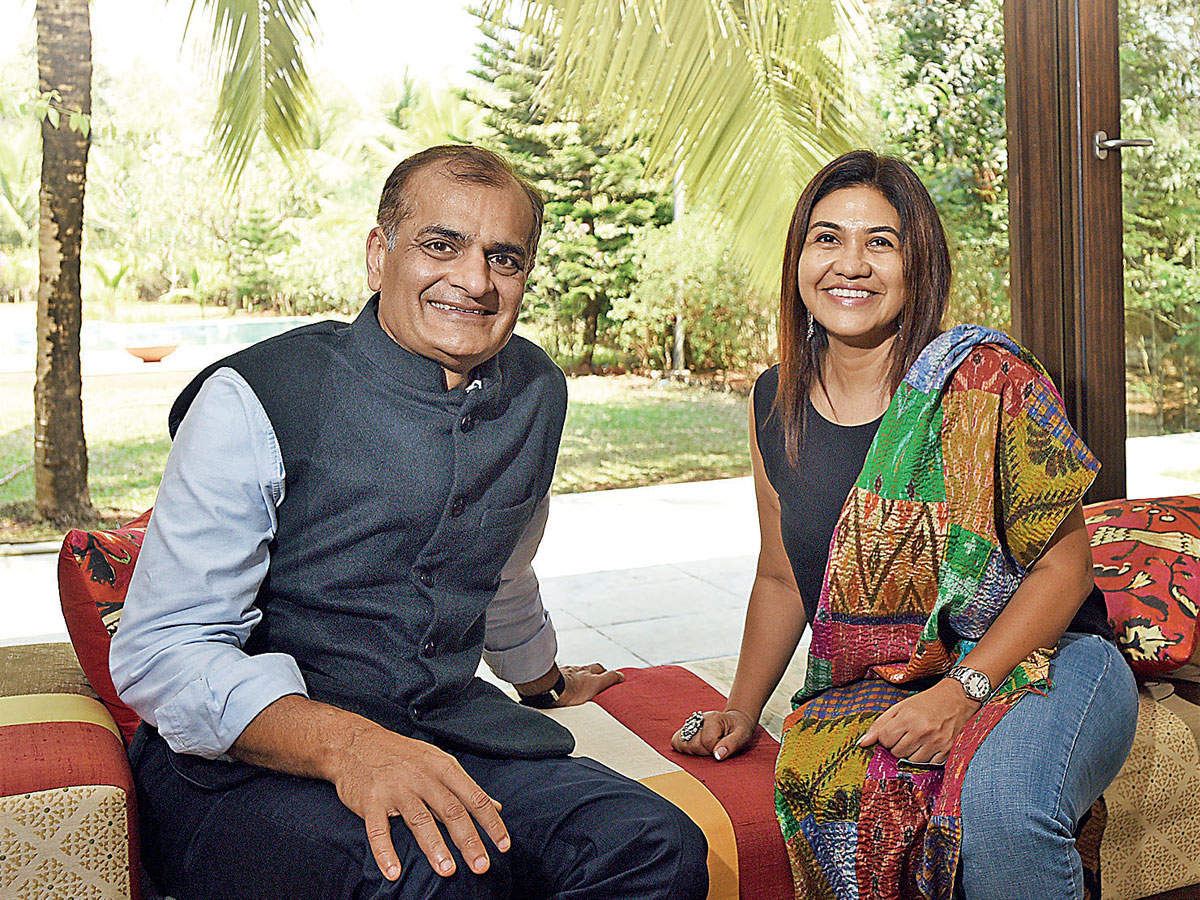

Edelweiss Group chairman Rashesh Shah and his wife Vidya Shah share views on a range of subjects, including business, credit crisis, corporate governance.

Edelweiss Group chairman Rashesh Shah and his wife Vidya Shah share views on a range of subjects, including business, credit crisis, corporate governance.from Banking/Finance-Industry-Economic Times http://bit.ly/2VPJCav

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

11:28 PM

11:28 PM

Blogger

Blogger

Edelweiss Group chairman Rashesh Shah and his wife Vidya Shah share views on a range of subjects, including business, credit crisis, corporate governance.

Edelweiss Group chairman Rashesh Shah and his wife Vidya Shah share views on a range of subjects, including business, credit crisis, corporate governance. 11:30 AM

11:30 AM

Blogger

Blogger

5:15 AM

5:15 AM

Blogger

Blogger

5:15 AM

5:15 AM

Blogger

Blogger

5:15 AM

5:15 AM

Blogger

Blogger

11:13 PM

11:13 PM

Blogger

Blogger

It said that over the last one week there has been a lot of unwarranted speculations in the market about continuous weakening of DHFL's credit profile.

It said that over the last one week there has been a lot of unwarranted speculations in the market about continuous weakening of DHFL's credit profile. 10:45 PM

10:45 PM

Blogger

Blogger

10:18 PM

10:18 PM

Blogger

Blogger

The crisis-ridden infrastructure conglomerate, once a pioneer of public-private partnership, came under the scanner of multiple regulators besides SEBI post defaults in debt obligations.

The crisis-ridden infrastructure conglomerate, once a pioneer of public-private partnership, came under the scanner of multiple regulators besides SEBI post defaults in debt obligations. 9:49 PM

9:49 PM

Blogger

Blogger

The State Bank of India has sold electoral bonds worth over Rs 3,622 crore in March and April this year, an RTI response has said. SBI said electoral bonds of Rs 1,365.69 crore were sold in March, which shot up by 65.21 per cent in April to Rs 2,256.37 crore.

The State Bank of India has sold electoral bonds worth over Rs 3,622 crore in March and April this year, an RTI response has said. SBI said electoral bonds of Rs 1,365.69 crore were sold in March, which shot up by 65.21 per cent in April to Rs 2,256.37 crore. 9:15 PM

9:15 PM

Blogger

Blogger

8:20 PM

8:20 PM

Blogger

Blogger

7:43 PM

7:43 PM

Blogger

Blogger

5:30 PM

5:30 PM

Blogger

Blogger

4:50 PM

4:50 PM

Blogger

Blogger

4:45 PM

4:45 PM

Blogger

Blogger

4:45 PM

4:45 PM

Blogger

Blogger

4:34 PM

4:34 PM

Blogger

Blogger

The country's largest lender State Bank of India (SBI) has reduced its marginal cost-based lending rate (MCLR) by five basis points (bps) with effect from May 10, the bank said in a statement. This is the second rate cut in this financial year. SBI had announced a 5 bps cut in MCLR across all tenors on April 10 in response to RBI's 25 bps repo rate cut.

The country's largest lender State Bank of India (SBI) has reduced its marginal cost-based lending rate (MCLR) by five basis points (bps) with effect from May 10, the bank said in a statement. This is the second rate cut in this financial year. SBI had announced a 5 bps cut in MCLR across all tenors on April 10 in response to RBI's 25 bps repo rate cut. 3:45 PM

3:45 PM

Blogger

Blogger

3:05 PM

3:05 PM

Blogger

Blogger

2:58 PM

2:58 PM

Blogger

Blogger

State Bank of India (SBI) reported a profit for the fourth quarter, compared with a record loss a year ago, as the country's largest lender benefited from better asset quality and higher income from its retail banking business.

State Bank of India (SBI) reported a profit for the fourth quarter, compared with a record loss a year ago, as the country's largest lender benefited from better asset quality and higher income from its retail banking business. 2:38 PM

2:38 PM

Blogger

Blogger

State Bank of India (SBI) reported a profit for the fourth quarter, compared with a record loss a year ago, as the country's largest lender benefited from better asset quality and higher income from its retail banking business.

State Bank of India (SBI) reported a profit for the fourth quarter, compared with a record loss a year ago, as the country's largest lender benefited from better asset quality and higher income from its retail banking business. 2:05 PM

2:05 PM

Blogger

Blogger

Speaking to TOI, SWIFT’s head of Asia-Pacific and Europe, Middle East & Africa, Alain Raes, said that the business model for remittance companies got created because of inefficiencies.

Speaking to TOI, SWIFT’s head of Asia-Pacific and Europe, Middle East & Africa, Alain Raes, said that the business model for remittance companies got created because of inefficiencies. 12:20 PM

12:20 PM

Blogger

Blogger

11:18 AM

11:18 AM

Blogger

Blogger

Already immediate account-to-account transfers are possible in several jurisdictions like China and Australia.

Already immediate account-to-account transfers are possible in several jurisdictions like China and Australia. 11:18 AM

11:18 AM

Blogger

Blogger

The bank is using its network to sell insurance policies and in turn planning to offer home loans to LIC’s customers.

The bank is using its network to sell insurance policies and in turn planning to offer home loans to LIC’s customers. 7:18 AM

7:18 AM

Blogger

Blogger

A consumer paying through Google Pay currently has to use UPI, which is connected to a specific bank account.

A consumer paying through Google Pay currently has to use UPI, which is connected to a specific bank account. 7:18 AM

7:18 AM

Blogger

Blogger

The agency is seeking information about the funding of ITNL by IFIN since LIC was one of the lenders to IL&FS.

The agency is seeking information about the funding of ITNL by IFIN since LIC was one of the lenders to IL&FS. 7:18 AM

7:18 AM

Blogger

Blogger

The new management at IL&FS wants the court to vacate its order.

The new management at IL&FS wants the court to vacate its order. 2:46 AM

2:46 AM

Blogger

Blogger

2:46 AM

2:46 AM

Blogger

Blogger

2:46 AM

2:46 AM

Blogger

Blogger

2:15 AM

2:15 AM

Blogger

Blogger

2:15 AM

2:15 AM

Blogger

Blogger

2:15 AM

2:15 AM

Blogger

Blogger

10:26 PM

10:26 PM

Blogger

Blogger

9:40 PM

9:40 PM

Blogger

Blogger

9:40 PM

9:40 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

8:19 PM

8:19 PM

Blogger

Blogger

Pai will be in charge of credit marketing, credit sanctions, branch banking & digital channels and transformation cell.

Pai will be in charge of credit marketing, credit sanctions, branch banking & digital channels and transformation cell. 8:15 PM

8:15 PM

Blogger

Blogger

7:08 PM

7:08 PM

Blogger

Blogger

In the year-ago fortnight, credit stood at Rs 85.17 lakh crore while deposits stood at Rs 113.81 lakh crore.

In the year-ago fortnight, credit stood at Rs 85.17 lakh crore while deposits stood at Rs 113.81 lakh crore. 6:52 PM

6:52 PM

Blogger

Blogger

RIL and TCS have in the past also competed with each other for the number one position in terms of market capitalisation. TCS is the country's most valued firm followed by RIL, HDFC Bank (Rs 6,24,362.11 crore), Hindustan Unilever (Rs 3,67,880.69 crore) and ITC (Rs 3,67,513.78 crore).

RIL and TCS have in the past also competed with each other for the number one position in terms of market capitalisation. TCS is the country's most valued firm followed by RIL, HDFC Bank (Rs 6,24,362.11 crore), Hindustan Unilever (Rs 3,67,880.69 crore) and ITC (Rs 3,67,513.78 crore). 6:03 PM

6:03 PM

Blogger

Blogger

RCom, which owes over Rs 50,000 crore to banks, has become the first Anil Ambani group company to be officially declared bankrupt after the NCLT on Thursday superseded its board and appointed a new resolution professional to run it and also allow the SBI-led consortium of 31 banks to form a committee of creditors.

RCom, which owes over Rs 50,000 crore to banks, has become the first Anil Ambani group company to be officially declared bankrupt after the NCLT on Thursday superseded its board and appointed a new resolution professional to run it and also allow the SBI-led consortium of 31 banks to form a committee of creditors. 5:15 PM

5:15 PM

Blogger

Blogger

4:13 PM

4:13 PM

Blogger

Blogger

The bank opened 50 new branches 250 new DSCs (doorstep service centre) in the last fiscal.

The bank opened 50 new branches 250 new DSCs (doorstep service centre) in the last fiscal. 2:15 PM

2:15 PM

Blogger

Blogger

11:30 AM

11:30 AM

Blogger

Blogger

9:58 AM

9:58 AM

Blogger

Blogger

In terms of value, credit cards were ahead at more than $10 billion compared with slightly less than $8 billion for debit cards.

In terms of value, credit cards were ahead at more than $10 billion compared with slightly less than $8 billion for debit cards. 9:13 AM

9:13 AM

Blogger

Blogger

State Bank of India, Axis Bank, IDBI and Punjab National Bank had complained that the ED had attached properties over which the banks had liens.

State Bank of India, Axis Bank, IDBI and Punjab National Bank had complained that the ED had attached properties over which the banks had liens. 10:33 PM

10:33 PM

Blogger

Blogger

10:23 PM

10:23 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

9:18 PM

9:18 PM

Blogger

Blogger

9:09 PM

9:09 PM

Blogger

Blogger

IL&FS Group companies, with a collective debt of over Rs 90,000 crore, are going through resolution process.

IL&FS Group companies, with a collective debt of over Rs 90,000 crore, are going through resolution process. 9:09 PM

9:09 PM

Blogger

Blogger

The Religare group company has been going through difficult times in the recent past on account of mismanagement and misappropriation of funds, RFL said in a release.

The Religare group company has been going through difficult times in the recent past on account of mismanagement and misappropriation of funds, RFL said in a release. 7:43 PM

7:43 PM

Blogger

Blogger

7:13 PM

7:13 PM

Blogger

Blogger

5:44 PM

5:44 PM

Blogger

Blogger

As part of the resolution efforts, the group companies have been classified into three categories, mainly based on their financial positions -- green, amber and red.

As part of the resolution efforts, the group companies have been classified into three categories, mainly based on their financial positions -- green, amber and red. 3:43 PM

3:43 PM

Blogger

Blogger

9:42 AM

9:42 AM

Blogger

Blogger

Describing Jet Airways’ 26th anniversary on this May 5 as “saddest of all days with no flights”, founder Naresh Goyal says he made Rs 250 crore available to banks from a group company. The airline’s taking to the skies again is now considered very difficult given its huge debt-cum-liabilities like payables to the tune of over Rs 25,000 crore.

Describing Jet Airways’ 26th anniversary on this May 5 as “saddest of all days with no flights”, founder Naresh Goyal says he made Rs 250 crore available to banks from a group company. The airline’s taking to the skies again is now considered very difficult given its huge debt-cum-liabilities like payables to the tune of over Rs 25,000 crore. 8:39 AM

8:39 AM

Blogger

Blogger

In theory, the central bank was doing what was needed to extend organised banking services to those left unbanked by traditional lenders.

In theory, the central bank was doing what was needed to extend organised banking services to those left unbanked by traditional lenders. 7:59 AM

7:59 AM

Blogger

Blogger

As of now, the expense caps are described according to product categories and the number of years a company has been in operations.

As of now, the expense caps are described according to product categories and the number of years a company has been in operations. 7:59 AM

7:59 AM

Blogger

Blogger

The bank is using its network to sell insurance policies and in turn planning to offer home loans to LIC’s customers.

The bank is using its network to sell insurance policies and in turn planning to offer home loans to LIC’s customers. 7:59 AM

7:59 AM

Blogger

Blogger

Personal vehicle loan portfolio, comprising cars and two-wheeler loans, nearly halved in the last fiscal

Personal vehicle loan portfolio, comprising cars and two-wheeler loans, nearly halved in the last fiscal 5:02 AM

5:02 AM

Blogger

Blogger

4:37 AM

4:37 AM

Blogger

Blogger

11:43 PM

11:43 PM

Blogger

Blogger

Describing Jet Airways’ 26th anniversary on this May 5 as “saddest of all days with no flights”, founder Naresh Goyal says he made Rs 250 crore available to banks from a group company. The airline’s taking to the skies again is now considered very difficult given its huge debt-cum-liabilities like payables to the tune of over Rs 25,000 crore.

Describing Jet Airways’ 26th anniversary on this May 5 as “saddest of all days with no flights”, founder Naresh Goyal says he made Rs 250 crore available to banks from a group company. The airline’s taking to the skies again is now considered very difficult given its huge debt-cum-liabilities like payables to the tune of over Rs 25,000 crore. 10:34 PM

10:34 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

9:23 PM

9:23 PM

Blogger

Blogger

9:13 PM

9:13 PM

Blogger

Blogger

4:34 PM

4:34 PM

Blogger

Blogger

1:22 PM

1:22 PM

Blogger

Blogger

Presently, one share of HDFC Bank has a face value of Rs 2. Its shares closed at Rs 2,328 apiece on the Bombay Stock Exchange, down 1.7%. At present, the bank has issued about 272 crore shares of face value of Rs 2.

Presently, one share of HDFC Bank has a face value of Rs 2. Its shares closed at Rs 2,328 apiece on the Bombay Stock Exchange, down 1.7%. At present, the bank has issued about 272 crore shares of face value of Rs 2. 10:47 AM

10:47 AM

Blogger

Blogger

10:47 AM

10:47 AM

Blogger

Blogger

10:47 AM

10:47 AM

Blogger

Blogger

10:47 AM

10:47 AM

Blogger

Blogger

10:47 AM

10:47 AM

Blogger

Blogger

9:37 AM

9:37 AM

Blogger

Blogger

9:37 AM

9:37 AM

Blogger

Blogger

9:37 AM

9:37 AM

Blogger

Blogger

9:37 AM

9:37 AM

Blogger

Blogger

9:37 AM

9:37 AM

Blogger

Blogger

1:37 AM

1:37 AM

Blogger

Blogger

1:37 AM

1:37 AM

Blogger

Blogger

1:37 AM

1:37 AM

Blogger

Blogger

10:43 PM

10:43 PM

Blogger

Blogger

8:58 PM

8:58 PM

Blogger

Blogger

8:58 PM

8:58 PM

Blogger

Blogger

8:58 PM

8:58 PM

Blogger

Blogger

8:58 PM

8:58 PM

Blogger

Blogger

8:58 PM

8:58 PM

Blogger

Blogger

8:53 PM

8:53 PM

Blogger

Blogger

8:53 PM

8:53 PM

Blogger

Blogger

8:53 PM

8:53 PM

Blogger

Blogger

7:54 PM

7:54 PM

Blogger

Blogger

The company has already invested USD 1 billion in the Indian market in the last five years.

The company has already invested USD 1 billion in the Indian market in the last five years. 7:08 PM

7:08 PM

Blogger

Blogger

6:44 PM

6:44 PM

Blogger

Blogger

The crisis in the NBFC sector started with a series of defaults by IL&FS, which owes over Rs 99,350 crore to banks, from last September.

The crisis in the NBFC sector started with a series of defaults by IL&FS, which owes over Rs 99,350 crore to banks, from last September. 6:43 PM

6:43 PM

Blogger

Blogger

5:03 PM

5:03 PM

Blogger

Blogger

4:57 PM

4:57 PM

Blogger

Blogger

Net profit dropped to Rs 969 crore ($139.71 million) in the three months ended March 31, from Rs 1,020 crore a year earlier when stricter central bank (RBI) rules had forced the country's third-biggest lender by assets to account for more bad loans.

Net profit dropped to Rs 969 crore ($139.71 million) in the three months ended March 31, from Rs 1,020 crore a year earlier when stricter central bank (RBI) rules had forced the country's third-biggest lender by assets to account for more bad loans. 4:07 PM

4:07 PM

Blogger

Blogger

Major laggards on the 30-share BSE platform include Yes Bank, Tata Motors, Tata Steel, Bajaj Finance, HDFC twins (HDFC and HDFC Bank), IndusInd Bank and Reliance Industries with their shares sliding as much as 4.78 per cent. 24 out of 30 stocks on the BSE index closed in red. On NSE, except for Nifty IT, all other sub-indices ended in red with Nifty Media and Metal falling the most, down as much as 2.18 per cent.

Major laggards on the 30-share BSE platform include Yes Bank, Tata Motors, Tata Steel, Bajaj Finance, HDFC twins (HDFC and HDFC Bank), IndusInd Bank and Reliance Industries with their shares sliding as much as 4.78 per cent. 24 out of 30 stocks on the BSE index closed in red. On NSE, except for Nifty IT, all other sub-indices ended in red with Nifty Media and Metal falling the most, down as much as 2.18 per cent. 11:33 AM

11:33 AM

Blogger

Blogger

11:03 AM

11:03 AM

Blogger

Blogger

11:03 AM

11:03 AM

Blogger

Blogger

10:43 AM

10:43 AM

Blogger

Blogger

10:09 AM

10:09 AM

Blogger

Blogger

Bank loan growth to large corporates touched a five-year high in FY19 clocking 8.2% to Rs 24 lakh crore compared to growth of less than 1% a year ago.

Bank loan growth to large corporates touched a five-year high in FY19 clocking 8.2% to Rs 24 lakh crore compared to growth of less than 1% a year ago. 10:02 AM

10:02 AM

Blogger

Blogger

On the 30-share BSE index, major laggards include Tata Motors, Yes Bank, Tata Steel, Vedanta, HDFC and IndusInd Bank with their shares diving as much as 4 per cent. On NSE, all sub-indices started on a negative tone with Nifty Metal sliding the most, down 2.42 per cent.

On the 30-share BSE index, major laggards include Tata Motors, Yes Bank, Tata Steel, Vedanta, HDFC and IndusInd Bank with their shares diving as much as 4 per cent. On NSE, all sub-indices started on a negative tone with Nifty Metal sliding the most, down 2.42 per cent. 6:54 AM

6:54 AM

Blogger

Blogger

RBI may assign a ‘lower risk weight’ on loans to cos against which bankruptcy has been initiated.

RBI may assign a ‘lower risk weight’ on loans to cos against which bankruptcy has been initiated. 8:58 PM

8:58 PM

Blogger

Blogger

1:47 PM

1:47 PM

Blogger

Blogger

Crisis-hit IL&FS group's debt burden is estimated to be more than Rs 94,000 crore and various entities

Crisis-hit IL&FS group's debt burden is estimated to be more than Rs 94,000 crore and various entities 12:47 PM

12:47 PM

Blogger

Blogger

DIPAM officials said that next round for sale of majority government holding in companies will be offered to willing CPSEs proposing to give a good valuation for Centre's stake.

DIPAM officials said that next round for sale of majority government holding in companies will be offered to willing CPSEs proposing to give a good valuation for Centre's stake. RSS Feed

RSS Feed Twitter

Twitter