blogger

Blogger

6:25 AM

6:25 AM

Blogger

Blogger

6:10 AM

6:10 AM

Blogger

Blogger

5:50 AM

5:50 AM

Blogger

Blogger

RSS Feed

RSS Feed Twitter

Twitter