Ramann, 1991-batch Indian Audit & Accounts Service officer, is currently CEO of National E-Governance Services Limited (NeSL), India's first Information Utility.

Ramann, 1991-batch Indian Audit & Accounts Service officer, is currently CEO of National E-Governance Services Limited (NeSL), India's first Information Utility.from Banking/Finance-Industry-Economic Times https://ift.tt/39LK67N

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

7:05 PM

7:05 PM

Blogger

Blogger

Ramann, 1991-batch Indian Audit & Accounts Service officer, is currently CEO of National E-Governance Services Limited (NeSL), India's first Information Utility.

Ramann, 1991-batch Indian Audit & Accounts Service officer, is currently CEO of National E-Governance Services Limited (NeSL), India's first Information Utility. 6:12 PM

6:12 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

At a time when the private sector is witnessing mergers and acquisitions, the central government scrapped its earlier plan to merge National Insurance Company Ltd, Oriental Insurance Company Ltd and United India Insurance Company Ltd into one.

At a time when the private sector is witnessing mergers and acquisitions, the central government scrapped its earlier plan to merge National Insurance Company Ltd, Oriental Insurance Company Ltd and United India Insurance Company Ltd into one. 12:12 PM

12:12 PM

Blogger

Blogger

12:12 PM

12:12 PM

Blogger

Blogger

10:12 AM

10:12 AM

Blogger

Blogger

7:14 AM

7:14 AM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

As the one-size-fits-all approach wouldn't work with NBFCs, the RBI is considering a scale-based filter to frame new rules for last-mile lenders.

As the one-size-fits-all approach wouldn't work with NBFCs, the RBI is considering a scale-based filter to frame new rules for last-mile lenders. 7:05 PM

7:05 PM

Blogger

Blogger

DBIL said it is well-capitalised, and its capital adequacy ratios (CAR) remains above regulatory requirements after the amalgamation.

DBIL said it is well-capitalised, and its capital adequacy ratios (CAR) remains above regulatory requirements after the amalgamation. 6:05 PM

6:05 PM

Blogger

Blogger

"We want the NBFC sector to remain robust. It plays an important part in filling the last mile gap and hence we have also made some changes like allowing co-lending with banks. It is a priorty for the RBI to ensure they remain strong and work well," Das said.

"We want the NBFC sector to remain robust. It plays an important part in filling the last mile gap and hence we have also made some changes like allowing co-lending with banks. It is a priorty for the RBI to ensure they remain strong and work well," Das said. 5:12 PM

5:12 PM

Blogger

Blogger

4:14 PM

4:14 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

The RBI's internal working group to review the current guidelines pertaining to ownership and corporate structure of Indian Private sector Banks has suggested increasing the cap on promoter holding to 26% from the current level of 15%.

The RBI's internal working group to review the current guidelines pertaining to ownership and corporate structure of Indian Private sector Banks has suggested increasing the cap on promoter holding to 26% from the current level of 15%. 3:05 PM

3:05 PM

Blogger

Blogger

In March this year the regulator imposed a moratorium on Yes Bank and quickly stitched a reconstruction plan with SBI and nine other domestic entities investing in the lender. Likewise, last month the RBI directed a forced merger between troubled Lakshmi Vilas Bank and DBS (India) Bank, wiping out holdings of all equity and tier 2 bond holders.

In March this year the regulator imposed a moratorium on Yes Bank and quickly stitched a reconstruction plan with SBI and nine other domestic entities investing in the lender. Likewise, last month the RBI directed a forced merger between troubled Lakshmi Vilas Bank and DBS (India) Bank, wiping out holdings of all equity and tier 2 bond holders. 3:05 PM

3:05 PM

Blogger

Blogger

Earlier episodes, overwhelming presence in digital payments prompted drastic measures on HDFC Bank, says RBI governor Shaktikanta Das. A central bank team probing outages at SBI as well.

Earlier episodes, overwhelming presence in digital payments prompted drastic measures on HDFC Bank, says RBI governor Shaktikanta Das. A central bank team probing outages at SBI as well. 2:12 PM

2:12 PM

Blogger

Blogger

2:05 PM

2:05 PM

Blogger

Blogger

In response to the pandemic, RBI has focused on resolution of stress among borrowers, and facilitating credit flow to the economy, while ensuring financial stability, RBI Governor Shaktikanta Das said.

In response to the pandemic, RBI has focused on resolution of stress among borrowers, and facilitating credit flow to the economy, while ensuring financial stability, RBI Governor Shaktikanta Das said. 2:05 PM

2:05 PM

Blogger

Blogger

The announcement comes a day after the RBI temporarily barred largest private sector lender HDFC Bank from selling new credit cards or launching new digital banking initiatives, taking a serious view of service outages at the systemically important bank over the last two years.

The announcement comes a day after the RBI temporarily barred largest private sector lender HDFC Bank from selling new credit cards or launching new digital banking initiatives, taking a serious view of service outages at the systemically important bank over the last two years. 1:12 PM

1:12 PM

Blogger

Blogger

1:12 PM

1:12 PM

Blogger

Blogger

1:05 PM

1:05 PM

Blogger

Blogger

The governor said that the RBI has not taken any decision on the bank licences so far and the recommendations in this regard are from an Internal Working Group.

The governor said that the RBI has not taken any decision on the bank licences so far and the recommendations in this regard are from an Internal Working Group. 1:05 PM

1:05 PM

Blogger

Blogger

Currently, RTGS is available for customers from 7.00 am to 6.00 pm on all working days of a week, except second and fourth Saturdays of every month.

Currently, RTGS is available for customers from 7.00 am to 6.00 pm on all working days of a week, except second and fourth Saturdays of every month. 12:12 PM

12:12 PM

Blogger

Blogger

11:12 AM

11:12 AM

Blogger

Blogger

10:12 AM

10:12 AM

Blogger

Blogger

10:05 AM

10:05 AM

Blogger

Blogger

HDFC Bank: Tech glitches and impact

HDFC Bank: Tech glitches and impact 6:14 AM

6:14 AM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

6:05 PM

6:05 PM

Blogger

Blogger

The RBIs internal group to review the current guidelines pertaining to ownership and corporate structure of Indian Private sector Banks has suggested increasing the cap on promoter holding to 26% from the current level of 15%.

The RBIs internal group to review the current guidelines pertaining to ownership and corporate structure of Indian Private sector Banks has suggested increasing the cap on promoter holding to 26% from the current level of 15%. 6:05 PM

6:05 PM

Blogger

Blogger

SBI which has a customer base of 490 million, processes at least 4 lakh transactions on its digital offerings on a daily basis. About 55% of the bank’s transactions are currently being conducted through the digital channel and half of it is contributed by Yono.

SBI which has a customer base of 490 million, processes at least 4 lakh transactions on its digital offerings on a daily basis. About 55% of the bank’s transactions are currently being conducted through the digital channel and half of it is contributed by Yono. 6:05 PM

6:05 PM

Blogger

Blogger

The Reserve Bank of India’s move to temporarily ban private lender HDFC Bank from onboarding new credit card clients and launching digital initiatives has led to a confusion among the customer’s minds on what services will be affected.

The Reserve Bank of India’s move to temporarily ban private lender HDFC Bank from onboarding new credit card clients and launching digital initiatives has led to a confusion among the customer’s minds on what services will be affected. 5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:05 PM

5:05 PM

Blogger

Blogger

RBI on Thursday asked HDFC Bank to temporarily halt new digital offerings and stop sourcing credit card customers.

RBI on Thursday asked HDFC Bank to temporarily halt new digital offerings and stop sourcing credit card customers. 4:05 PM

4:05 PM

Blogger

Blogger

This unprecedented order by the RBI comes after the bank suffered its third big outage in the span of just two years. The RBI order also states that the lender’s board needs to examine these lapses and fix accountability.

This unprecedented order by the RBI comes after the bank suffered its third big outage in the span of just two years. The RBI order also states that the lender’s board needs to examine these lapses and fix accountability. 4:05 PM

4:05 PM

Blogger

Blogger

“The global recession and the expansionary monetary policies undertaken by countries globally is expected to have ramifications of the financial sector with banking sector likely to remain impaired over the next few years,” the report said.

“The global recession and the expansionary monetary policies undertaken by countries globally is expected to have ramifications of the financial sector with banking sector likely to remain impaired over the next few years,” the report said. 4:05 PM

4:05 PM

Blogger

Blogger

In this capacity, Verma will oversee the company's public policy, regulatory affairs and litigation teams around the world, Mastercard said in a statement.

In this capacity, Verma will oversee the company's public policy, regulatory affairs and litigation teams around the world, Mastercard said in a statement. 3:12 PM

3:12 PM

Blogger

Blogger

1:05 PM

1:05 PM

Blogger

Blogger

The RBI order comes after another recent major outage, the third such instance in a span of two years, at HDFC Bank which is the country's leading private lender.

The RBI order comes after another recent major outage, the third such instance in a span of two years, at HDFC Bank which is the country's leading private lender. 1:05 PM

1:05 PM

Blogger

Blogger

The regulator has sought an explanation from HDFC Bank about an interruption in digital services on November 21. This is the third disruption of digital services that HDFC Bank customers have faced in the past two years.

The regulator has sought an explanation from HDFC Bank about an interruption in digital services on November 21. This is the third disruption of digital services that HDFC Bank customers have faced in the past two years. 12:14 PM

12:14 PM

Blogger

Blogger

12:12 PM

12:12 PM

Blogger

Blogger

10:12 AM

10:12 AM

Blogger

Blogger

3:14 AM

3:14 AM

Blogger

Blogger

1:14 AM

1:14 AM

Blogger

Blogger

10:12 PM

10:12 PM

Blogger

Blogger

10:05 PM

10:05 PM

Blogger

Blogger

Most banks and NBFCs have claimed of achieving near normal collection efficiency levels, but data suggests that Covid has altered borrower repayment behaviour.

Most banks and NBFCs have claimed of achieving near normal collection efficiency levels, but data suggests that Covid has altered borrower repayment behaviour. 9:12 PM

9:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

Bankers have requested the regulator that given the case in the Supreme Court leading to a prolonged moratorium, they haven’t been able to assess borrower cash flows.

Bankers have requested the regulator that given the case in the Supreme Court leading to a prolonged moratorium, they haven’t been able to assess borrower cash flows. 6:12 PM

6:12 PM

Blogger

Blogger

6:05 PM

6:05 PM

Blogger

Blogger

With this IT integration, all of erstwhile Corporation Bank, including service and specialised branches, have been fully integrated with Union Bank of India (UBI), it said in a release.

With this IT integration, all of erstwhile Corporation Bank, including service and specialised branches, have been fully integrated with Union Bank of India (UBI), it said in a release. 5:12 PM

5:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

3:14 PM

3:14 PM

Blogger

Blogger

1:05 PM

1:05 PM

Blogger

Blogger

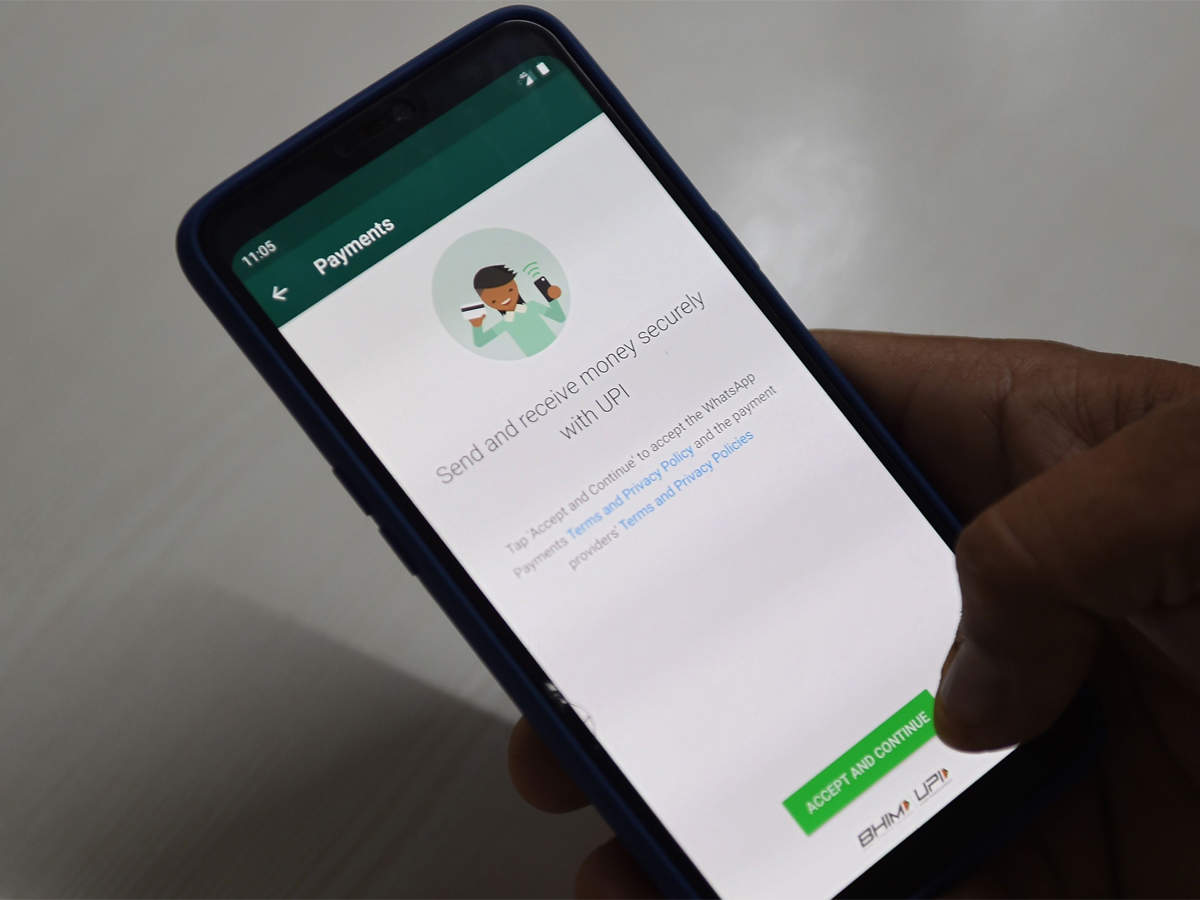

Under India's unique rule, no single player can grab more than 30% of total payments transactions. Every company also has to use India’s open payments platform, guaranteeing interoperability so money can be transferred between any of more than 100 traditional banks and digital services like Google Pay — all without fees.

Under India's unique rule, no single player can grab more than 30% of total payments transactions. Every company also has to use India’s open payments platform, guaranteeing interoperability so money can be transferred between any of more than 100 traditional banks and digital services like Google Pay — all without fees. 1:05 PM

1:05 PM

Blogger

Blogger

The National Company Law Tribunal (NCLT) admitted 80 cases during the second quarter, one less than the previous quarter and substantially lower than the 588 admitted in the second quarter last year, data released by the Insolvency and Bankruptcy Board of India showed.

The National Company Law Tribunal (NCLT) admitted 80 cases during the second quarter, one less than the previous quarter and substantially lower than the 588 admitted in the second quarter last year, data released by the Insolvency and Bankruptcy Board of India showed. 11:05 AM

11:05 AM

Blogger

Blogger

The nationwide bank holidays this month will fall on December 12, December 25 and December 26. Here is the list of the other state-specific bank holidays to help you come up with a planner for the month.

The nationwide bank holidays this month will fall on December 12, December 25 and December 26. Here is the list of the other state-specific bank holidays to help you come up with a planner for the month. 10:08 AM

10:08 AM

Blogger

Blogger

Goldman along with an Edelweiss fund have agreed to infuse Rs 1,600 crore in the form of 5 year debentures. Another Rs 200 crore will be used for working capital requirements and other general corporate purposes as part of RBI's resolution plan for stressed assets. There is a possibility of a third investor but that is not yet finalised.

Goldman along with an Edelweiss fund have agreed to infuse Rs 1,600 crore in the form of 5 year debentures. Another Rs 200 crore will be used for working capital requirements and other general corporate purposes as part of RBI's resolution plan for stressed assets. There is a possibility of a third investor but that is not yet finalised. 7:15 AM

7:15 AM

Blogger

Blogger

11:12 PM

11:12 PM

Blogger

Blogger

9:12 PM

9:12 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

6:05 PM

6:05 PM

Blogger

Blogger

Since the opening up of the insurance market in 2000, the non-life sector attracted a total FDI of Rs 4,721.68 crore as on March 2020. It was Rs 4,212.61 crore at the end of March 2019.

Since the opening up of the insurance market in 2000, the non-life sector attracted a total FDI of Rs 4,721.68 crore as on March 2020. It was Rs 4,212.61 crore at the end of March 2019. 6:05 PM

6:05 PM

Blogger

Blogger

Yes Bank aims to open up to 1 lakh fresh accounts every month by leveraging technology, he said adding that it expects this trend to continue in the coming quarters.

Yes Bank aims to open up to 1 lakh fresh accounts every month by leveraging technology, he said adding that it expects this trend to continue in the coming quarters. 5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

With this card, customers would be able to transact on ATMs (Automatic Teller Machines) & PoS (Point of Sale) terminals across the globe under the JCB network. They can also shop online from JCB-partnered international e-commerce merchants using the card.

With this card, customers would be able to transact on ATMs (Automatic Teller Machines) & PoS (Point of Sale) terminals across the globe under the JCB network. They can also shop online from JCB-partnered international e-commerce merchants using the card. 3:12 PM

3:12 PM

Blogger

Blogger

3:05 PM

3:05 PM

Blogger

Blogger

Punjab and Maharashtra Cooperative Bank has been put under restrictions, including limiting withdrawals, by the RBI, following the unearthing of a Rs 4,355-crore scam.

Punjab and Maharashtra Cooperative Bank has been put under restrictions, including limiting withdrawals, by the RBI, following the unearthing of a Rs 4,355-crore scam. 3:05 PM

3:05 PM

Blogger

Blogger

IL&FS in a statement said Sekura had bid Rs 916 crore for the 100 per cent stake in Jorabat Shillong Expressway (JSEL). JSEL is a wholly-owned subsidiary of IL&FS Transport Network .

IL&FS in a statement said Sekura had bid Rs 916 crore for the 100 per cent stake in Jorabat Shillong Expressway (JSEL). JSEL is a wholly-owned subsidiary of IL&FS Transport Network . 2:12 PM

2:12 PM

Blogger

Blogger

2:05 PM

2:05 PM

Blogger

Blogger

The bench was hearing Kochhar's appeal against the March 5 order of the high court which had dismissed the plea against termination of her services as managing director and CEO of ICICI Bank while noting that the dispute arises from a contract of personal service.

The bench was hearing Kochhar's appeal against the March 5 order of the high court which had dismissed the plea against termination of her services as managing director and CEO of ICICI Bank while noting that the dispute arises from a contract of personal service. 11:12 AM

11:12 AM

Blogger

Blogger

9:14 AM

9:14 AM

Blogger

Blogger

9:05 AM

9:05 AM

Blogger

Blogger

Creditors are confident that they are well within their rights to ask for a rebid as they seek to maximise returns. They have also sought former attorney general Mukul Rohatgi’s opinion on whether rebids can be done in the current situation especially in the light of opposition from three bidders to the Adani Group’s late bid.

Creditors are confident that they are well within their rights to ask for a rebid as they seek to maximise returns. They have also sought former attorney general Mukul Rohatgi’s opinion on whether rebids can be done in the current situation especially in the light of opposition from three bidders to the Adani Group’s late bid. 9:12 PM

9:12 PM

Blogger

Blogger

9:05 PM

9:05 PM

Blogger

Blogger

Non-food bank credit growth decelerated to 5.6 per cent on a year-on-year (y-o-y) basis, in October 2020 from 8.3 per cent in October 2019.

Non-food bank credit growth decelerated to 5.6 per cent on a year-on-year (y-o-y) basis, in October 2020 from 8.3 per cent in October 2019. 8:12 PM

8:12 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

8:12 PM

8:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:05 PM

7:05 PM

Blogger

Blogger

Sidbi's helpline- a web portal-"arm-msme" is designed to help MSMEs take benefit of Reserve Bank of India’s MSME restructuring guideline.

Sidbi's helpline- a web portal-"arm-msme" is designed to help MSMEs take benefit of Reserve Bank of India’s MSME restructuring guideline. 6:12 PM

6:12 PM

Blogger

Blogger

5:12 PM

5:12 PM

Blogger

Blogger

4:12 PM

4:12 PM

Blogger

Blogger

4:05 PM

4:05 PM

Blogger

Blogger

"In the Asia Pacific region, banks' rising nonperforming loans and insurers' volatile investment portfolios are in focus. Capital will moderately fall in emerging Asia over the next two years, and banks in India and Sri Lanka will post larger capital declines without public or private injections," Moody's said.

"In the Asia Pacific region, banks' rising nonperforming loans and insurers' volatile investment portfolios are in focus. Capital will moderately fall in emerging Asia over the next two years, and banks in India and Sri Lanka will post larger capital declines without public or private injections," Moody's said. 3:05 PM

3:05 PM

Blogger

Blogger

The amalgamation of LVB into DBS Bank India came into effect from November 27 under the special powers of the government and the Reserve Bank of India under Section 45 of the Banking Regulation Act, 1949.

The amalgamation of LVB into DBS Bank India came into effect from November 27 under the special powers of the government and the Reserve Bank of India under Section 45 of the Banking Regulation Act, 1949. 3:05 PM

3:05 PM

Blogger

Blogger

Southeast Asia's largest lender, which will pump in 25 billion rupees ($338 million) into its India unit, until recently had just over 30 branches in India but has now added more than 550 and 900-plus ATMs.

Southeast Asia's largest lender, which will pump in 25 billion rupees ($338 million) into its India unit, until recently had just over 30 branches in India but has now added more than 550 and 900-plus ATMs. 3:05 PM

3:05 PM

Blogger

Blogger

Social distancing rules have forced consumers to rethink how they spend, with digital payments becoming an increasingly attractive. This shift in mindset is reflected in the growth in outstanding balances. Credit card outstanding balances increased by 32% y-o-y in July 2020. This compares to a 33% y-o-y increase in balances at the same time last year.

Social distancing rules have forced consumers to rethink how they spend, with digital payments becoming an increasingly attractive. This shift in mindset is reflected in the growth in outstanding balances. Credit card outstanding balances increased by 32% y-o-y in July 2020. This compares to a 33% y-o-y increase in balances at the same time last year. 2:12 PM

2:12 PM

Blogger

Blogger

1:12 PM

1:12 PM

Blogger

Blogger

12:12 PM

12:12 PM

Blogger

Blogger

11:05 AM

11:05 AM

Blogger

Blogger

"We have suggested revisiting the fit-and-proper criteria. We have said that financial conglomerates getting into banking should have a structure NOFHC to come through and that companies should be regulated through RBI guidelines and necessary legislative framework," says Sachin Chaturvedi who is on RBI's central board.

"We have suggested revisiting the fit-and-proper criteria. We have said that financial conglomerates getting into banking should have a structure NOFHC to come through and that companies should be regulated through RBI guidelines and necessary legislative framework," says Sachin Chaturvedi who is on RBI's central board. 11:05 AM

11:05 AM

Blogger

Blogger

ATM players say that the main reason is that over seven years, the number of debit cards in India has doubled to 86 crore as of September 2020. And of those cards, 35 per cent (30 crore) are RuPay ones issued to PM Jan Dhan Yojana accounts.

ATM players say that the main reason is that over seven years, the number of debit cards in India has doubled to 86 crore as of September 2020. And of those cards, 35 per cent (30 crore) are RuPay ones issued to PM Jan Dhan Yojana accounts. 10:12 AM

10:12 AM

Blogger

Blogger

10:05 AM

10:05 AM

Blogger

Blogger

November this year saw a substantial number of bank holidays. There were quite a few nationwide holidays as well as some state-specific ones.

November this year saw a substantial number of bank holidays. There were quite a few nationwide holidays as well as some state-specific ones. RSS Feed

RSS Feed Twitter

Twitter