Adds that this will help the government unearth illicit transactions and take action against them

from Business Line - Money & Banking https://ift.tt/3FzB0ru

Read more »

from Business Line - Money & Banking https://ift.tt/3FzB0ru

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

3:09 PM

3:09 PM

Blogger

Blogger

6:11 AM

6:11 AM

Blogger

Blogger

3:11 AM

3:11 AM

Blogger

Blogger

11:02 PM

11:02 PM

Blogger

Blogger

This tie-up makes the purchase and use of tags convenient for about five million motorists, it said in a statement. “As a digital-first bank, our effort is to make all transit-related payments simpler. IDFC First Bank has issued close to five million FASTags and these tags are used actively by motorists across toll plazas with transactions averaging two million a day," said B Madhivanan, chief operating officer, IDFC First Bank.

This tie-up makes the purchase and use of tags convenient for about five million motorists, it said in a statement. “As a digital-first bank, our effort is to make all transit-related payments simpler. IDFC First Bank has issued close to five million FASTags and these tags are used actively by motorists across toll plazas with transactions averaging two million a day," said B Madhivanan, chief operating officer, IDFC First Bank. 4:02 PM

4:02 PM

Blogger

Blogger

As per regulation 4 of IRDAI (issuance of e-insurance policies) Regulations, 2016, an insurer has to issue both physical and electronic insurance certificates to policyholders.

As per regulation 4 of IRDAI (issuance of e-insurance policies) Regulations, 2016, an insurer has to issue both physical and electronic insurance certificates to policyholders. 2:09 PM

2:09 PM

Blogger

Blogger

1:09 PM

1:09 PM

Blogger

Blogger

12:09 PM

12:09 PM

Blogger

Blogger

12:09 PM

12:09 PM

Blogger

Blogger

11:02 AM

11:02 AM

Blogger

Blogger

The state government had earlier informed the Centre that non-payment of claims by the company to many farmers could result in a "law-and-order situation" in the state as five other insurers had paid about 90% of the claims for the 2021 kharif season.

The state government had earlier informed the Centre that non-payment of claims by the company to many farmers could result in a "law-and-order situation" in the state as five other insurers had paid about 90% of the claims for the 2021 kharif season. 11:02 AM

11:02 AM

Blogger

Blogger

Modi said the banking sector has to understand that in India it was time for investing in ideas. "It is time to support startups. Startup is an idea, there is no asset, it is just an idea," he said.

Modi said the banking sector has to understand that in India it was time for investing in ideas. "It is time to support startups. Startup is an idea, there is no asset, it is just an idea," he said. 8:11 AM

8:11 AM

Blogger

Blogger

5:11 AM

5:11 AM

Blogger

Blogger

12:02 AM

12:02 AM

Blogger

Blogger

The bank has issued and allotted Basel III compliant tier-II bonds at a coupon of 7.10 per cent per annum aggregating to Rs 1,919 crore on a private placement basis, it said in a BSE filing.

The bank has issued and allotted Basel III compliant tier-II bonds at a coupon of 7.10 per cent per annum aggregating to Rs 1,919 crore on a private placement basis, it said in a BSE filing. 11:09 PM

11:09 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

7:09 PM

7:09 PM

Blogger

Blogger

7:02 PM

7:02 PM

Blogger

Blogger

Scripbox will provide solutions for customer’s needs. This will be supplemented by issuance and claims process assistance as well. Life insurance is one of the fundamental pillars of sound financial planning. While life insurance has been available in India for decades, the level of protection is quite low.

Scripbox will provide solutions for customer’s needs. This will be supplemented by issuance and claims process assistance as well. Life insurance is one of the fundamental pillars of sound financial planning. While life insurance has been available in India for decades, the level of protection is quite low. 5:09 PM

5:09 PM

Blogger

Blogger

5:09 PM

5:09 PM

Blogger

Blogger

5:09 PM

5:09 PM

Blogger

Blogger

5:09 PM

5:09 PM

Blogger

Blogger

5:09 PM

5:09 PM

Blogger

Blogger

3:09 PM

3:09 PM

Blogger

Blogger

3:09 PM

3:09 PM

Blogger

Blogger

3:02 PM

3:02 PM

Blogger

Blogger

Addressing bankers at the symposium to 'Build Synergy for Seamless Credit Flow and Economic Growth', Modi said banks have to now adopt a partnership model to help businesses thrive and move away from the idea of being a loan "approver" to a loan "applicant".

Addressing bankers at the symposium to 'Build Synergy for Seamless Credit Flow and Economic Growth', Modi said banks have to now adopt a partnership model to help businesses thrive and move away from the idea of being a loan "approver" to a loan "applicant". 2:02 PM

2:02 PM

Blogger

Blogger

Global financial services major Macquarie isn't enthused and sees a 40% downside from its issue price in what it described as a 'cash guzzler'.

Global financial services major Macquarie isn't enthused and sees a 40% downside from its issue price in what it described as a 'cash guzzler'. 1:09 PM

1:09 PM

Blogger

Blogger

12:09 PM

12:09 PM

Blogger

Blogger

12:09 PM

12:09 PM

Blogger

Blogger

11:09 AM

11:09 AM

Blogger

Blogger

1:12 AM

1:12 AM

Blogger

Blogger

12:02 AM

12:02 AM

Blogger

Blogger

Bank loans rose Rs 1.19 lakh crore during the fortnight ended November 2021 to Rs 111.63 lakh crore. This translates into year-on-year growth rate of 7.14 per cent compared to 6.8 per cent in the previous fortnight. Bulk of the loan demand is , bulk of which is expected to be in the retail space as consumers spent a a record Rs 1.25 lakh crore this Diwali according to data by Confederation of All India Traders.

Bank loans rose Rs 1.19 lakh crore during the fortnight ended November 2021 to Rs 111.63 lakh crore. This translates into year-on-year growth rate of 7.14 per cent compared to 6.8 per cent in the previous fortnight. Bulk of the loan demand is , bulk of which is expected to be in the retail space as consumers spent a a record Rs 1.25 lakh crore this Diwali according to data by Confederation of All India Traders. 12:02 AM

12:02 AM

Blogger

Blogger

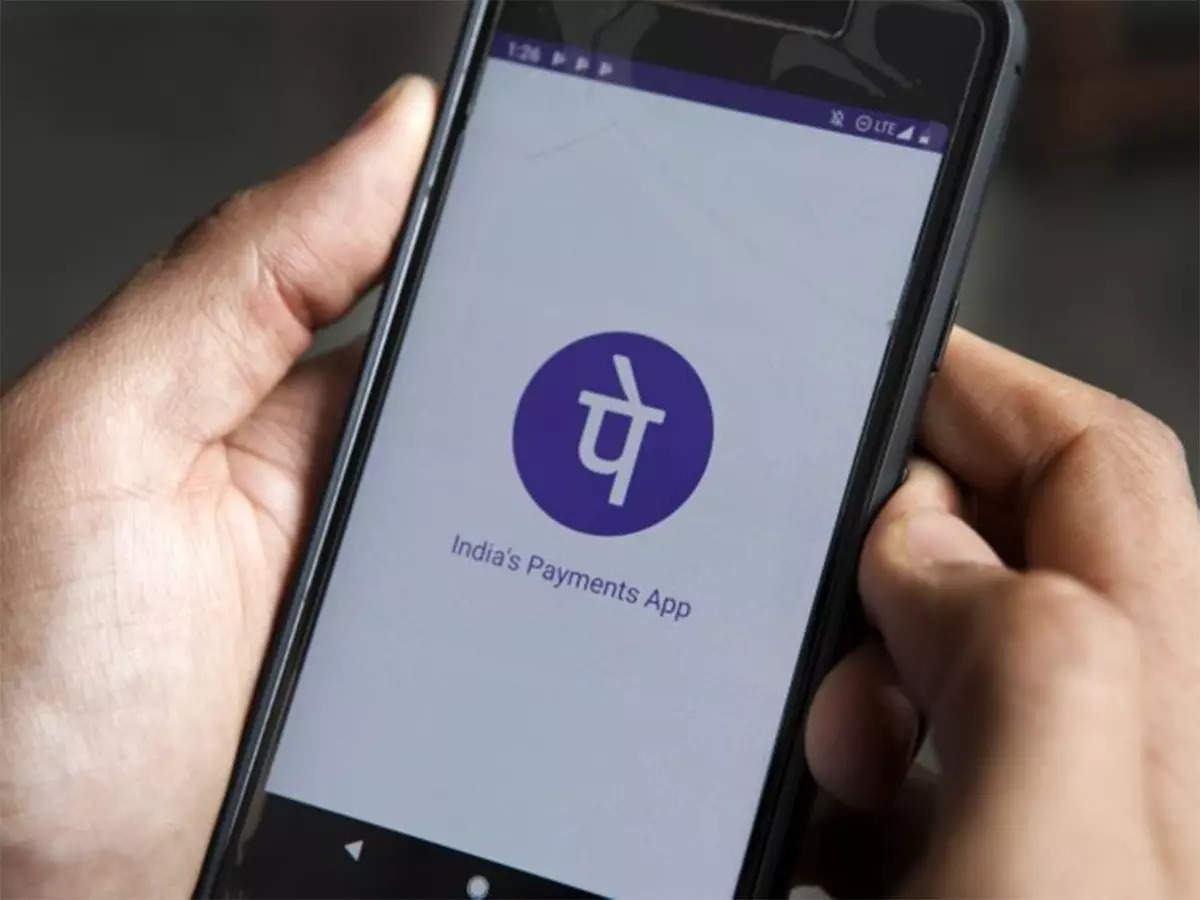

PhonePe, part of Walmart-controlled Flipkart Group, clocked more than two billion transactions across payment channels in October. It was only in February that PhonePe had recorded one billion monthly transactions.

PhonePe, part of Walmart-controlled Flipkart Group, clocked more than two billion transactions across payment channels in October. It was only in February that PhonePe had recorded one billion monthly transactions. 10:02 PM

10:02 PM

Blogger

Blogger

Soon after the preference issue of shares was announced in May this year, controversy erupted with regard to the valuation of the shares to be offered to the investors and the capital markets regulator Sebi intervened and stalled the deal until there was revaluation of the shares.

Soon after the preference issue of shares was announced in May this year, controversy erupted with regard to the valuation of the shares to be offered to the investors and the capital markets regulator Sebi intervened and stalled the deal until there was revaluation of the shares. 9:02 PM

9:02 PM

Blogger

Blogger

Further, the bank delayed the reporting of frauds on many occasions, and also granted director-related loans in contravention of/ non-compliance of directions. A show cause notice was issued to it.

Further, the bank delayed the reporting of frauds on many occasions, and also granted director-related loans in contravention of/ non-compliance of directions. A show cause notice was issued to it. 9:02 PM

9:02 PM

Blogger

Blogger

In the previous fortnight ended October 22, 2021, bank credit had grown by 6.84 per cent and deposits by 9.94 per cent. In FY2020-21, bank credit had risen by 5.56 per cent and deposits by 11.4 per cent.

In the previous fortnight ended October 22, 2021, bank credit had grown by 6.84 per cent and deposits by 9.94 per cent. In FY2020-21, bank credit had risen by 5.56 per cent and deposits by 11.4 per cent. 8:10 PM

8:10 PM

Blogger

Blogger

8:10 PM

8:10 PM

Blogger

Blogger

8:10 PM

8:10 PM

Blogger

Blogger

8:10 PM

8:10 PM

Blogger

Blogger

7:02 PM

7:02 PM

Blogger

Blogger

The Bombay High Court has allowed the petition filed by Dewan Housing Finance Ltd (DHFL) to discharge its name and drop proceedings against it in an ongoing investigation by the Central Bureau of Investigation (CBI).

The Bombay High Court has allowed the petition filed by Dewan Housing Finance Ltd (DHFL) to discharge its name and drop proceedings against it in an ongoing investigation by the Central Bureau of Investigation (CBI). 6:10 PM

6:10 PM

Blogger

Blogger

6:03 PM

6:03 PM

Blogger

Blogger

The agreement aims at expanding RuPay card and UPI acceptance across PPRO’s global clients such as payment service providers (PSPs) and global merchant acquirers.

The agreement aims at expanding RuPay card and UPI acceptance across PPRO’s global clients such as payment service providers (PSPs) and global merchant acquirers. 4:02 PM

4:02 PM

Blogger

Blogger

Department of Investment and Public Asset Management Secy Tuhin Kanta Pandey has said that the much-awaited LIC IPO is expected to hit the market by the fourth quarter of the current fiscal.

Department of Investment and Public Asset Management Secy Tuhin Kanta Pandey has said that the much-awaited LIC IPO is expected to hit the market by the fourth quarter of the current fiscal. 3:09 PM

3:09 PM

Blogger

Blogger

2:09 PM

2:09 PM

Blogger

Blogger

2:09 PM

2:09 PM

Blogger

Blogger

11:02 AM

11:02 AM

Blogger

Blogger

One important aspect of investing through mutual fund schemes is the selection of the right distributor. Investors should always select a distributor with high integrity, high experience, and deep knowledge of the stock market.

One important aspect of investing through mutual fund schemes is the selection of the right distributor. Investors should always select a distributor with high integrity, high experience, and deep knowledge of the stock market. 11:02 AM

11:02 AM

Blogger

Blogger

RGICL, which covers 10 districts of Maharashtra under the Pradhan Mantri Fasal Bima Yojana (PMFBY), in its correspondence with the state commissioner (agriculture), had said it “has constraints towards disbursements of kharif 2021 claims before settlement of kharif 2020 and rabi 2020 claims”.

RGICL, which covers 10 districts of Maharashtra under the Pradhan Mantri Fasal Bima Yojana (PMFBY), in its correspondence with the state commissioner (agriculture), had said it “has constraints towards disbursements of kharif 2021 claims before settlement of kharif 2020 and rabi 2020 claims”. 9:10 AM

9:10 AM

Blogger

Blogger

8:02 AM

8:02 AM

Blogger

Blogger

Chaudhry had pivoted the bank toward a better quality franchise and the bank would soon catch up with the NIMs and RoAs reported by the likes of ICICI Bank and HDFC Bank.

Chaudhry had pivoted the bank toward a better quality franchise and the bank would soon catch up with the NIMs and RoAs reported by the likes of ICICI Bank and HDFC Bank. 5:12 AM

5:12 AM

Blogger

Blogger

4:11 AM

4:11 AM

Blogger

Blogger

4:11 AM

4:11 AM

Blogger

Blogger

12:09 AM

12:09 AM

Blogger

Blogger

12:09 AM

12:09 AM

Blogger

Blogger

11:02 PM

11:02 PM

Blogger

Blogger

While the bank reported Gross Non-Performing Assets (GNPAs) at Rs 16,323 crore in FY21, the Reserve Bank assessed it at Rs 17,023 crore, leading to a divergence of Rs 700 crore in gross bad loans.

While the bank reported Gross Non-Performing Assets (GNPAs) at Rs 16,323 crore in FY21, the Reserve Bank assessed it at Rs 17,023 crore, leading to a divergence of Rs 700 crore in gross bad loans. 10:10 PM

10:10 PM

Blogger

Blogger

10:10 PM

10:10 PM

Blogger

Blogger

10:10 PM

10:10 PM

Blogger

Blogger

8:09 PM

8:09 PM

Blogger

Blogger

8:09 PM

8:09 PM

Blogger

Blogger

7:02 PM

7:02 PM

Blogger

Blogger

Total disbursement of all lenders during the second quarter of FY22 was Rs 66,694 crore compared to Rs 34,135 crore disbursed during the same quarter of the last year, the report said. Sa-Dhan Executive Director P Satish said the sector, which was affected in the first quarter of this financial year due to the second COVID wave, has seen improvement in repayments and fresh disbursements.

Total disbursement of all lenders during the second quarter of FY22 was Rs 66,694 crore compared to Rs 34,135 crore disbursed during the same quarter of the last year, the report said. Sa-Dhan Executive Director P Satish said the sector, which was affected in the first quarter of this financial year due to the second COVID wave, has seen improvement in repayments and fresh disbursements. 7:02 PM

7:02 PM

Blogger

Blogger

Shaktikanta Das said at the conclave, “I firmly believe that India has the potential to grow at a reasonably high pace in the post-pandemic scenario.”

Shaktikanta Das said at the conclave, “I firmly believe that India has the potential to grow at a reasonably high pace in the post-pandemic scenario.” 5:02 PM

5:02 PM

Blogger

Blogger

Moody's said that entities that fail to adapt will be at the most risk with risks rising across the board during periods when organizations transition to new cybersecurity procedures. Also, reduced cyber security coverage will have a negative impact on the credit profile of companies.

Moody's said that entities that fail to adapt will be at the most risk with risks rising across the board during periods when organizations transition to new cybersecurity procedures. Also, reduced cyber security coverage will have a negative impact on the credit profile of companies. 5:02 PM

5:02 PM

Blogger

Blogger

The HIB study was conducted across 9 cities that includes Delhi, Jaipur, Bangalore, Hyderabad, Bhopal, Mumbai, Kolkata, Patna, Ranchi. The primary sample size was over 1,200 respondents (Home Credit customers) in the age group of 21-45 years, with an income of less than Rs 30,000 per month.

The HIB study was conducted across 9 cities that includes Delhi, Jaipur, Bangalore, Hyderabad, Bhopal, Mumbai, Kolkata, Patna, Ranchi. The primary sample size was over 1,200 respondents (Home Credit customers) in the age group of 21-45 years, with an income of less than Rs 30,000 per month. 4:09 PM

4:09 PM

Blogger

Blogger

4:09 PM

4:09 PM

Blogger

Blogger

3:02 PM

3:02 PM

Blogger

Blogger

Addressing a virtual press conference, Kotak Mahindra Bank President – Products, Alternate Channels and Customer Experience Delivery - Puneet Kapoor said, the bank has been associated with PVR for over 10 years and wants to add more to the existing products of the two co-branded Kotak PVR credit cards.

Addressing a virtual press conference, Kotak Mahindra Bank President – Products, Alternate Channels and Customer Experience Delivery - Puneet Kapoor said, the bank has been associated with PVR for over 10 years and wants to add more to the existing products of the two co-branded Kotak PVR credit cards. 3:02 PM

3:02 PM

Blogger

Blogger

FIA Global, which works with as many as 35 banks including State Bank of India, HDFC Bank and Axis Bank as their business correspondent, is now planning to venture into direct lending, leveraging the 47 million customers it mobilized in its nine-year journey.

FIA Global, which works with as many as 35 banks including State Bank of India, HDFC Bank and Axis Bank as their business correspondent, is now planning to venture into direct lending, leveraging the 47 million customers it mobilized in its nine-year journey. 2:09 PM

2:09 PM

Blogger

Blogger

11:09 AM

11:09 AM

Blogger

Blogger

8:03 AM

8:03 AM

Blogger

Blogger

Industry chambers and financial institutions, including non-banking financial companies (NBFCs), have been invited to the conference.

Industry chambers and financial institutions, including non-banking financial companies (NBFCs), have been invited to the conference. 1:12 AM

1:12 AM

Blogger

Blogger

12:02 AM

12:02 AM

Blogger

Blogger

"The NCUI President talked about the problem faced due to RBI's different approach towards cooperative banks ... such issues have been discussed point-wise with the RBI chief and the Finance Minister. There was a positive discussion and the decision is in the pipeline. That decision will be in our favour," Verma said.

"The NCUI President talked about the problem faced due to RBI's different approach towards cooperative banks ... such issues have been discussed point-wise with the RBI chief and the Finance Minister. There was a positive discussion and the decision is in the pipeline. That decision will be in our favour," Verma said. 11:09 PM

11:09 PM

Blogger

Blogger

11:09 PM

11:09 PM

Blogger

Blogger

11:09 PM

11:09 PM

Blogger

Blogger

11:09 PM

11:09 PM

Blogger

Blogger

11:02 PM

11:02 PM

Blogger

Blogger

The scheme allows customers to have a new current account by maintaining a monthly average balance of Rs 25,000 and avail a host of premium facilities, the bank’s new chairman P Pradeep Kumar and MD & CEO MS Mahabaleshwara told reporters on Monday.

The scheme allows customers to have a new current account by maintaining a monthly average balance of Rs 25,000 and avail a host of premium facilities, the bank’s new chairman P Pradeep Kumar and MD & CEO MS Mahabaleshwara told reporters on Monday. 9:09 PM

9:09 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

7:09 PM

7:09 PM

Blogger

Blogger

7:02 PM

7:02 PM

Blogger

Blogger

The campaign will tell the customers about ways to safeguard themselves against financial fraud, starting with not disclosing any information on banking details.

The campaign will tell the customers about ways to safeguard themselves against financial fraud, starting with not disclosing any information on banking details. 5:10 PM

5:10 PM

Blogger

Blogger

5:02 PM

5:02 PM

Blogger

Blogger

The Pune-headquartered lender recorded an 11.46 per cent increase in gross advances at Rs 1,15,236 crore in the July-September period of 2021-22, according to the published data of BoM.

The Pune-headquartered lender recorded an 11.46 per cent increase in gross advances at Rs 1,15,236 crore in the July-September period of 2021-22, according to the published data of BoM. 3:09 PM

3:09 PM

Blogger

Blogger

3:02 PM

3:02 PM

Blogger

Blogger

Value funds are suitable for investors looking for diversification in investment style over growth funds. Investors may also consider investing in value funds to build one’s core portfolio holding and looking for achieving long-term goals.

Value funds are suitable for investors looking for diversification in investment style over growth funds. Investors may also consider investing in value funds to build one’s core portfolio holding and looking for achieving long-term goals. 2:09 PM

2:09 PM

Blogger

Blogger

12:11 PM

12:11 PM

Blogger

Blogger

7:02 PM

7:02 PM

Blogger

Blogger

Edelweiss General Insurance has rolled out a host of initiatives to support customers in the wake of the devastation caused by incessant rains over the last few days in the city, the company said on Sunday.

Edelweiss General Insurance has rolled out a host of initiatives to support customers in the wake of the devastation caused by incessant rains over the last few days in the city, the company said on Sunday. 4:02 PM

4:02 PM

Blogger

Blogger

There have been vacancies at the independent director level across the public sector space, leading to regulatory non-compliance, sources said.

There have been vacancies at the independent director level across the public sector space, leading to regulatory non-compliance, sources said. 4:02 PM

4:02 PM

Blogger

Blogger

Insurance products emerged as the preferred choice of savings and investments for parents after the pandemic, as they consider these as low-risk and reliable financial tools to meet future goals, according to a survey.

Insurance products emerged as the preferred choice of savings and investments for parents after the pandemic, as they consider these as low-risk and reliable financial tools to meet future goals, according to a survey. 12:09 PM

12:09 PM

Blogger

Blogger

7:11 AM

7:11 AM

Blogger

Blogger

2:02 AM

2:02 AM

Blogger

Blogger

The Maharashtra AAR ruling in an application filed by Tata Power said the recovery of insurance premium is not an activity done "in the course of business or for the furtherance of business" and hence, should be outside the gamut of GST.

The Maharashtra AAR ruling in an application filed by Tata Power said the recovery of insurance premium is not an activity done "in the course of business or for the furtherance of business" and hence, should be outside the gamut of GST. RSS Feed

RSS Feed Twitter

Twitter