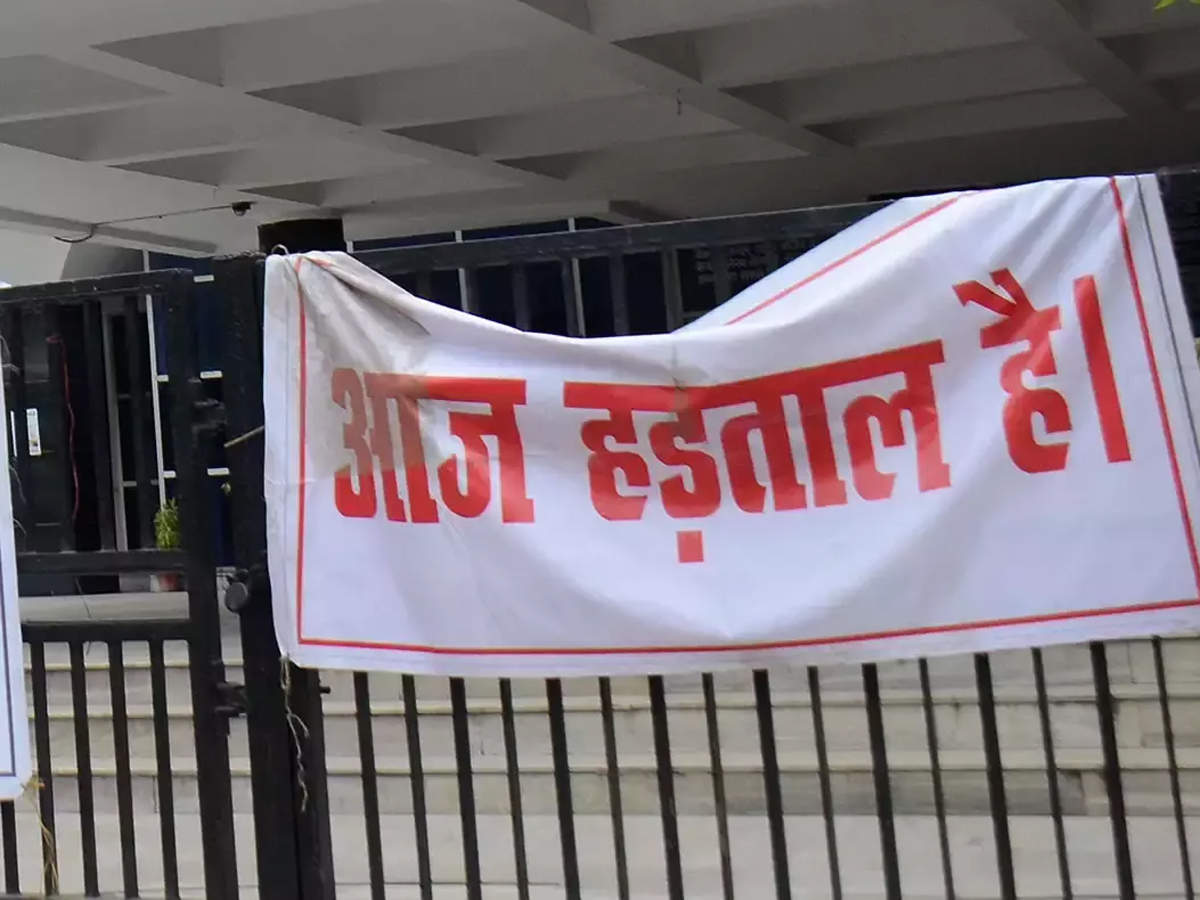

Employees of all public and private sector banks wore black badges to work as a mark of protest to the government's decision.

Employees of all public and private sector banks wore black badges to work as a mark of protest to the government's decision.from Banking/Finance-Industry-Economic Times https://ift.tt/2ZoF8dk

A Complete Banking Guide... Bank of Baroda, Allahabad Bank, Andhra Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Dena Bank, ICICI Bank, IDBI Bank Limited, Indian Bank, Indian Overseas Bank,, Oriental Bank of Commerce, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, UTI Bank Ltd., Union Bank of India, United Bank Of India, Vijaya Bank, Yes Bank, Mutual Funds, Income Tax

2:40 PM

2:40 PM

Blogger

Blogger

Employees of all public and private sector banks wore black badges to work as a mark of protest to the government's decision.

Employees of all public and private sector banks wore black badges to work as a mark of protest to the government's decision. 2:37 PM

2:37 PM

Blogger

Blogger

Members of the All India Bank Employees' Association on Saturday staged a protest here against the Centre's decision to merge 10 public sector banks into four entities.

Members of the All India Bank Employees' Association on Saturday staged a protest here against the Centre's decision to merge 10 public sector banks into four entities. 2:10 PM

2:10 PM

Blogger

Blogger

"A meeting of board of directors to consider the amalgamation will be convened by the bank shortly," PNB said.

"A meeting of board of directors to consider the amalgamation will be convened by the bank shortly," PNB said. 1:50 PM

1:50 PM

Blogger

Blogger

1:50 PM

1:50 PM

Blogger

Blogger

1:50 PM

1:50 PM

Blogger

Blogger

1:22 PM

1:22 PM

Blogger

Blogger

While the big bang merger will bring in much needed economies of scale in the operations of some of the smaller banks, it will also result in erasing the identity of six banks, some of which are more than a century old.

While the big bang merger will bring in much needed economies of scale in the operations of some of the smaller banks, it will also result in erasing the identity of six banks, some of which are more than a century old. 1:05 PM

1:05 PM

Blogger

Blogger

12:05 PM

12:05 PM

Blogger

Blogger

11:50 AM

11:50 AM

Blogger

Blogger

There were several calculations, including political ones. Finally, it was tech that settled the issue.

There were several calculations, including political ones. Finally, it was tech that settled the issue. 11:50 AM

11:50 AM

Blogger

Blogger

Now Kolkata could soon be left with just one HQ of a state-run lender — UCO Bank.

Now Kolkata could soon be left with just one HQ of a state-run lender — UCO Bank. 11:50 AM

11:50 AM

Blogger

Blogger

The oldest is Kolkata-based Allahabad Bank, which is also the oldest joint stock company in India.

The oldest is Kolkata-based Allahabad Bank, which is also the oldest joint stock company in India. 11:36 AM

11:36 AM

Blogger

Blogger

11:27 AM

11:27 AM

Blogger

Blogger

For the last six months or so, officials in the department of financial services and the public sector bank brass had been brainstorming to move ahead with the long-pending consolidation plan. But it was not until Friday afternoon that even the bank chiefs were informed about the combinations that had been worked out by the government.

For the last six months or so, officials in the department of financial services and the public sector bank brass had been brainstorming to move ahead with the long-pending consolidation plan. But it was not until Friday afternoon that even the bank chiefs were informed about the combinations that had been worked out by the government. 11:27 AM

11:27 AM

Blogger

Blogger

The biggest challenge in implementing an amalgamation of public sector banks (PSBs) is the integration of technology platforms and managing HR & cultural issues, said bankers who have gone through a merger exercise.

The biggest challenge in implementing an amalgamation of public sector banks (PSBs) is the integration of technology platforms and managing HR & cultural issues, said bankers who have gone through a merger exercise. 11:05 AM

11:05 AM

Blogger

Blogger

10:22 AM

10:22 AM

Blogger

Blogger

The merged entity comprising Punjab National Bank, Oriental Bank of Commerce and United Bank of India will become the second largest lender after SBI. The merger of Canara Bank and Syndicate Bank will create the fifth largest lender, with the Union Bank, Andhra Bank and Corporation Bank amalgamation at number six, based on business at the end of March 2019.

The merged entity comprising Punjab National Bank, Oriental Bank of Commerce and United Bank of India will become the second largest lender after SBI. The merger of Canara Bank and Syndicate Bank will create the fifth largest lender, with the Union Bank, Andhra Bank and Corporation Bank amalgamation at number six, based on business at the end of March 2019. 9:35 AM

9:35 AM

Blogger

Blogger

After these mergers, the total number of PSBs in India will come down to 12 from 27 two years ago.

After these mergers, the total number of PSBs in India will come down to 12 from 27 two years ago. 9:35 AM

9:35 AM

Blogger

Blogger

Post merger, these insurance companies may get better opportunities and reach for business.

Post merger, these insurance companies may get better opportunities and reach for business. 9:10 AM

9:10 AM

Blogger

Blogger

7:36 AM

7:36 AM

Blogger

Blogger

6:49 AM

6:49 AM

Blogger

Blogger

6:05 AM

6:05 AM

Blogger

Blogger

10:28 AM

10:28 AM

Blogger

Blogger

10:28 AM

10:28 AM

Blogger

Blogger

8:53 AM

8:53 AM

Blogger

Blogger

8:53 AM

8:53 AM

Blogger

Blogger

8:53 AM

8:53 AM

Blogger

Blogger

8:35 AM

8:35 AM

Blogger

Blogger

8:28 AM

8:28 AM

Blogger

Blogger

Insurers have launched mobile phone apps, making it easier for customers to transact with them. They are, slowly and surely, moving towards paperless claims as well.

Insurers have launched mobile phone apps, making it easier for customers to transact with them. They are, slowly and surely, moving towards paperless claims as well. 8:03 AM

8:03 AM

Blogger

Blogger

8:03 AM

8:03 AM

Blogger

Blogger

8:03 AM

8:03 AM

Blogger

Blogger

7:58 AM

7:58 AM

Blogger

Blogger

Development managers may be appointed; Adani, Piramal and Tata among groups approached.

Development managers may be appointed; Adani, Piramal and Tata among groups approached. 6:55 AM

6:55 AM

Blogger

Blogger

6:55 AM

6:55 AM

Blogger

Blogger

6:55 AM

6:55 AM

Blogger

Blogger

6:35 AM

6:35 AM

Blogger

Blogger

6:35 AM

6:35 AM

Blogger

Blogger

6:35 AM

6:35 AM

Blogger

Blogger

6:20 AM

6:20 AM

Blogger

Blogger

6:20 AM

6:20 AM

Blogger

Blogger

6:20 AM

6:20 AM

Blogger

Blogger

5:40 AM

5:40 AM

Blogger

Blogger

5:40 AM

5:40 AM

Blogger

Blogger

5:40 AM

5:40 AM

Blogger

Blogger

9:50 PM

9:50 PM

Blogger

Blogger

9:35 PM

9:35 PM

Blogger

Blogger

9:35 PM

9:35 PM

Blogger

Blogger

7:50 PM

7:50 PM

Blogger

Blogger

6:51 PM

6:51 PM

Blogger

Blogger

The number of cases of frauds reported by banks saw a jump of 15 per cent year-on-year basis in 2018-19, with the amount involved increasing by 73.8 per cent in the year, RBI's annual report showed. In FY19, banking sector reported 6,801 frauds involving Rs 71,542.93 crore as against 5,916 cases involving Rs 41,167.04 crore reported in 2017-18.

The number of cases of frauds reported by banks saw a jump of 15 per cent year-on-year basis in 2018-19, with the amount involved increasing by 73.8 per cent in the year, RBI's annual report showed. In FY19, banking sector reported 6,801 frauds involving Rs 71,542.93 crore as against 5,916 cases involving Rs 41,167.04 crore reported in 2017-18. 5:05 PM

5:05 PM

Blogger

Blogger

4:50 PM

4:50 PM

Blogger

Blogger

4:37 PM

4:37 PM

Blogger

Blogger

2:48 PM

2:48 PM

Blogger

Blogger

Besides, the number of merchants accepting digital payments modes has increased to over 10 million in a short span of two to three years.

Besides, the number of merchants accepting digital payments modes has increased to over 10 million in a short span of two to three years. 1:54 PM

1:54 PM

Blogger

Blogger

12:40 PM

12:40 PM

Blogger

Blogger

12:32 PM

12:32 PM

Blogger

Blogger

11:50 AM

11:50 AM

Blogger

Blogger

11:25 AM

11:25 AM

Blogger

Blogger

9:25 AM

9:25 AM

Blogger

Blogger

8:03 AM

8:03 AM

Blogger

Blogger

8:03 AM

8:03 AM

Blogger

Blogger

8:03 AM

8:03 AM

Blogger

Blogger

7:53 AM

7:53 AM

Blogger

Blogger

RBI has made it clear that any losses incurred by customers during testing would be borne by participant.

RBI has made it clear that any losses incurred by customers during testing would be borne by participant. 7:53 AM

7:53 AM

Blogger

Blogger

Loans mainly from power, manufacturing sectors, UBI may put up the largest chunk.

Loans mainly from power, manufacturing sectors, UBI may put up the largest chunk. 7:17 AM

7:17 AM

Blogger

Blogger

7:05 AM

7:05 AM

Blogger

Blogger

7:05 AM

7:05 AM

Blogger

Blogger

9:35 PM

9:35 PM

Blogger

Blogger

9:35 PM

9:35 PM

Blogger

Blogger

7:38 PM

7:38 PM

Blogger

Blogger

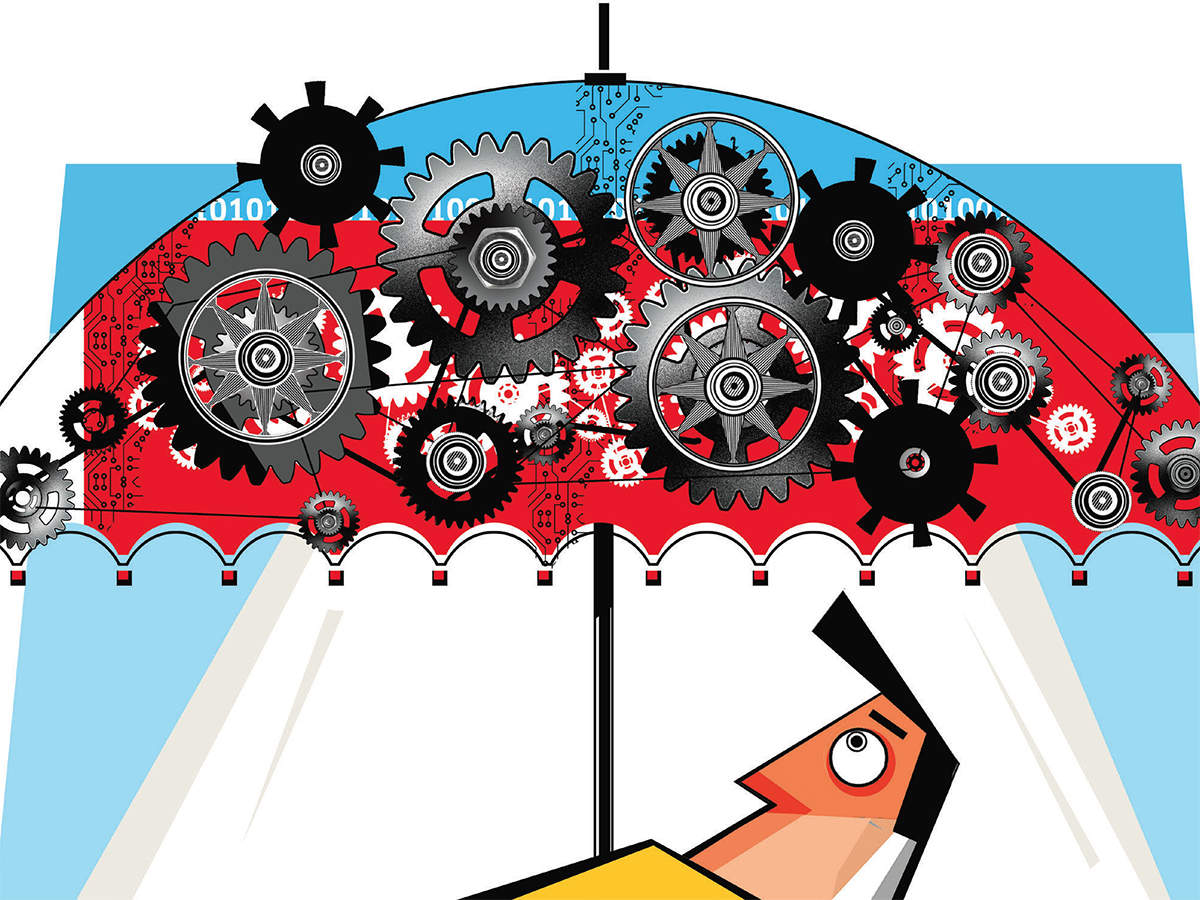

Digital KYC will ensure a smooth process for those who do not want to share their Aadhaar number for opening bank account.

Digital KYC will ensure a smooth process for those who do not want to share their Aadhaar number for opening bank account. 6:46 PM

6:46 PM

Blogger

Blogger

After issuing two downgrade warnings since June 11, global rating agency Moody's on Wednesday yanked down private sector lender Yes Bank's ratings to junk status with a negative outlook, citing the lower-than-expected capital raising from the recent QIP issue and the plunging share prices that's a hurdle in raising more funds.

After issuing two downgrade warnings since June 11, global rating agency Moody's on Wednesday yanked down private sector lender Yes Bank's ratings to junk status with a negative outlook, citing the lower-than-expected capital raising from the recent QIP issue and the plunging share prices that's a hurdle in raising more funds. 5:55 PM

5:55 PM

Blogger

Blogger

5:36 PM

5:36 PM

Blogger

Blogger

4:41 PM

4:41 PM

Blogger

Blogger

Snapping its three-day rising streak, benchmark BSE sensex dropped 189 points on Wednesday, tracking heavy losses in metals, energy, banking and auto counters amid concerns over a looming global recession. After a choppy session, the 30-share sensex settled 189.43 points, or 0.50 per cent, lower at 37,451.84. It hit an intra-day high of 37,687.82 and low of 37,249.19.

Snapping its three-day rising streak, benchmark BSE sensex dropped 189 points on Wednesday, tracking heavy losses in metals, energy, banking and auto counters amid concerns over a looming global recession. After a choppy session, the 30-share sensex settled 189.43 points, or 0.50 per cent, lower at 37,451.84. It hit an intra-day high of 37,687.82 and low of 37,249.19. 4:21 PM

4:21 PM

Blogger

Blogger

British travel operator Thomas Cook Group said on Wednesday it had agreed the main terms of a rescue package that will see Hong Kong's Fosun Tourism take over its tour operations and creditor banks and bondholders acquire its airline. The world's oldest travel company has struggled with intense competition, high debt levels and an unusually hot summer in 2018 which reduced its last-minute bookings.

British travel operator Thomas Cook Group said on Wednesday it had agreed the main terms of a rescue package that will see Hong Kong's Fosun Tourism take over its tour operations and creditor banks and bondholders acquire its airline. The world's oldest travel company has struggled with intense competition, high debt levels and an unusually hot summer in 2018 which reduced its last-minute bookings. 3:35 PM

3:35 PM

Blogger

Blogger

3:35 PM

3:35 PM

Blogger

Blogger

3:02 PM

3:02 PM

Blogger

Blogger

2:33 PM

2:33 PM

Blogger

Blogger

1:55 PM

1:55 PM

Blogger

Blogger

12:05 PM

12:05 PM

Blogger

Blogger

11:51 AM

11:51 AM

Blogger

Blogger

The Bimal Jalan-led committee has warned in its report that India, whose credit ratings is borderline investment grade, risks a flight of capital following a downgrade if government overstretches itself in recapitalising banks after a private sector debt crisis.

The Bimal Jalan-led committee has warned in its report that India, whose credit ratings is borderline investment grade, risks a flight of capital following a downgrade if government overstretches itself in recapitalising banks after a private sector debt crisis. 11:50 AM

11:50 AM

Blogger

Blogger

11:36 AM

11:36 AM

Blogger

Blogger

The relief rally in Indian bonds on Tuesday was largely owing to the Reserve Bank's decision to transfer a record Rs 1.76 lakh crore dividend and surplus reserves to the government, a DBS report said.

The relief rally in Indian bonds on Tuesday was largely owing to the Reserve Bank's decision to transfer a record Rs 1.76 lakh crore dividend and surplus reserves to the government, a DBS report said. 11:16 AM

11:16 AM

Blogger

Blogger

In a closed-door address to India’s top fund managers on Tuesday, Sebi chairman Ajay Tyagi put industry players on notice. The regulator had some advice for almost every stakeholder in the MF industry — from top executives of fund houses to fund managers to trustees, everyone.

In a closed-door address to India’s top fund managers on Tuesday, Sebi chairman Ajay Tyagi put industry players on notice. The regulator had some advice for almost every stakeholder in the MF industry — from top executives of fund houses to fund managers to trustees, everyone. 10:25 AM

10:25 AM

Blogger

Blogger

9:16 AM

9:16 AM

Blogger

Blogger

9:16 AM

9:16 AM

Blogger

Blogger

8:08 AM

8:08 AM

Blogger

Blogger

When the government superseded the IL&FS board and appointed Uday Kotak to head it, there was hope of a quick resolution.

When the government superseded the IL&FS board and appointed Uday Kotak to head it, there was hope of a quick resolution. 6:05 AM

6:05 AM

Blogger

Blogger

8:44 PM

8:44 PM

Blogger

Blogger

Punjab National Bank launched PNB Advantage, a retail lending scheme linked with the repo rate effective Tuesday.

Punjab National Bank launched PNB Advantage, a retail lending scheme linked with the repo rate effective Tuesday. 8:05 PM

8:05 PM

Blogger

Blogger

Finance minister Nirmala Sitharaman on Tuesday expressed concerns about questions being raised on the credibility of the Reserve Bank of India (RBI), which on Monday decided to transfer Rs 1.76 lakh crore surpluses to a fund-starved government. "Any suggestions questioning credibility of RBI, therefore, for me seems a bit outlandish," she said.

Finance minister Nirmala Sitharaman on Tuesday expressed concerns about questions being raised on the credibility of the Reserve Bank of India (RBI), which on Monday decided to transfer Rs 1.76 lakh crore surpluses to a fund-starved government. "Any suggestions questioning credibility of RBI, therefore, for me seems a bit outlandish," she said. 7:47 PM

7:47 PM

Blogger

Blogger

7:22 PM

7:22 PM

Blogger

Blogger

6:57 PM

6:57 PM

Blogger

Blogger

6:39 PM

6:39 PM

Blogger

Blogger

The rupee on Tuesday spurted by 54 paise, its biggest single-day gain in more than five months, to close at a one-week high of 71.48 against the US dollar, boosted by positive sentiment over the fiscal situation. The Reserve Bank's decision to transfer a record Rs 1.76 lakh crore dividend and surplus reserves to the government revived the rupee, forex traders said.

The rupee on Tuesday spurted by 54 paise, its biggest single-day gain in more than five months, to close at a one-week high of 71.48 against the US dollar, boosted by positive sentiment over the fiscal situation. The Reserve Bank's decision to transfer a record Rs 1.76 lakh crore dividend and surplus reserves to the government revived the rupee, forex traders said. 6:09 PM

6:09 PM

Blogger

Blogger

A record windfall from the Reserve Bank of India under governor Shaktikanta Das to the tune of Rs 1.76 lakh crore -- higher than the aggregate dividend paid out by the central bank in previous three years -- will give the Modi government ammunition to fight an ever-widening slowdown in the economy by spurring investment and giving sectoral stimulus.

A record windfall from the Reserve Bank of India under governor Shaktikanta Das to the tune of Rs 1.76 lakh crore -- higher than the aggregate dividend paid out by the central bank in previous three years -- will give the Modi government ammunition to fight an ever-widening slowdown in the economy by spurring investment and giving sectoral stimulus. 5:17 PM

5:17 PM

Blogger

Blogger

4:27 PM

4:27 PM

Blogger

Blogger

4:14 PM

4:14 PM

Blogger

Blogger

Bain Capital Credit is a leading global credit specialist with $41 billion in assets under management.

Bain Capital Credit is a leading global credit specialist with $41 billion in assets under management. 3:42 PM

3:42 PM

Blogger

Blogger

12:02 PM

12:02 PM

Blogger

Blogger

11:24 AM

11:24 AM

Blogger

Blogger

Puri, nephew of Madhya Pradesh chief minister Kamal Nath, was arrested by the agency on August 20 while he was undergoing questioning in the AgustaWestland case.

Puri, nephew of Madhya Pradesh chief minister Kamal Nath, was arrested by the agency on August 20 while he was undergoing questioning in the AgustaWestland case. 10:37 AM

10:37 AM

Blogger

Blogger

10:34 AM

10:34 AM

Blogger

Blogger

During 2018-19, 179 ATM fraud cases were reported in Delhi.

During 2018-19, 179 ATM fraud cases were reported in Delhi. 10:24 AM

10:24 AM

Blogger

Blogger

Amid the hostility in the Bimal Jalan committee over the optimum level of reserves or excess capital that the RBI should hold, the central bank was expected to transfer around Rs 66,000 crore to the Centre, including Rs 8,000 crore of "surplus reserves". This was far lower than the Rs 90,000 crore that had been budgeted for during the current fiscal year, when government finances are already strained.

Amid the hostility in the Bimal Jalan committee over the optimum level of reserves or excess capital that the RBI should hold, the central bank was expected to transfer around Rs 66,000 crore to the Centre, including Rs 8,000 crore of "surplus reserves". This was far lower than the Rs 90,000 crore that had been budgeted for during the current fiscal year, when government finances are already strained. 10:22 AM

10:22 AM

Blogger

Blogger

10:06 AM

10:06 AM

Blogger

Blogger

8:57 AM

8:57 AM

Blogger

Blogger

8:49 AM

8:49 AM

Blogger

Blogger

The ambitions for India reflect Deutsche Bank’s wider focus on retail banking and wealth management.

The ambitions for India reflect Deutsche Bank’s wider focus on retail banking and wealth management. 8:31 AM

8:31 AM

Blogger

Blogger

7:06 AM

7:06 AM

Blogger

Blogger

5:46 AM

5:46 AM

Blogger

Blogger

1:11 AM

1:11 AM

Blogger

Blogger

12:41 AM

12:41 AM

Blogger

Blogger

10:48 PM

10:48 PM

Blogger

Blogger

10:07 PM

10:07 PM

Blogger

Blogger

10:07 PM

10:07 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

9:33 PM

9:33 PM

Blogger

Blogger

7:12 PM

7:12 PM

Blogger

Blogger

7:09 PM

7:09 PM

Blogger

Blogger

The lender had already bought around Rs 3,500 crore loans from NBFCs in the June quarter.

The lender had already bought around Rs 3,500 crore loans from NBFCs in the June quarter. 6:34 PM

6:34 PM

Blogger

Blogger

As per a BSE filing, the appointment of the new auditor comes into effect from August 26.

As per a BSE filing, the appointment of the new auditor comes into effect from August 26. 6:02 PM

6:02 PM

Blogger

Blogger

1:17 PM

1:17 PM

Blogger

Blogger

11:29 AM

11:29 AM

Blogger

Blogger

RBI's central board will meet in Mumbai on Monday to take up the annual accounts. With the Bimal Jalan report on an ideal level of reserves to be maintained by the RBI having been submitted, the meeting is also likely to discuss the same. The August board meeting finalises the central bank’s accounts for the year and also decides on surplus to be transferred to the government.

RBI's central board will meet in Mumbai on Monday to take up the annual accounts. With the Bimal Jalan report on an ideal level of reserves to be maintained by the RBI having been submitted, the meeting is also likely to discuss the same. The August board meeting finalises the central bank’s accounts for the year and also decides on surplus to be transferred to the government. 11:02 AM

11:02 AM

Blogger

Blogger

10:16 AM

10:16 AM

Blogger

Blogger

8:27 AM

8:27 AM

Blogger

Blogger

8:17 AM

8:17 AM

Blogger

Blogger

7:59 AM

7:59 AM

Blogger

Blogger

Govt's move on customer onboarding through Aadhaar may not bring down costs on physical verification for shadow banks.

Govt's move on customer onboarding through Aadhaar may not bring down costs on physical verification for shadow banks. 7:41 AM

7:41 AM

Blogger

Blogger

7:06 AM

7:06 AM

Blogger

Blogger

6:36 AM

6:36 AM

Blogger

Blogger

6:16 AM

6:16 AM

Blogger

Blogger

12:21 AM

12:21 AM

Blogger

Blogger

11:56 PM

11:56 PM

Blogger

Blogger

11:16 PM

11:16 PM

Blogger

Blogger

9:56 PM

9:56 PM

Blogger

Blogger

9:41 PM

9:41 PM

Blogger

Blogger

9:27 PM

9:27 PM

Blogger

Blogger

9:27 PM

9:27 PM

Blogger

Blogger

9:27 PM

9:27 PM

Blogger

Blogger

9:16 PM

9:16 PM

Blogger

Blogger

9:01 PM

9:01 PM

Blogger

Blogger

6:09 PM

6:09 PM

Blogger

Blogger

The inter-bank meeting, held under the aegis of the State Level Bankers' Committee (SLBC), was organised by BoM, convenor, SLBC, Maharashtra State.

The inter-bank meeting, held under the aegis of the State Level Bankers' Committee (SLBC), was organised by BoM, convenor, SLBC, Maharashtra State. 4:24 PM

4:24 PM

Blogger

Blogger

The panel in its previous avatar called the Advisory Board on Bank, Commercial and Financial Frauds.

The panel in its previous avatar called the Advisory Board on Bank, Commercial and Financial Frauds. 4:22 PM

4:22 PM

Blogger

Blogger

2:47 PM

2:47 PM

Blogger

Blogger

2:01 PM

2:01 PM

Blogger

Blogger

1:47 PM

1:47 PM

Blogger

Blogger

12:31 PM

12:31 PM

Blogger

Blogger

RSS Feed

RSS Feed Twitter

Twitter