from Business Line - Money & Banking http://bit.ly/2JOJ1jt

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

12:36 PM

12:36 PM

Blogger

Blogger

8:25 AM

8:25 AM

Blogger

Blogger

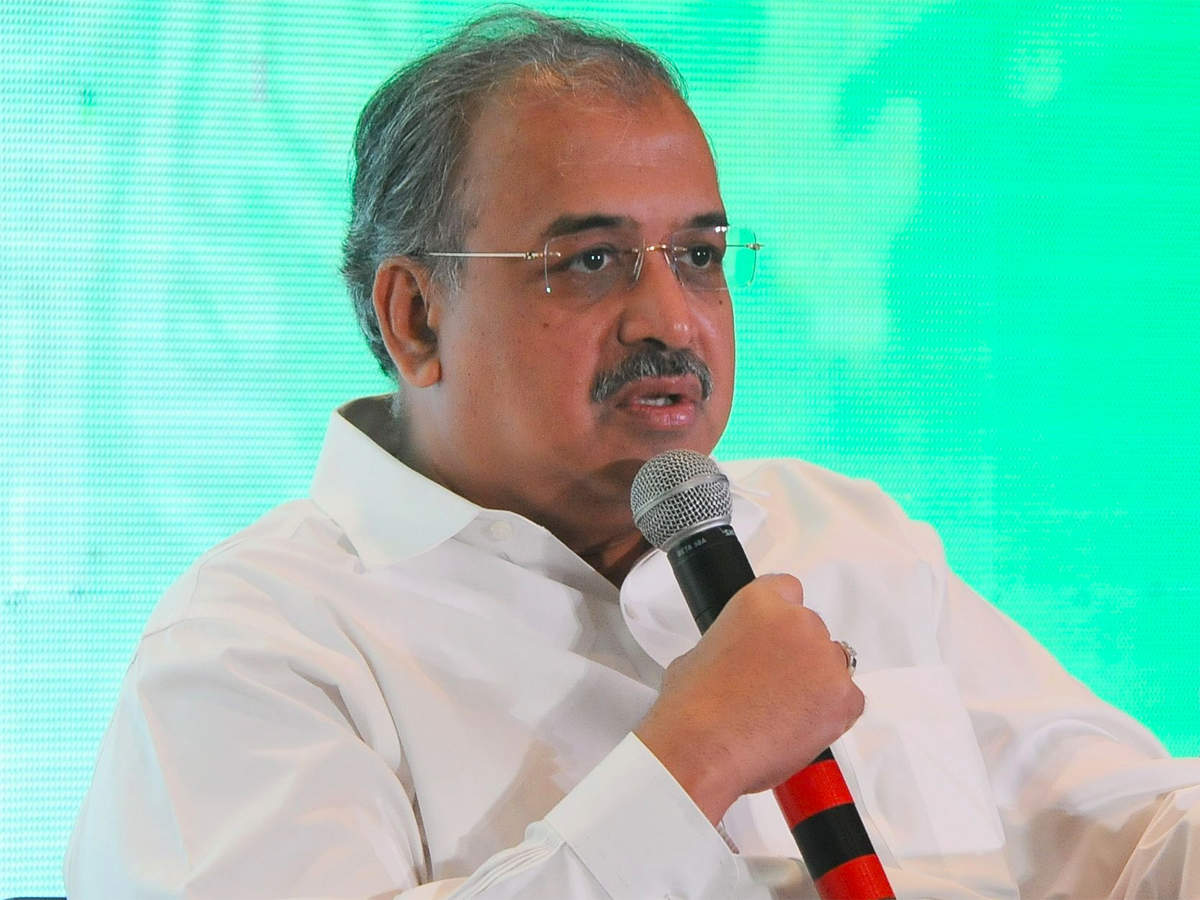

Siva Group chairman C Sivasankaran is one of the 30 individuals and entities against whom the SFIO filed its chargesheet in the IL&FS case.

Siva Group chairman C Sivasankaran is one of the 30 individuals and entities against whom the SFIO filed its chargesheet in the IL&FS case. 7:25 AM

7:25 AM

Blogger

Blogger

SBI made the proposal at a meeting of lenders on Thursday, arguing that it would ensure better coordination during the bankruptcy proceedings of RCom.

SBI made the proposal at a meeting of lenders on Thursday, arguing that it would ensure better coordination during the bankruptcy proceedings of RCom. 10:11 PM

10:11 PM

Blogger

Blogger

9:51 PM

9:51 PM

Blogger

Blogger

9:51 PM

9:51 PM

Blogger

Blogger

9:31 PM

9:31 PM

Blogger

Blogger

7:29 PM

7:29 PM

Blogger

Blogger

India's forex reserves increased by $1.994 billion to $419.992 billion for the week ended May 24 on swelling up of the core currency assets, the Reserve Bank said on Friday. The overall reserves had declined by $2.05 billion to $417.99 billion in the previous reporting week. The reserves had touched an all-time high of $426 billion in April 2018.

India's forex reserves increased by $1.994 billion to $419.992 billion for the week ended May 24 on swelling up of the core currency assets, the Reserve Bank said on Friday. The overall reserves had declined by $2.05 billion to $417.99 billion in the previous reporting week. The reserves had touched an all-time high of $426 billion in April 2018. 5:51 PM

5:51 PM

Blogger

Blogger

5:21 PM

5:21 PM

Blogger

Blogger

4:15 PM

4:15 PM

Blogger

Blogger

Rupee Bank has submitted Merger Proposal to Maharashtra State Co-op. Bank Ltd., Mumbai (MSC Bank)

Rupee Bank has submitted Merger Proposal to Maharashtra State Co-op. Bank Ltd., Mumbai (MSC Bank) 3:46 PM

3:46 PM

Blogger

Blogger

3:46 PM

3:46 PM

Blogger

Blogger

11:00 AM

11:00 AM

Blogger

Blogger

To discuss these paradigm shifts, SWIFT - a financial messaging services provider - hosted the India and South Asia Regional Conference 2019.

To discuss these paradigm shifts, SWIFT - a financial messaging services provider - hosted the India and South Asia Regional Conference 2019. 7:35 AM

7:35 AM

Blogger

Blogger

Sivasankaran, nine IFIN ex-directors, auditors BSR & Deloitte accused of hiding info, falsifying accounts.

Sivasankaran, nine IFIN ex-directors, auditors BSR & Deloitte accused of hiding info, falsifying accounts. 6:25 AM

6:25 AM

Blogger

Blogger

6:25 AM

6:25 AM

Blogger

Blogger

6:15 AM

6:15 AM

Blogger

Blogger

6:15 AM

6:15 AM

Blogger

Blogger

2:31 AM

2:31 AM

Blogger

Blogger

10:40 PM

10:40 PM

Blogger

Blogger

10:25 PM

10:25 PM

Blogger

Blogger

Microfinance business has gained stability, setting aside the funding woes with banks backing micro lenders.

Microfinance business has gained stability, setting aside the funding woes with banks backing micro lenders. 10:21 PM

10:21 PM

Blogger

Blogger

10:21 PM

10:21 PM

Blogger

Blogger

10:16 PM

10:16 PM

Blogger

Blogger

10:06 PM

10:06 PM

Blogger

Blogger

10:06 PM

10:06 PM

Blogger

Blogger

9:31 PM

9:31 PM

Blogger

Blogger

9:31 PM

9:31 PM

Blogger

Blogger

9:31 PM

9:31 PM

Blogger

Blogger

9:10 PM

9:10 PM

Blogger

Blogger

9:10 PM

9:10 PM

Blogger

Blogger

9:10 PM

9:10 PM

Blogger

Blogger

5:56 PM

5:56 PM

Blogger

Blogger

5:29 PM

5:29 PM

Blogger

Blogger

A UK court on Thursday extended till June 27 the remand of fugitive diamond merchant Nirav Modi, who is fighting his extradition to India in the nearly $2 billion Punjab National Bank (PNB) fraud and money laundering case. The 48-year-old has been lodged at Wandsworth prison in south-west London since his third attempt at seeking bail was rejected.

A UK court on Thursday extended till June 27 the remand of fugitive diamond merchant Nirav Modi, who is fighting his extradition to India in the nearly $2 billion Punjab National Bank (PNB) fraud and money laundering case. The 48-year-old has been lodged at Wandsworth prison in south-west London since his third attempt at seeking bail was rejected. 5:06 PM

5:06 PM

Blogger

Blogger

4:51 PM

4:51 PM

Blogger

Blogger

4:01 PM

4:01 PM

Blogger

Blogger

2:41 PM

2:41 PM

Blogger

Blogger

12:31 PM

12:31 PM

Blogger

Blogger

12:31 PM

12:31 PM

Blogger

Blogger

12:00 PM

12:00 PM

Blogger

Blogger

12:00 PM

12:00 PM

Blogger

Blogger

11:50 AM

11:50 AM

Blogger

Blogger

11:50 AM

11:50 AM

Blogger

Blogger

10:15 AM

10:15 AM

Blogger

Blogger

India’s shadow lenders have been under pressure since last year, when a series of defaults by IL&FS forced the government to intervene and exposed weaknesses in the sector.

India’s shadow lenders have been under pressure since last year, when a series of defaults by IL&FS forced the government to intervene and exposed weaknesses in the sector. 7:25 AM

7:25 AM

Blogger

Blogger

This is part of Reliance Capital’s efforts to reduce its Rs 18,000 crore debt.

This is part of Reliance Capital’s efforts to reduce its Rs 18,000 crore debt. 5:20 AM

5:20 AM

Blogger

Blogger

5:20 AM

5:20 AM

Blogger

Blogger

5:20 AM

5:20 AM

Blogger

Blogger

5:20 AM

5:20 AM

Blogger

Blogger

5:20 AM

5:20 AM

Blogger

Blogger

5:20 AM

5:20 AM

Blogger

Blogger

5:20 AM

5:20 AM

Blogger

Blogger

3:20 AM

3:20 AM

Blogger

Blogger

3:20 AM

3:20 AM

Blogger

Blogger

3:20 AM

3:20 AM

Blogger

Blogger

3:20 AM

3:20 AM

Blogger

Blogger

3:20 AM

3:20 AM

Blogger

Blogger

3:20 AM

3:20 AM

Blogger

Blogger

3:20 AM

3:20 AM

Blogger

Blogger

3:00 AM

3:00 AM

Blogger

Blogger

3:00 AM

3:00 AM

Blogger

Blogger

3:00 AM

3:00 AM

Blogger

Blogger

3:00 AM

3:00 AM

Blogger

Blogger

3:00 AM

3:00 AM

Blogger

Blogger

3:00 AM

3:00 AM

Blogger

Blogger

3:00 AM

3:00 AM

Blogger

Blogger

11:58 PM

11:58 PM

Blogger

Blogger

The RBI specifies Know Your Customer norms to be followed by banks and other entities regulated by it for various customer services, including opening of bank accounts.

The RBI specifies Know Your Customer norms to be followed by banks and other entities regulated by it for various customer services, including opening of bank accounts. 10:58 PM

10:58 PM

Blogger

Blogger

The regulator on Wednesday wrote a letter to these companies, stipulating the responsibilities of this senior executive. ET has viewed a copy of the letter.

The regulator on Wednesday wrote a letter to these companies, stipulating the responsibilities of this senior executive. ET has viewed a copy of the letter. 9:48 PM

9:48 PM

Blogger

Blogger

NCLAT also said that if 'amber' listed companies are not reclassified into 'green' category, then it may pass an order directing them to pay 100% of their obligations towards provident and pension funds.

NCLAT also said that if 'amber' listed companies are not reclassified into 'green' category, then it may pass an order directing them to pay 100% of their obligations towards provident and pension funds. 9:48 PM

9:48 PM

Blogger

Blogger

These panels have been asked to review the existing market operations and come up with recommendations aligning them with global best practices.

These panels have been asked to review the existing market operations and come up with recommendations aligning them with global best practices. 9:24 PM

9:24 PM

Blogger

Blogger

9:24 PM

9:24 PM

Blogger

Blogger

9:19 PM

9:19 PM

Blogger

Blogger

9:19 PM

9:19 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

9:08 PM

9:08 PM

Blogger

Blogger

The state-owned bank’s target is 25% higher than recoveries of Rs 16,000 crore in the previous financial year.

The state-owned bank’s target is 25% higher than recoveries of Rs 16,000 crore in the previous financial year. 9:08 PM

9:08 PM

Blogger

Blogger

The government had first invited application for the job in May 2017, but could not find a suitable candidate. Subsequently, another failed attempt was made last year.

The government had first invited application for the job in May 2017, but could not find a suitable candidate. Subsequently, another failed attempt was made last year. 8:33 PM

8:33 PM

Blogger

Blogger

The lender is expecting a write-back of Rs 4,000 crore from Essar Steel and Bhushan Power and Steel which are undergoing resolution under the Insolvency and Bankruptcy Code.

The lender is expecting a write-back of Rs 4,000 crore from Essar Steel and Bhushan Power and Steel which are undergoing resolution under the Insolvency and Bankruptcy Code. 8:03 PM

8:03 PM

Blogger

Blogger

The company has disbursed subsidy amounting to over Rs 2,300 crore benefitting over 1,04,000 families under PMAY.

The company has disbursed subsidy amounting to over Rs 2,300 crore benefitting over 1,04,000 families under PMAY. 5:29 PM

5:29 PM

Blogger

Blogger

5:29 PM

5:29 PM

Blogger

Blogger

2:55 PM

2:55 PM

Blogger

Blogger

11:29 AM

11:29 AM

Blogger

Blogger

An acquisition of government shares in the other two entities will also help the Centre raise some funds and bolster its disinvestment corpus.

An acquisition of government shares in the other two entities will also help the Centre raise some funds and bolster its disinvestment corpus. 8:48 AM

8:48 AM

Blogger

Blogger

8:48 AM

8:48 AM

Blogger

Blogger

8:34 AM

8:34 AM

Blogger

Blogger

The NBFC crisis has highlighted the need for a reinvention of the institutional framework in financial intermediation.

The NBFC crisis has highlighted the need for a reinvention of the institutional framework in financial intermediation. 8:03 AM

8:03 AM

Blogger

Blogger

RBI puts on hold Shanghvi Finance's request for core investment company licence.

RBI puts on hold Shanghvi Finance's request for core investment company licence. 7:23 AM

7:23 AM

Blogger

Blogger

Janakiraman, a former managing director of State Bank of India, was also head of the risk management committee at ISSL and had been part of the panel for more than a decade.

Janakiraman, a former managing director of State Bank of India, was also head of the risk management committee at ISSL and had been part of the panel for more than a decade. 6:08 AM

6:08 AM

Blogger

Blogger

6:08 AM

6:08 AM

Blogger

Blogger

5:13 AM

5:13 AM

Blogger

Blogger

5:13 AM

5:13 AM

Blogger

Blogger

4:28 AM

4:28 AM

Blogger

Blogger

4:28 AM

4:28 AM

Blogger

Blogger

3:18 AM

3:18 AM

Blogger

Blogger

3:18 AM

3:18 AM

Blogger

Blogger

3:18 AM

3:18 AM

Blogger

Blogger

3:18 AM

3:18 AM

Blogger

Blogger

1:33 AM

1:33 AM

Blogger

Blogger

1:33 AM

1:33 AM

Blogger

Blogger

12:08 AM

12:08 AM

Blogger

Blogger

12:08 AM

12:08 AM

Blogger

Blogger

11:58 PM

11:58 PM

Blogger

Blogger

Latest IBBI data shows that in 16% cases, bids received were higher than liquidation value of assets, but deferred payments offer prompted lenders to reject them.

Latest IBBI data shows that in 16% cases, bids received were higher than liquidation value of assets, but deferred payments offer prompted lenders to reject them. 11:48 PM

11:48 PM

Blogger

Blogger

11:48 PM

11:48 PM

Blogger

Blogger

10:29 PM

10:29 PM

Blogger

Blogger

10:29 PM

10:29 PM

Blogger

Blogger

10:24 PM

10:24 PM

Blogger

Blogger

10:14 PM

10:14 PM

Blogger

Blogger

9:49 PM

9:49 PM

Blogger

Blogger

9:49 PM

9:49 PM

Blogger

Blogger

9:39 PM

9:39 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

Effectively, the transactions will now take place under three windows: 8am to 11am, 11am to 1am and 1am to 6pm.

Effectively, the transactions will now take place under three windows: 8am to 11am, 11am to 1am and 1am to 6pm. 8:59 PM

8:59 PM

Blogger

Blogger

8:59 PM

8:59 PM

Blogger

Blogger

8:49 PM

8:49 PM

Blogger

Blogger

8:49 PM

8:49 PM

Blogger

Blogger

8:44 PM

8:44 PM

Blogger

Blogger

5:09 PM

5:09 PM

Blogger

Blogger

4:39 PM

4:39 PM

Blogger

Blogger

IFC may also provide advisory services to bring global best practices to MFL’s risk management systems and help it build capacity in MSME lending.

IFC may also provide advisory services to bring global best practices to MFL’s risk management systems and help it build capacity in MSME lending. 2:44 PM

2:44 PM

Blogger

Blogger

State-owned Punjab National Bank on Tuesday said it has narrowed its loss to Rs 4,750 crore in the last quarter of the fiscal ended March 2019. The scam-hit lender had posted a staggering loss of Rs 13,417 crore during the corresponding January-March period of 2017-18.

State-owned Punjab National Bank on Tuesday said it has narrowed its loss to Rs 4,750 crore in the last quarter of the fiscal ended March 2019. The scam-hit lender had posted a staggering loss of Rs 13,417 crore during the corresponding January-March period of 2017-18. 1:39 PM

1:39 PM

Blogger

Blogger

1:29 PM

1:29 PM

Blogger

Blogger

11:28 AM

11:28 AM

Blogger

Blogger

For the financial year ended March 2019, the target was of about 30 billion digital transactions, of which 90-95% was met.

For the financial year ended March 2019, the target was of about 30 billion digital transactions, of which 90-95% was met. 9:49 AM

9:49 AM

Blogger

Blogger

The Central Information Commission (CIC) has directed the Reserve Bank of India (RBI) to disclose the list of big loan defaulters that the central bank had sent to lenders for resolution.

The Central Information Commission (CIC) has directed the Reserve Bank of India (RBI) to disclose the list of big loan defaulters that the central bank had sent to lenders for resolution. 7:28 AM

7:28 AM

Blogger

Blogger

In an interview with ET, Anil Ambani talks about his plans of monetising assets to reduce debt and his focus on capital-light businesses.

In an interview with ET, Anil Ambani talks about his plans of monetising assets to reduce debt and his focus on capital-light businesses. 6:58 AM

6:58 AM

Blogger

Blogger

Reliance Group chief expects new govt and RBI to provide support in the form of immediate liquidity window.

Reliance Group chief expects new govt and RBI to provide support in the form of immediate liquidity window. 6:03 AM

6:03 AM

Blogger

Blogger

6:03 AM

6:03 AM

Blogger

Blogger

6:03 AM

6:03 AM

Blogger

Blogger

5:30 AM

5:30 AM

Blogger

Blogger

5:30 AM

5:30 AM

Blogger

Blogger

5:30 AM

5:30 AM

Blogger

Blogger

9:50 PM

9:50 PM

Blogger

Blogger

9:39 PM

9:39 PM

Blogger

Blogger

9:24 PM

9:24 PM

Blogger

Blogger

9:24 PM

9:24 PM

Blogger

Blogger

9:24 PM

9:24 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

8:23 PM

8:23 PM

Blogger

Blogger

6:58 PM

6:58 PM

Blogger

Blogger

Hyderabad Ring Road Projects Private Ltd, is a special purpose vehicle related to Era Infra Engineering Ltd and raised an amount of Rs 193.60 crore between January 2014 to September 2015.

Hyderabad Ring Road Projects Private Ltd, is a special purpose vehicle related to Era Infra Engineering Ltd and raised an amount of Rs 193.60 crore between January 2014 to September 2015. 6:45 PM

6:45 PM

Blogger

Blogger

1:19 PM

1:19 PM

Blogger

Blogger

11:48 AM

11:48 AM

Blogger

Blogger

11:34 AM

11:34 AM

Blogger

Blogger

A clear mandate to the Narendra Modi-led National Democratic Alliance could pave the way for easier interest rates from the Reserve Bank of India when it announces its second bi-monthly policy for 2019 on June 6th.

A clear mandate to the Narendra Modi-led National Democratic Alliance could pave the way for easier interest rates from the Reserve Bank of India when it announces its second bi-monthly policy for 2019 on June 6th. 11:23 AM

11:23 AM

Blogger

Blogger

11:08 AM

11:08 AM

Blogger

Blogger

10:43 AM

10:43 AM

Blogger

Blogger

10:28 AM

10:28 AM

Blogger

Blogger

10:14 PM

10:14 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

8:08 PM

8:08 PM

Blogger

Blogger

7:58 PM

7:58 PM

Blogger

Blogger

5:39 PM

5:39 PM

Blogger

Blogger

8:49 AM

8:49 AM

Blogger

Blogger

8:14 AM

8:14 AM

Blogger

Blogger

3:04 AM

3:04 AM

Blogger

Blogger

RSS Feed

RSS Feed Twitter

Twitter